Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ram Company completed the following transactions for October 2020. 1. Purchased on account direct materials of P150,000 2. The factory payroll was recorded. Direct

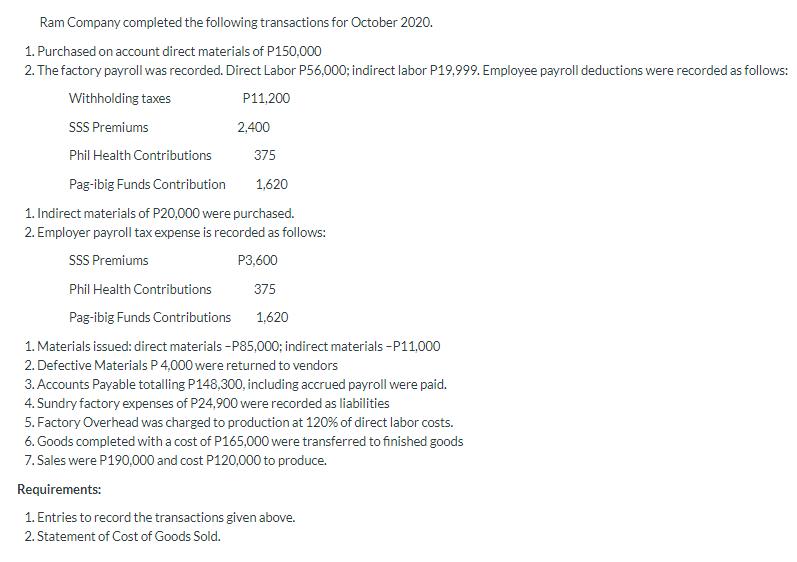

Ram Company completed the following transactions for October 2020. 1. Purchased on account direct materials of P150,000 2. The factory payroll was recorded. Direct Labor P56,000; indirect labor P19,999. Employee payroll deductions were recorded as follows: Withholding taxes P11,200 SSS Premiums 2,400 Phil Health Contributions 375 Pag-ibig Funds Contribution 1,620 1. Indirect materials of P20,000 were purchased. 2. Employer payroll tax expense is recorded as follows: SSS Premiums P3,600 Phil Health Contributions 375 Pag-ibig Funds Contributions 1,620 1. Materials issued: direct materials -P85,000; indirect materials -P11,000 2. Defective Materials P 4,000 were returned to vendors 3. Accounts Payable totalling P148,300, including accrued payroll were paid. 4. Sundry factory expenses of P24,900 were recorded as liabilities 5. Factory Overhead was charged to production at 120% of direct labor costs. 6. Goods completed with a cost of P165,000 were transferred to finished goods 7. Sales were P190,000 and cost P120,000 to produce. Requirements: 1. Entries to record the transactions given above. 2. Statement of Cost of Goods Sold.

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

1 Transaction General Journal Debit Credit 1 Raw materials inventory 150000 Accounts payable 150000 To record direct materials purchased on account 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started