Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For several years, Alexandra Blanco has represented several companies as an independent sales and Tetra Ltd., are interested in hiring her as a full-time

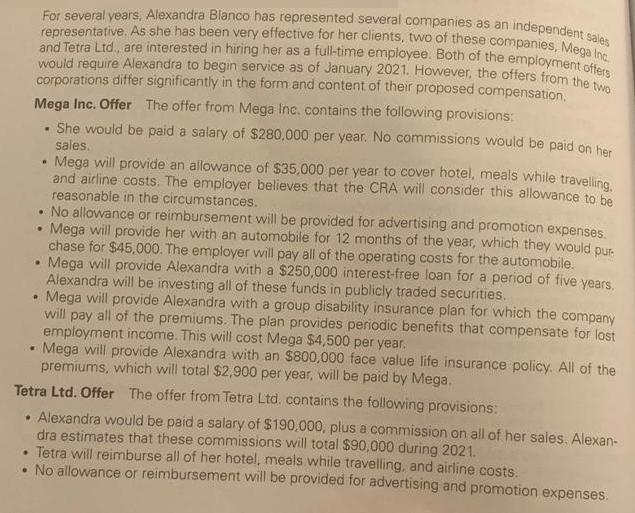

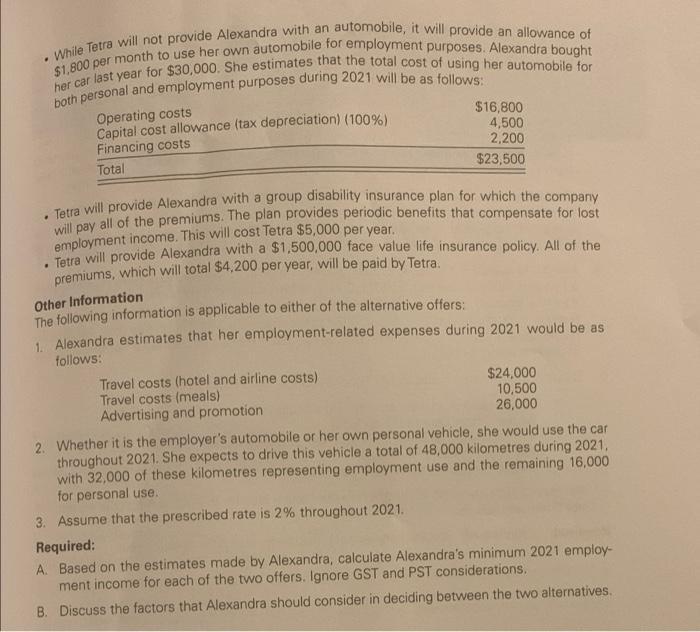

For several years, Alexandra Blanco has represented several companies as an independent sales and Tetra Ltd., are interested in hiring her as a full-time employee. Both of the employment offers representative. As she has been very effective for her clients, two of these companies, Mega would require Alexandra to begin service as of January 2021. However, the offers from the two corporations differ significantly in the form and content of their proposed compensation. Mega Inc. Offer The offer from Mega Inc. contains the following provisions: She would be paid a salary of $280,000 per year. No commissions would be paid on her sales. . Mega will provide an allowance of $35,000 per year to cover hotel, meals while travelling. and airline costs. The employer believes that the CRA will consider this allowance to be reasonable in the circumstances. No allowance or reimbursement will be provided for advertising and promotion expenses. Mega will provide her with an automobile for 12 months of the year, which they would pur chase for $45,000. The employer will pay all of the operating costs for the automobile. . Mega will provide Alexandra with a $250,000 interest-free loan for a period of five years. Alexandra will be investing all of these funds in publicly traded securities. Mega will provide Alexandra with a group disability insurance plan for which the company will pay all of the premiums. The plan provides periodic benefits that compensate for lost employment income. This will cost Mega $4,500 per year. . Mega will provide Alexandra with an $800,000 face value life insurance policy. All of the premiums, which will total $2,900 per year, will be paid by Mega. Tetra Ltd. Offer The offer from Tetra Ltd. contains the following provisions: Alexandra would be paid a salary of $190,000, plus a commission on all of her sales. Alexan- dra estimates that these commissions will total $90,000 during 2021. Tetra will reimburse all of her hotel, meals while travelling, and airline costs. . No allowance or reimbursement will be provided for advertising and promotion expenses. . While Tetra will not provide Alexandra with an automobile, it will provide an allowance of $1,800 per month to use her own automobile for employment purposes. Alexandra bought her car last year for $30,000. She estimates that the total cost of using her automobile for both personal and employment purposes during 2021 will be as follows: Operating costs Capital cost allowance (tax depreciation) (100%) Financing costs $16,800 4,500 2,200 Total $23,500 . Tetra will provide Alexandra with a group disability insurance plan for which the company will pay all of the premiums. The plan provides periodic benefits that compensate for lost employment income. This will cost Tetra $5,000 per year. . Tetra will provide Alexandra with a $1,500,000 face value life insurance policy. All of the premiums, which will total $4,200 per year, will be paid by Tetra. Other Information The following information is applicable to either of the alternative offers: 1. Alexandra estimates that her employment-related expenses during 2021 would be as follows: Travel costs (hotel and airline costs) Travel costs (meals) $24,000 10,500 26,000 Advertising and promotion 2. Whether it is the employer's automobile or her own personal vehicle, she would use the car throughout 2021. She expects to drive this vehicle a total of 48,000 kilometres during 2021, with 32,000 of these kilometres representing employment use and the remaining 16,000 for personal use. 3. Assume that the prescribed rate is 2% throughout 2021. Required: A. Based on the estimates made by Alexandra, calculate Alexandra's minimum 2021 employ- ment income for each of the two offers. Ignore GST and PST considerations. B. Discuss the factors that Alexandra should consider in deciding between the two alternatives.

Step by Step Solution

★★★★★

3.29 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A Based on the estimates made by Alexandra calculate Alexandras minimum 2021 employ ment i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started