Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For results which are irrational numbers, please keep 4 decimal places. Please show all stepsin your solution. ( a ) Calculate the expected return and

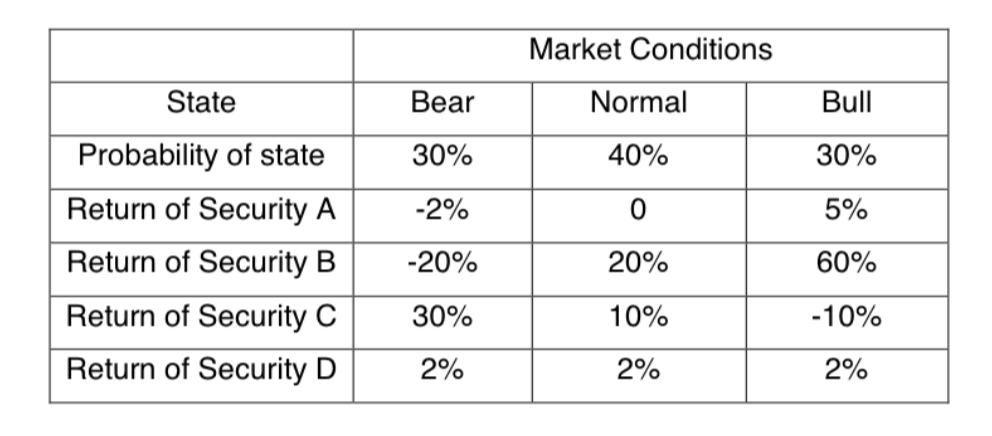

For results which are irrational numbers, please keep decimal places. Please show all stepsin your solution.a Calculate the expected return and variance for security A B C and D marksb Calculate all pairwise covariances between the securities There are pairwise covariances. marksc Calculate all pairwise correlation coefficients between the securities Fill out the matrix below. marks d Assuming equal weights for each security, what are the expected returns and standarddeviations for the following portfolios?i A B and C marksii A and C marksiii B and D markse Would it be possible to construct a twosecurity portfolio from A B C and D which wouldgive us zero risk standard deviation If so what are the two securities and what are theirrespective weights in the portfolio? Verify that the portfolio standard deviation is zero underthese weights and calculate the portfolio expected return. marksf Consider all portfolios which can be constructed from the two securities you found in part eShow graphically the locus of the expected return and standard deviation of the portfolio whilethe weight of one security changes from to markstableMarket ConditionsStateBear,Normal,BullProbability of state,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started