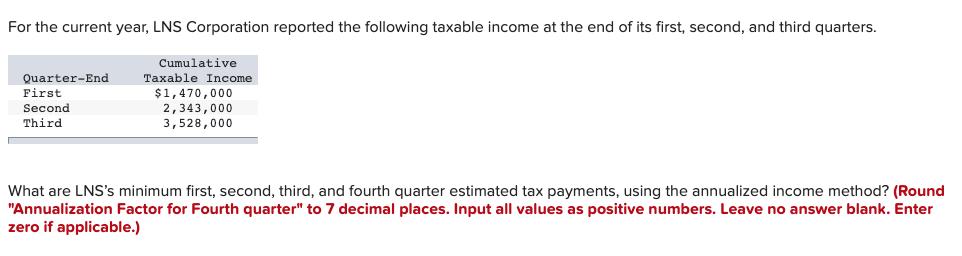

For the current year, LNS Corporation reported the following taxable income at the end of its first, second, and third quarters. Quarter-End First Cumulative

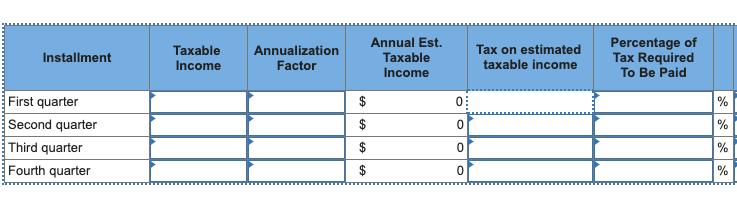

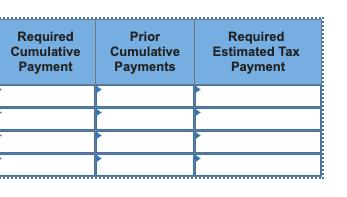

For the current year, LNS Corporation reported the following taxable income at the end of its first, second, and third quarters. Quarter-End First Cumulative Taxable Income $1,470,000 Second 2,343,000 3,528,000 Third What are LNS's minimum first, second, third, and fourth quarter estimated tax payments, using the annualized income method? (Round "Annualization Factor for Fourth quarter" to 7 decimal places. Input all values as positive numbers. Leave no answer blank. Enter zero if applicable.) Taxable Income Annualization Factor Annual Est. Taxable Income Tax on estimated taxable income Percentage of Tax Required To Be Paid Installment First quarter % Second quarter Third quarter Fourth quarter $ % $ % $ % %24 Required Cumulative Prior Cumulative Required Estimated Tax Payment Payment Payments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Corporate tax rate 21 Please note it will vary with the year and different country so values ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started