Question

For the following Accounting Equation, please complete the following: Journals General Ledger Trial Balance Financial Statements Profit & Loss Balance Sheet Toms Real Estate Company

For the following Accounting Equation, please complete the following:

Journals

General Ledger

Trial Balance

Financial Statements

Profit & Loss

Balance Sheet

Tom’s Real Estate Company opened its doors in May 2014 in the sunny state of Florida. Tom has

always dreamed of owning a large business and believes Real Estate is the key to his future success. Over the years, he has met with high level teams across the nation and has been mentored by some of the greatest teams around. Tom has found a building to rent, along with multiple talented people to help run his business. In his first month, Tom sold 6 closings for a whopping Gross Income of $30,000.00. Of course at the end of the month, the bank balance was a lot less than he anticipated. Please help Tom figure out his net income and what his company is worth.

Tom invested $15,000.00 of personal money into his business on May 1st, 2014.

He used $3,000.00 to purchase Computers & Other Equipment for the business from

Best Buy.

Received Commission checks of $9,000.00 on May 7th.

10% of Tom’s Commissions were paid to his Agent, Tim Jones on May 8th.

His rent, paid on May 15th to Chase Bank was for $650.00. $200.00 of which is a

refundable security deposit.

Check 1322, in the amount of $32.00 was written on May 16th for the Internet Bill to

Century Link.

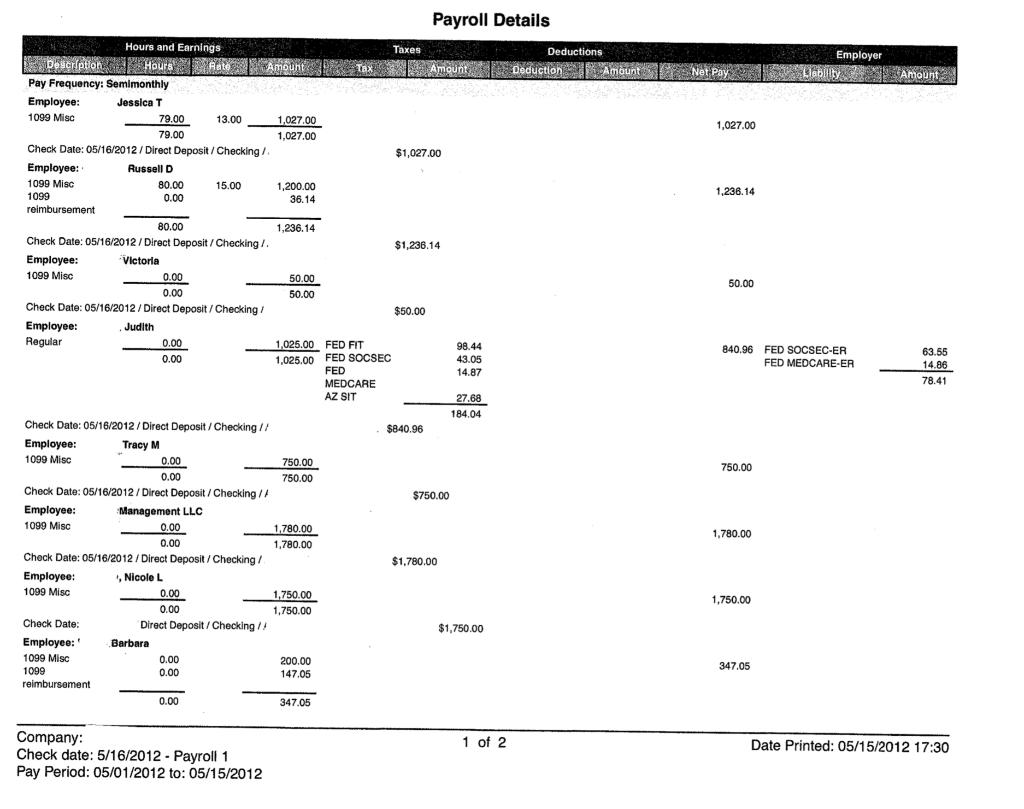

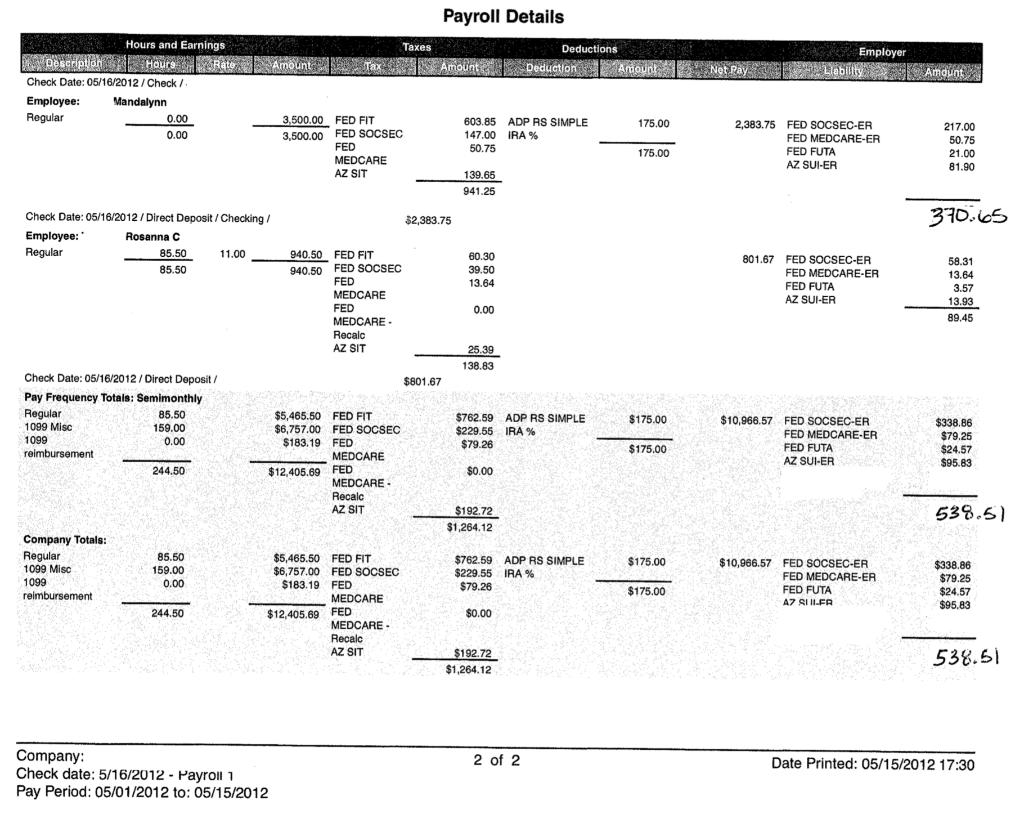

Salaries were paid to 1099 Vendors & Support Staff via ADP on May 16th. Payroll Journal

attached. Employee Withholdings will be paid next month, along with the IRA. Payroll

Processing Fees were $85.00.

Employer Payroll Taxes were deducted on May 16th.

Received Commission checks in the amount of $18,000.00 on May 20th.

20% of Tom’s Commissions were paid to his Agent, Tim Jones on May 21st.

$2,000.00 worth of Advertising Expenses were spent on May 25th on the Company

Credit Card. He paid XYZ Marketing Company.

Received Commission checks in the amount of $3,000.00 on May 27th.

Tom loaned one of his agents, Tim Jones, $1,500.00 on May 27th.

A payment of $200.00 was made on the Company Credit Card May 30th.

Possible G/L Categories

Bank

Pre-Paid Legal

Pre-Paid Insurance

Cost of Goods Sold Commission Income Advertising Expense Security Deposit Furnishings & Equipment Computer & Internet Loan Payable

Loan Receivable

Credit Card

Payroll Processing Fees Lead Generation

Salary Expense

Payroll Taxes

Payroll Taxes Payable IRA Payable

IRA Match

Rent

$49 Description Pay Frequency: Semimonthly Jessica T Employee: 1099 Misc reimbursement Hours and Earnings Check Date: 05/16/2012/Direct Deposit / Checking /. Employee: 1099 Misc 1099 Employee: 1099 Misc Hours Rate Employee: 1099 Misc 79.00 79.00 Employee: 1099 Misc Russell D Check Date: Employee: 1099 Misc 1099 Check Date: 05/16/2012/Direct Deposit/Checking/. Employee: Victoria 1099 Misc reimbursement 80.00 0.00 Check Date: 05/16/2012/Direct Deposit/Checking/ Employee: Judith Regular 80.00 0.00 0.00 Check Date: 05/16/2012/Direct Deposit/Checking // Tracy M Barbara 0.00 0.00 Check Date: 05/16/2012/Direct Deposit / Checking // Management LLC 13.00 0.00 0.00 Check Date: 05/16/2012/Direct Deposit / Checking/ , Nicole L 15.00 0.00 0.00 0.00 0.00 Direct Deposit/Checking // 0.00 0.00 Amount: 0.00 Company: Check date: 5/16/2012 - Payroll 1 Pay Period: 05/01/2012 to: 05/15/2012 1,027.00 1,027.00 1,200.00 36.14 1,236.14 50.00 50.00 1,025.00 FED FIT 1,025.00 FED SOCSEC FED 750.00 750.00 1,780.00 1,780.00 1,750.00 1,750.00 200.00 147.05 Tax 347.05 MEDCARE AZ SIT Taxes $1,027.00 Payroll Details 2240 Amount ount Deduction Amount Not Pay $1,236.14 $50.00 $840.96 $750.00 $1,780.00 98.44 43.05 14.87 27.68 184.04 $1,750.00 1 of 2 Deductions 1,027.00 1,236.14 50.00 750.00 840.96 FED SOCSEC-ER FED MEDCARE-ER 1,780.00 1,750.00 Employer 347.05 Liability Amount 63.55 14.86 78.41 Date Printed: 05/15/2012 17:30

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answers and Guidelines Alright lets organize Toms transactions into the accounting equation components 1 Journals May 1st Tom invests 1500000 into his ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started