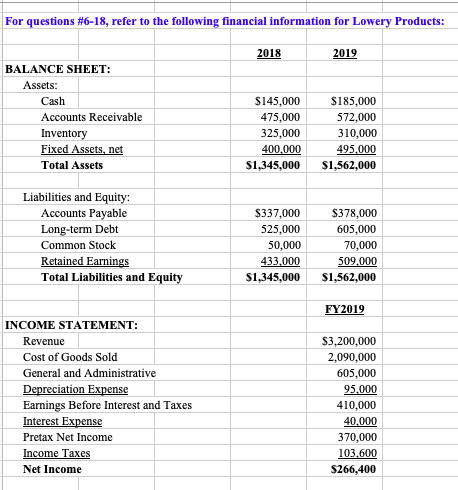

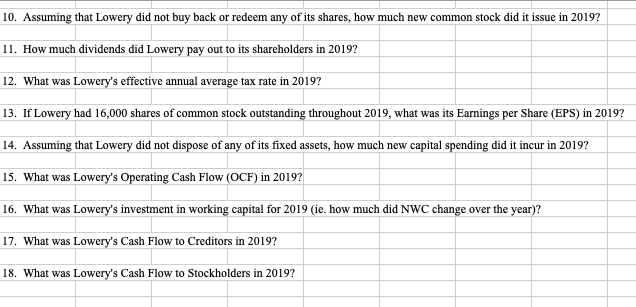

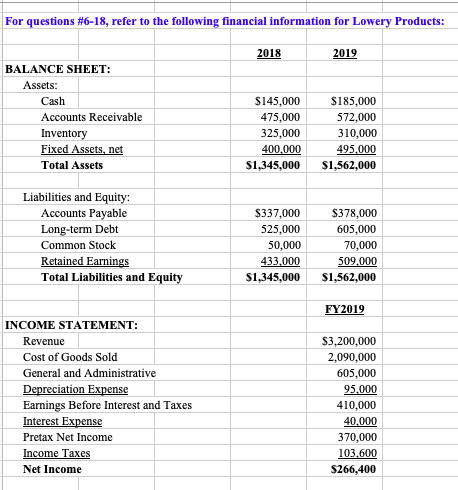

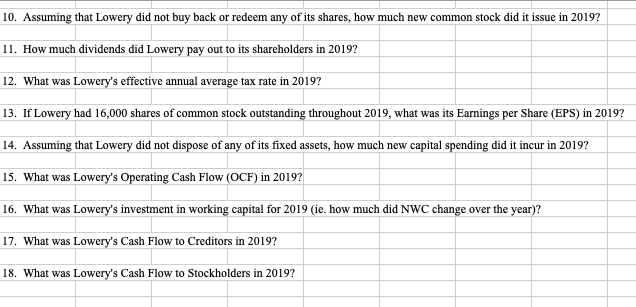

For questions #6-18, refer to the following financial information for Lowery Products: 2018 2019 BALANCE SHEET: Assets: Cash Accounts Receivable Inventory Fixed Assets, net Total Assets $145,000 475,000 325,000 400.000 $1,345,000 $185,000 572,000 310,000 495.000 $1,562,000 Liabilities and Equity: Accounts Payable Long-term Debt Common Stock Retained Earnings Total Liabilities and Equity $337,000 525,000 50,000 433.000 $1,345,000 $378,000 605,000 70,000 509,000 $1,562,000 FY2019 INCOME STATEMENT: Revenue Cost of Goods Sold General and Administrative Depreciation Expense Earnings Before Interest and Taxes Interest Expense Pretax Net Income Income Taxes Net Income $3,200,000 2,090,000 605,000 95.000 410,000 40,000 370,000 103,600 $266,400 10. Assuming that Lowery did not buy back or redeem any of its shares, how much new common stock did it issue in 2019? 11. How much dividends did Lowery pay out to its shareholders in 2019? 12. What was Lowery's effective annual average tax rate in 2019? 13. If Lowery had 16,000 shares of common stock outstanding throughout 2019, what was its Earnings per Share (EPS) in 2019? 14. Assuming that Lowery did not dispose of any of its fixed assets, how much new capital spending did it incur in 2019? 15. What was Lowery's Operating Cash Flow (OCF) in 2019? 16. What was Lowery's investment in working capital for 2019 (ie. how much did NWC change over the year)? 17. What was Lowery's Cash Flow to Creditors in 2019? 18. What was Lowery's Cash Flow to Stockholders in 2019? For questions #6-18, refer to the following financial information for Lowery Products: 2018 2019 BALANCE SHEET: Assets: Cash Accounts Receivable Inventory Fixed Assets, net Total Assets $145,000 475,000 325,000 400.000 $1,345,000 $185,000 572,000 310,000 495.000 $1,562,000 Liabilities and Equity: Accounts Payable Long-term Debt Common Stock Retained Earnings Total Liabilities and Equity $337,000 525,000 50,000 433.000 $1,345,000 $378,000 605,000 70,000 509,000 $1,562,000 FY2019 INCOME STATEMENT: Revenue Cost of Goods Sold General and Administrative Depreciation Expense Earnings Before Interest and Taxes Interest Expense Pretax Net Income Income Taxes Net Income $3,200,000 2,090,000 605,000 95.000 410,000 40,000 370,000 103,600 $266,400 10. Assuming that Lowery did not buy back or redeem any of its shares, how much new common stock did it issue in 2019? 11. How much dividends did Lowery pay out to its shareholders in 2019? 12. What was Lowery's effective annual average tax rate in 2019? 13. If Lowery had 16,000 shares of common stock outstanding throughout 2019, what was its Earnings per Share (EPS) in 2019? 14. Assuming that Lowery did not dispose of any of its fixed assets, how much new capital spending did it incur in 2019? 15. What was Lowery's Operating Cash Flow (OCF) in 2019? 16. What was Lowery's investment in working capital for 2019 (ie. how much did NWC change over the year)? 17. What was Lowery's Cash Flow to Creditors in 2019? 18. What was Lowery's Cash Flow to Stockholders in 2019