Question

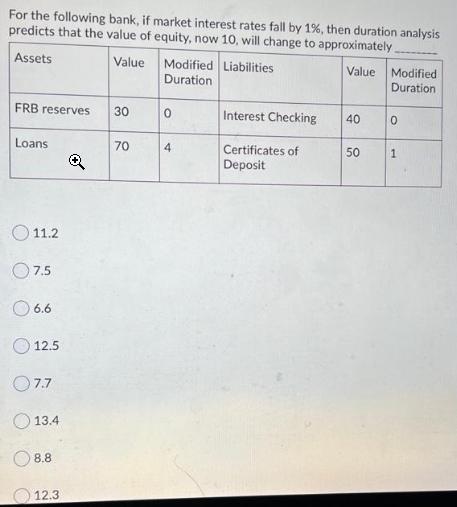

For the following bank, if market interest rates fall by 1%, then duration analysis predicts that the value of equity, now 10, will change

For the following bank, if market interest rates fall by 1%, then duration analysis predicts that the value of equity, now 10, will change to approximately Assets Modified Liabilities Duration Value Value Modified Duration FRB reserves 30 Interest Checking 40 Loans 70 4 Certificates of Deposit 50 O 11.2 O7.5 O 6.6 O 12.5 O7.7 O 13.4 8.8 O 12.3 1.

Step by Step Solution

3.50 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Change on Loan Value Duration Change in Yield Change on Loan Value 10 1 Change on L...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Markets and Institutions

Authors: Jeff Madura

12th edition

9781337515535, 1337099740, 1337515531, 978-1337099745

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App