Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the 2023 taxation year, Sundal Ltd. has net income of $235,000. Included in this amount is foreign business income of $48,000 of which

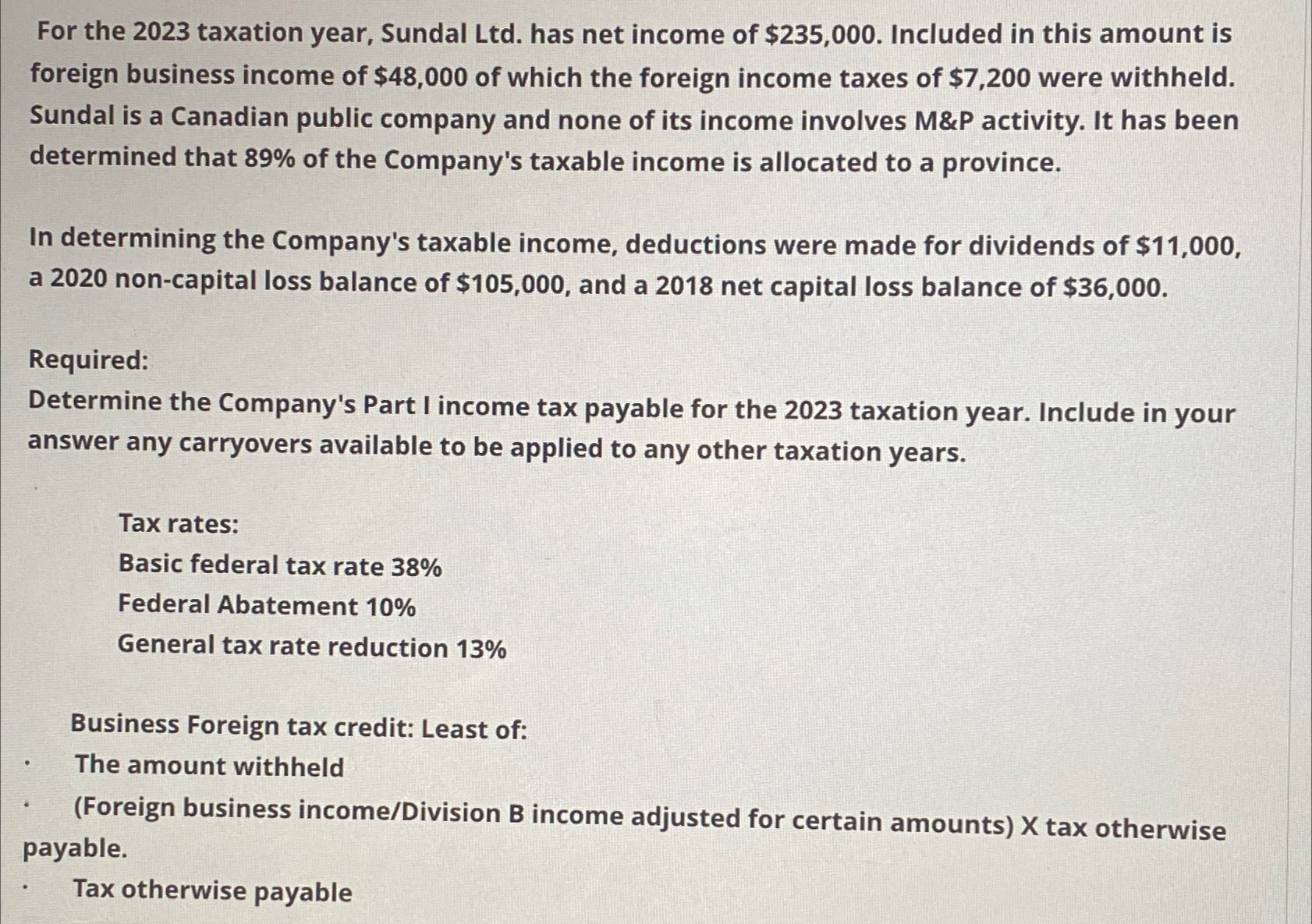

For the 2023 taxation year, Sundal Ltd. has net income of $235,000. Included in this amount is foreign business income of $48,000 of which the foreign income taxes of $7,200 were withheld. Sundal is a Canadian public company and none of its income involves M&P activity. It has been determined that 89% of the Company's taxable income is allocated to a province. In determining the Company's taxable income, deductions were made for dividends of $11,000, a 2020 non-capital loss balance of $105,000, and a 2018 net capital loss balance of $36,000. . Required: Determine the Company's Part I income tax payable for the 2023 taxation year. Include in your answer any carryovers available to be applied to any other taxation years. Tax rates: Basic federal tax rate 38% Federal Abatement 10% General tax rate reduction 13% Business Foreign tax credit: Least of: The amount withheld (Foreign business income/Division B income adjusted for certain amounts) X tax otherwise payable. Tax otherwise payable

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To determine Sundal Ltds Part I income tax payable for the 2023 taxation year we need to follow thes...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started