Question

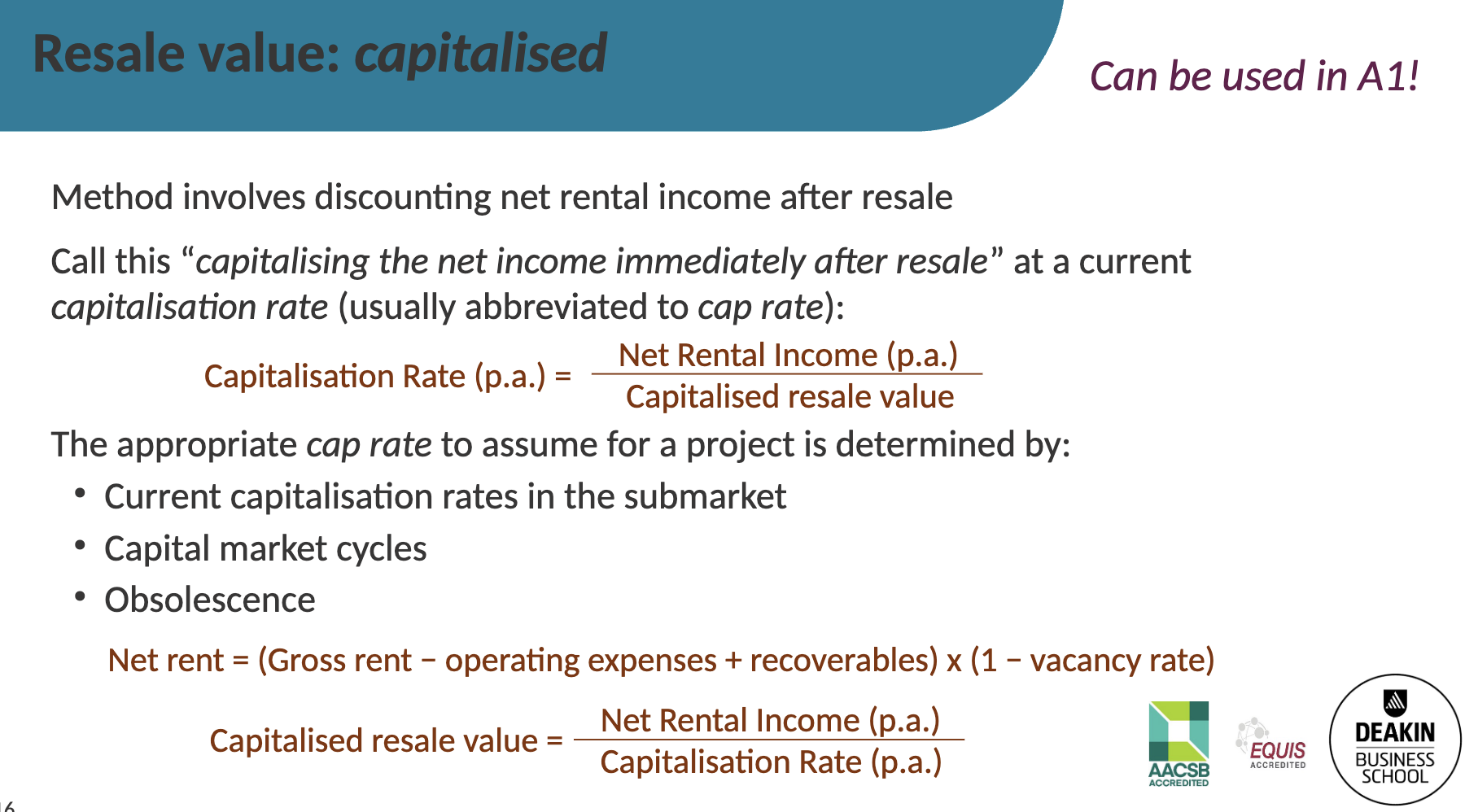

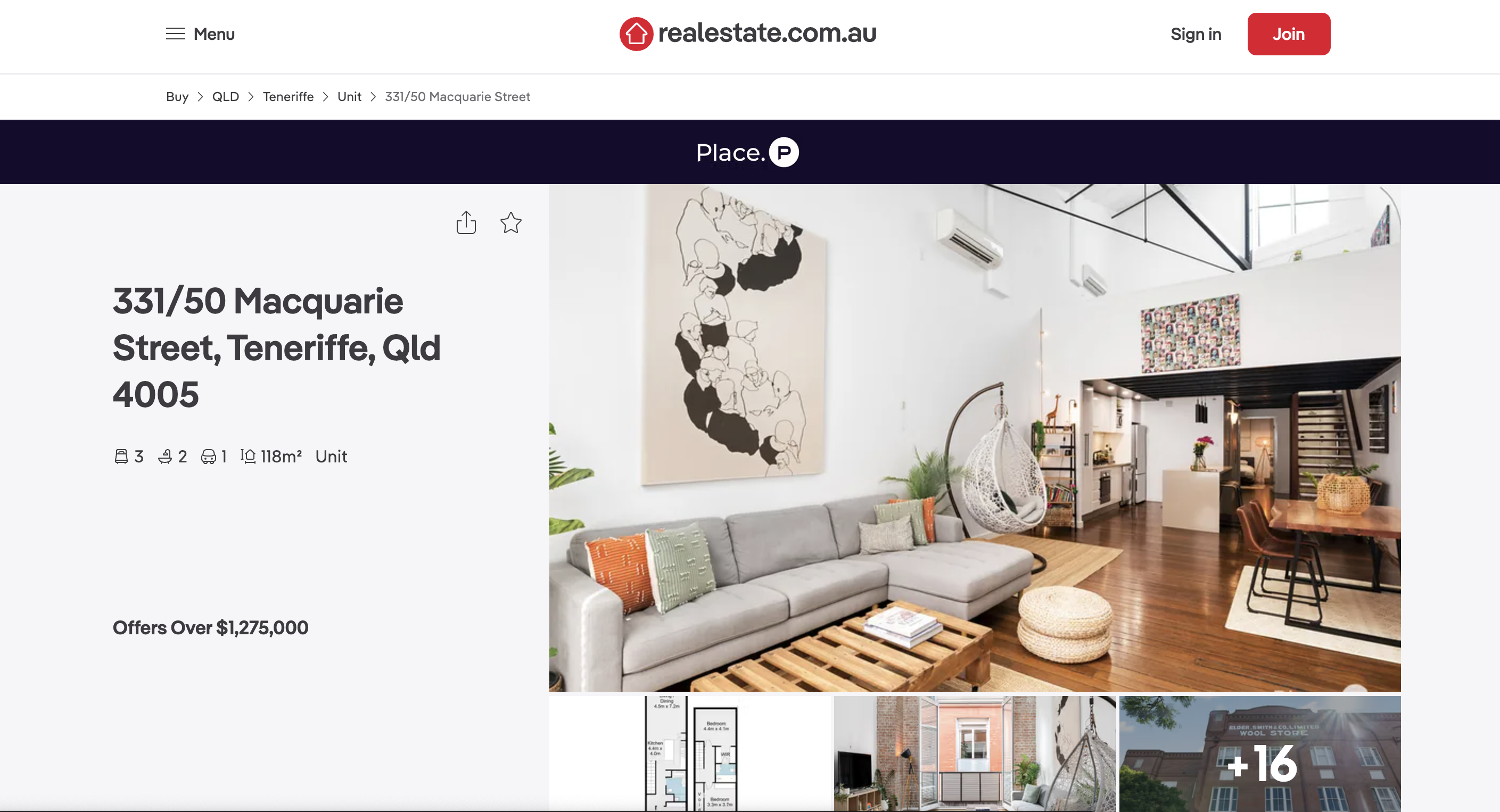

For the apartment currently for sale that you used in Part D i), use the capitalised resale value or the discounted cash flow method from

For the apartment currently for sale that you used in Part D i), use the capitalised resale value or the

discounted cash flow method from Week 2's lecture to calculate the price of the apartment. Justify

the input that you used in the formula such as how you have projected net rental income (see Week

1 part 2 and Week 2 part 1) and capitalisation/discount rate (Week 2 part 1). How did you come up

with these numbers and what assumptions did you use? Compare the calculated capitalised resale

value/discounted cash flow valuation to the actual price and the estimated sale price from your

regression model. Discuss what property market dynamic factors that exist or are missing in the

models that make the values differ.

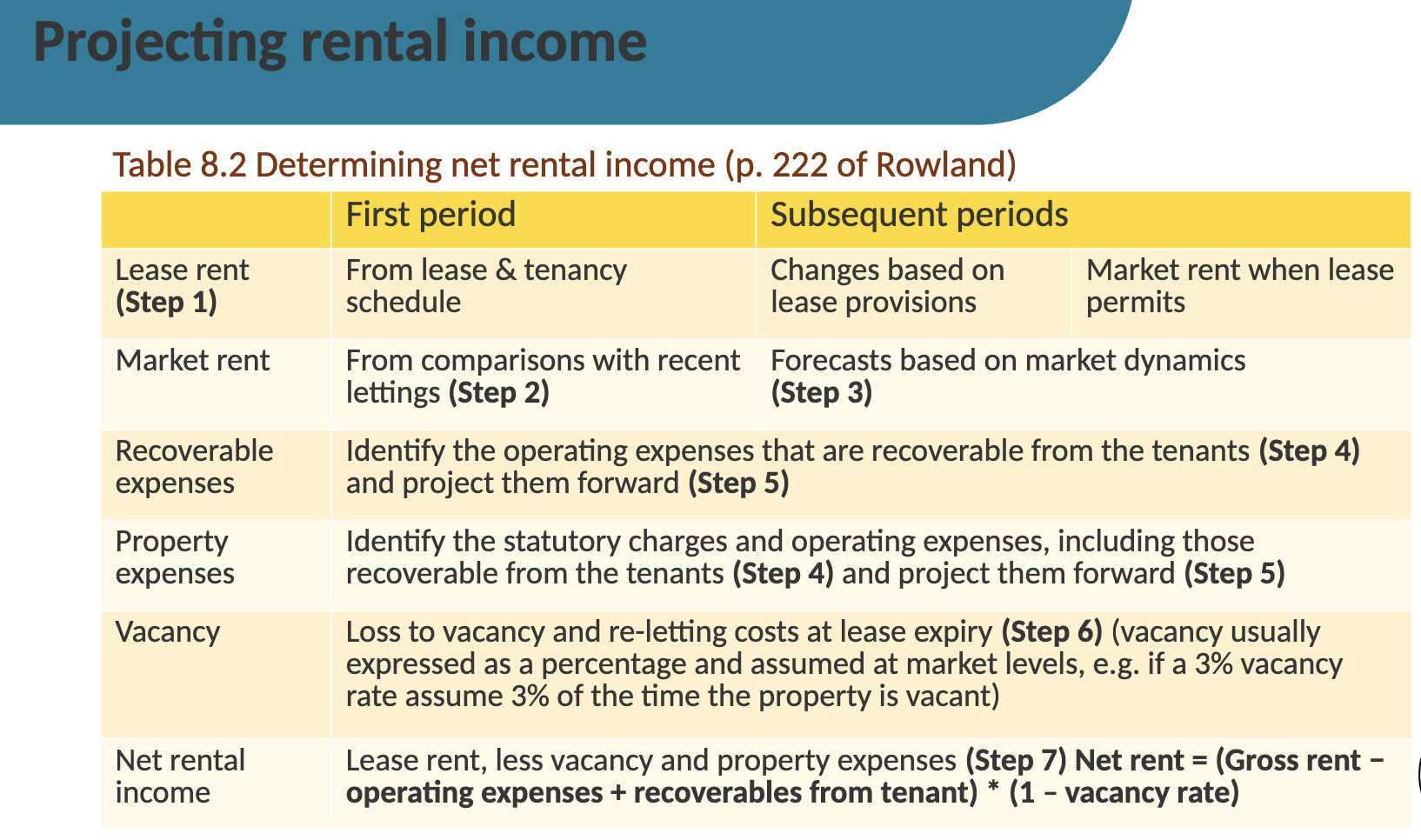

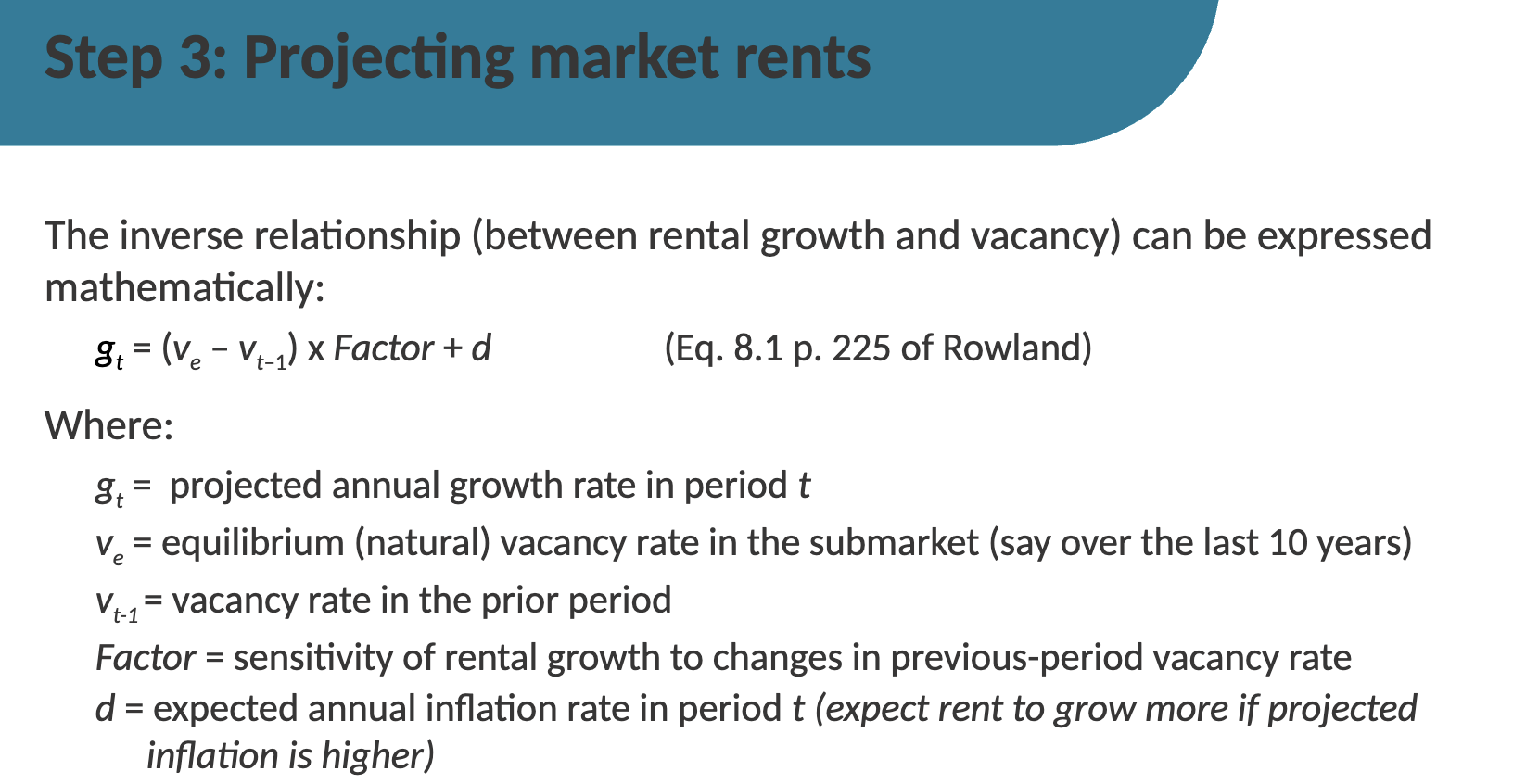

Projecting rental income Table 8.2 Determining net rental income (p. 222 of Rowland) First period Lease rent (Step 1) From lease & tenancy schedule Market rent Recoverable expenses Property expenses Vacancy Net rental income Subsequent periods Changes based on lease provisions Market rent when lease permits (Step 3) From comparisons with recent Forecasts based on market dynamics lettings (Step 2) Identify the operating expenses that are recoverable from the tenants (Step 4) and project them forward (Step 5) Identify the statutory charges and operating expenses, including those recoverable from the tenants (Step 4) and project them forward (Step 5) Loss to vacancy and re-letting costs at lease expiry (Step 6) (vacancy usually expressed as a percentage and assumed at market levels, e.g. if a 3% vacancy rate assume 3% of the time the property is vacant) Lease rent, less vacancy and property expenses (Step 7) Net rent = (Gross rent - operating expenses + recoverables from tenant) * (1 - vacancy rate)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started