Question

For the audit of the financial statements of Mercury Fifo Company, Stella Mason, CPA, has decided to apply nonstatistical audit sampling in the tests of

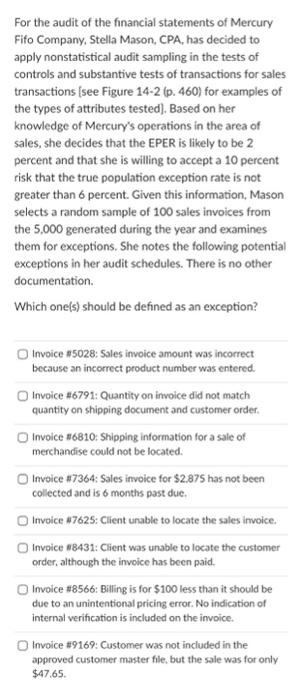

For the audit of the financial statements of Mercury Fifo Company, Stella Mason, CPA, has decided to apply nonstatistical audit sampling in the tests of controls and substantive tests of transactions for sales transactions [see Figure 14-2 (p. 460) for examples of the types of attributes tested]. Based on her knowledge of Mercury's operations in the area of sales, she decides that the EPER is likely to be 2 percent and that she is willing to accept a 10 percent risk that the true population exception rate is not greater than 6 percent. Given this information, Mason selects a random sample of 100 sales invoices from the 5,000 generated during the year and examines them for exceptions. She notes the following potential exceptions in her audit schedules. There is no other documentation.

Which one(s) should be defined as an exception?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started