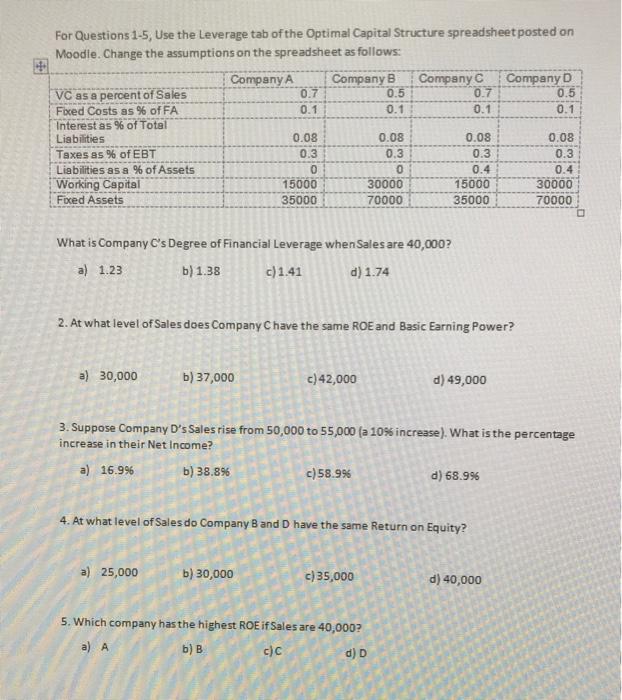

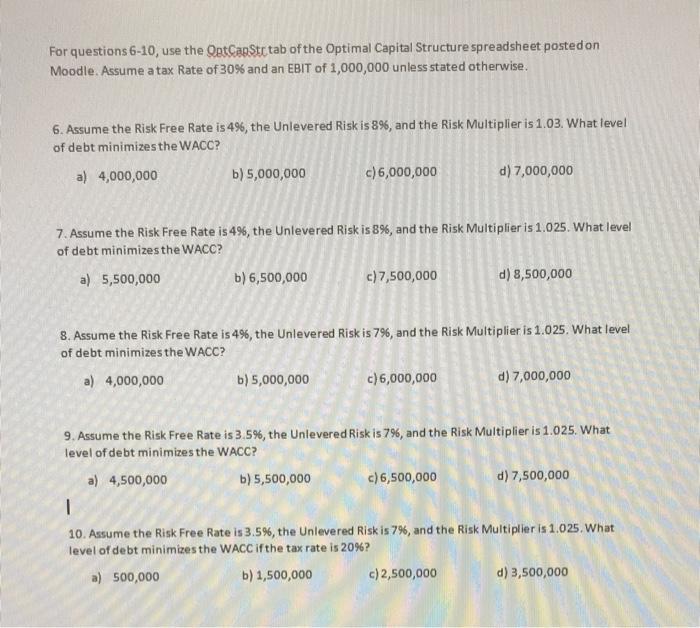

For Questions 1-5, Use the Leverage tab of the Optimal Capital Structure spreadsheet posted on Moodle. Change the assumptions on the spreadsheet as follows: Company A 0.7 0.1 Company B 0.5 0.1 Company 0.7 0.1 Company D 0.5 0.1 0.08 0.08 0.08 0.08 VC as a percent of Sales Fixed Costs as % of FA Interest as % of Total Liabilities Taxes as % of EBT Liabilities as a % of Assets Working Capital Foed Assets 0.3 0.3 0.3 0.3 0 15000 35000 0 30000 70000 0.4 15000 35000 0.4 30000 70000 What is Company C's Degree of Financial Leverage when Sales are 40,000? a) 1.23 b) 1.38 c)1.41 d) 1.74 2. At what level of Sales does Company C have the same ROE and Basic Earning Power? a) 30,000 b) 37,000 c) 42,000 d) 49,000 3. Suppose Company D's Sales rise from 50,000 to 55,000 (a 10% increase). What is the percentage increase in their Net Income? a) 16.996 b) 38.896 c)58.9% d) 68.996 4. At what level of Sales do Company B and have the same Return on Equity? a) 25,000 b) 30,000 c)35,000 d) 40,000 5. Which company has the highest ROE if Sales are 40,000? a) A b) B c)c d) D For questions 6-10, use the OatCapStr tab of the Optimal Capital Structure spreadsheet posted on Moodle. Assume a tax Rate of 30% and an EBIT of 1,000,000 unless stated otherwise. 6. Assume the Risk Free Rate is 4%, the Unlevered Risk is 8%, and the Risk Multiplier is 1.03. What level of debt minimizes the WACC? a) 4,000,000 b) 5,000,000 c) 6,000,000 d) 7,000,000 7. Assume the Risk Free Rate is 4%, the Unlevered Risk is 8%, and the Risk Multiplier is 1.025. What level of debt minimizes the WACC? a) 5,500,000 b) 6,500,000 c) 7,500,000 d) 8,500,000 8. Assume the Risk Free Rate is 4%, the Unlevered Risk is 7%, and the Risk Multiplier is 1.025. What level of debt minimizes the WACC? a) 4,000,000 b) 5,000,000 c)6,000,000 d) 7,000,000 9. Assume the Risk Free Rate is 3.5%, the Unlevered Risk is 7%, and the Risk Multiplier is 1.025. What level of debt minimizes the WACC? a) 4,500,000 b) 5,500,000 c) 6,500,000 d) 7,500,000 1 10. Assume the Risk Free Rate is 3.5%, the Unlevered Risk is 7%, and the Risk Multiplier is 1.025. What level of debt minimizes the WACC if the tax rate is 20%? a) 500,000 b) 1,500,000 c) 2,500,000 d) 3,500,000 For Questions 1-5, Use the Leverage tab of the Optimal Capital Structure spreadsheet posted on Moodle. Change the assumptions on the spreadsheet as follows: Company A 0.7 0.1 Company B 0.5 0.1 Company 0.7 0.1 Company D 0.5 0.1 0.08 0.08 0.08 0.08 VC as a percent of Sales Fixed Costs as % of FA Interest as % of Total Liabilities Taxes as % of EBT Liabilities as a % of Assets Working Capital Foed Assets 0.3 0.3 0.3 0.3 0 15000 35000 0 30000 70000 0.4 15000 35000 0.4 30000 70000 What is Company C's Degree of Financial Leverage when Sales are 40,000? a) 1.23 b) 1.38 c)1.41 d) 1.74 2. At what level of Sales does Company C have the same ROE and Basic Earning Power? a) 30,000 b) 37,000 c) 42,000 d) 49,000 3. Suppose Company D's Sales rise from 50,000 to 55,000 (a 10% increase). What is the percentage increase in their Net Income? a) 16.996 b) 38.896 c)58.9% d) 68.996 4. At what level of Sales do Company B and have the same Return on Equity? a) 25,000 b) 30,000 c)35,000 d) 40,000 5. Which company has the highest ROE if Sales are 40,000? a) A b) B c)c d) D For questions 6-10, use the OatCapStr tab of the Optimal Capital Structure spreadsheet posted on Moodle. Assume a tax Rate of 30% and an EBIT of 1,000,000 unless stated otherwise. 6. Assume the Risk Free Rate is 4%, the Unlevered Risk is 8%, and the Risk Multiplier is 1.03. What level of debt minimizes the WACC? a) 4,000,000 b) 5,000,000 c) 6,000,000 d) 7,000,000 7. Assume the Risk Free Rate is 4%, the Unlevered Risk is 8%, and the Risk Multiplier is 1.025. What level of debt minimizes the WACC? a) 5,500,000 b) 6,500,000 c) 7,500,000 d) 8,500,000 8. Assume the Risk Free Rate is 4%, the Unlevered Risk is 7%, and the Risk Multiplier is 1.025. What level of debt minimizes the WACC? a) 4,000,000 b) 5,000,000 c)6,000,000 d) 7,000,000 9. Assume the Risk Free Rate is 3.5%, the Unlevered Risk is 7%, and the Risk Multiplier is 1.025. What level of debt minimizes the WACC? a) 4,500,000 b) 5,500,000 c) 6,500,000 d) 7,500,000 1 10. Assume the Risk Free Rate is 3.5%, the Unlevered Risk is 7%, and the Risk Multiplier is 1.025. What level of debt minimizes the WACC if the tax rate is 20%? a) 500,000 b) 1,500,000 c) 2,500,000 d) 3,500,000