Answered step by step

Verified Expert Solution

Question

1 Approved Answer

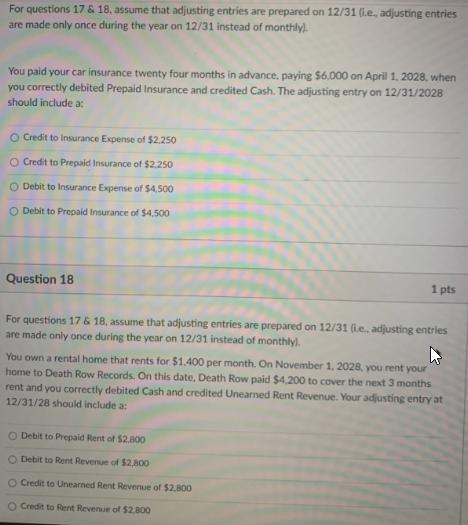

For questions 17& 18. assume that adjusting entries are prepared on 12/31 (L.e., adjusting entries are made only once during the year on 12/31

For questions 17& 18. assume that adjusting entries are prepared on 12/31 (L.e., adjusting entries are made only once during the year on 12/31 instead of monthly). You paid your car insurance twenty four months in advance, paying $6.000 on April 1, 2028, when you correctly debited Prepaid Insurance and credited Cash. The adjusting entry on 12/31/2028 should include a: O Credit to Insurance Expense of $2.250 O Credit to Prepaid Insurance of $2.250 O Debit to Insurance Expense of $4,500 O Debit to Prepaid Insurance of $4,500 Question 18 1 pts For questions 17 & 18, assume that adjusting entries are prepared on 12/31 (i.e, adjusting entries are made only once during the year on 12/31 instead of monthlyl. You own a rental home that rents for $1.400 per month. On November 1, 2028, you rent your home to Death Row Records. On this date, Death Row paid $4.200 to cover the next 3 months rent and you correctly debited Cash and credited Unearned Rent Revenue. Your adjusting entry at 12/31/28 should include a: O Debit to Prepaid Rent of $2.800 O Debit to Rent Revenue of $2,800 O Credit to Unearned Rent Revenue of $2.800 O Credit to Rent Revenue of $2.800

Step by Step Solution

★★★★★

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 The correct answer is Option b Credit prepaid insurance of 2250 Explaina...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started