Answered step by step

Verified Expert Solution

Question

1 Approved Answer

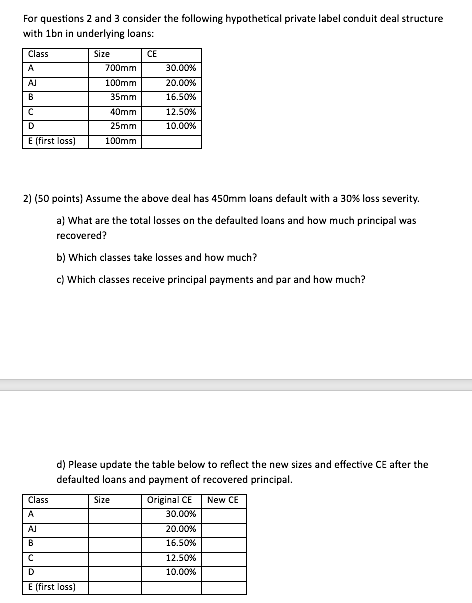

For questions 2 and 3 consider the following hypothetical private label conduit deal structure with 1bn in underlying loans: 2) (50 points) Assume the above

For questions 2 and 3 consider the following hypothetical private label conduit deal structure with 1bn in underlying loans: 2) (50 points) Assume the above deal has 450mm loans default with a 30% loss severity. a) What are the total losses on the defaulted loans and how much principal was recovered? b) Which classes take losses and how much? c) Which classes receive principal payments and par and how much? d) Please update the table below to reflect the new sizes and effective CE after the defaulted loans and payment of recovered principal

For questions 2 and 3 consider the following hypothetical private label conduit deal structure with 1bn in underlying loans: 2) (50 points) Assume the above deal has 450mm loans default with a 30% loss severity. a) What are the total losses on the defaulted loans and how much principal was recovered? b) Which classes take losses and how much? c) Which classes receive principal payments and par and how much? d) Please update the table below to reflect the new sizes and effective CE after the defaulted loans and payment of recovered principal Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started