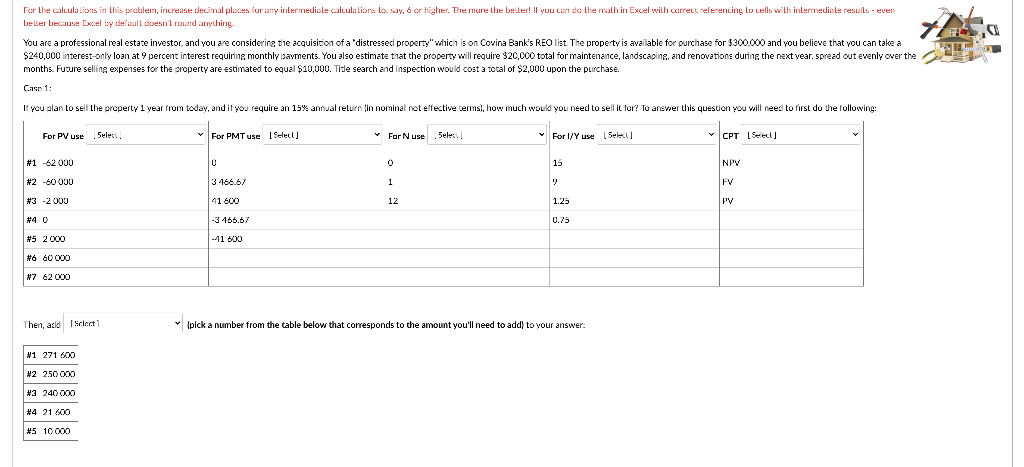

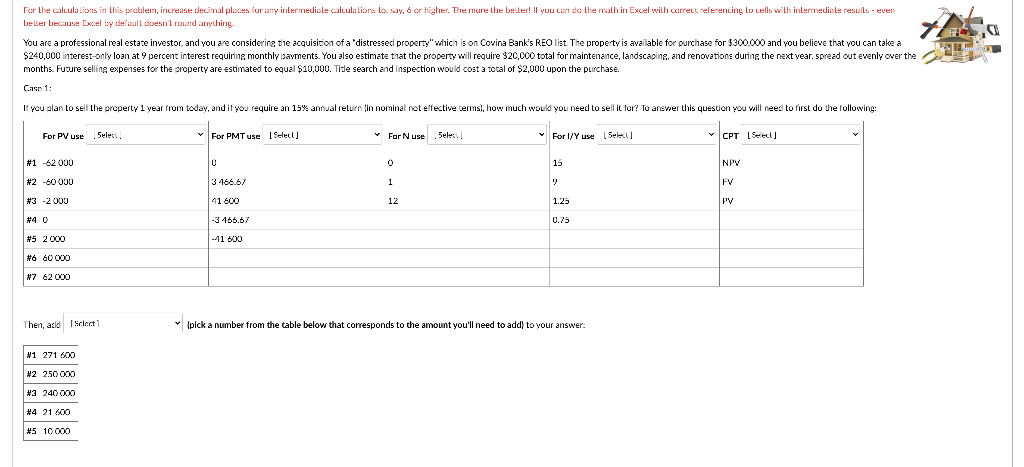

For the calculations in this problem, increase decimal places for any intermediile calculations to say, 6 or higher. The more the better! Il you can do the math in Excel with correct referencing locells with intermediate results - even belter because Excel y debull doesn't round anything You are a professional real estate investor, and you are considering the acquisition of a 'distressed property" which is on Covina Bank's REO list. The property is available for purchase for $300,000 and you believe that you can take a $240,000 interest-only loan at 9 percent interest requiring monthly payments. You also estimate that the property will require $20,000 total for maintenance, landscaping, and renovations during the next year. spread out evenly over the months. Future selling expenses for the property are estimated to equal $10,000. Tidle search and inspection would cost a total of $2,000 upon the purchase. Case 1 If you plan to sell the property 1 year from today, and if you require an 15% annual return in nominal not effective terms, how much would you need to sell it for? To answer this question you will need to first do the following: For PV use | Delet, For PMT use Select] For N use 5elec For 1/Y use (5elex CPT Seed #1 -62000 0 0 15 NPV #2 -60 000 3 466.64 1 FV 41 600 12 1.25 PV #3 -2000 #4 O -3466.67 0.75 #5 2000 -41 500 #6 60 000 N7 62 000 Then, add Sclect pick a number from the table below that corresponds to the amount you'll need to add to your answer. #1 271 500 w2 250 000 #3 240 000 #4 21 600 #5 10000 For the calculations in this problem, increase decimal places for any intermediile calculations to say, 6 or higher. The more the better! Il you can do the math in Excel with correct referencing locells with intermediate results - even belter because Excel y debull doesn't round anything You are a professional real estate investor, and you are considering the acquisition of a 'distressed property" which is on Covina Bank's REO list. The property is available for purchase for $300,000 and you believe that you can take a $240,000 interest-only loan at 9 percent interest requiring monthly payments. You also estimate that the property will require $20,000 total for maintenance, landscaping, and renovations during the next year. spread out evenly over the months. Future selling expenses for the property are estimated to equal $10,000. Tidle search and inspection would cost a total of $2,000 upon the purchase. Case 1 If you plan to sell the property 1 year from today, and if you require an 15% annual return in nominal not effective terms, how much would you need to sell it for? To answer this question you will need to first do the following: For PV use | Delet, For PMT use Select] For N use 5elec For 1/Y use (5elex CPT Seed #1 -62000 0 0 15 NPV #2 -60 000 3 466.64 1 FV 41 600 12 1.25 PV #3 -2000 #4 O -3466.67 0.75 #5 2000 -41 500 #6 60 000 N7 62 000 Then, add Sclect pick a number from the table below that corresponds to the amount you'll need to add to your answer. #1 271 500 w2 250 000 #3 240 000 #4 21 600 #5 10000