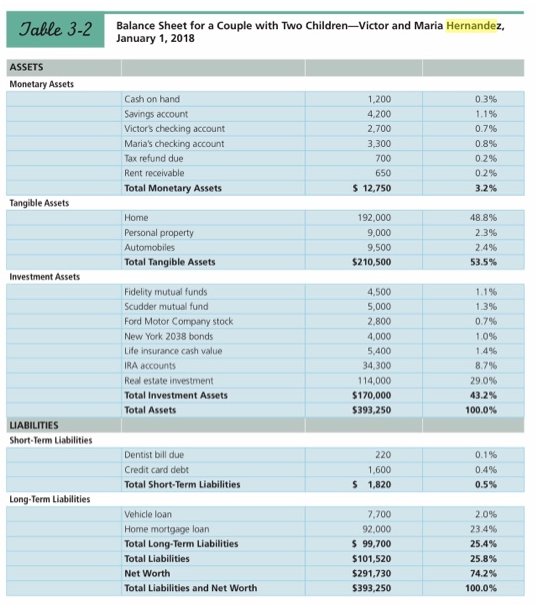

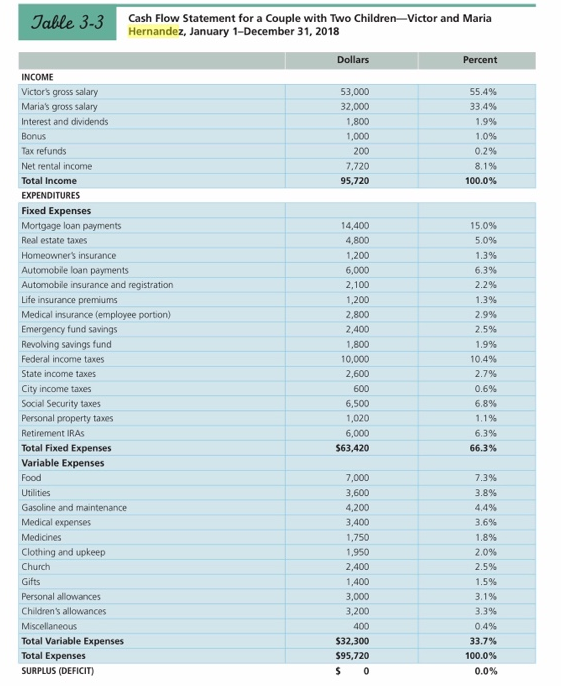

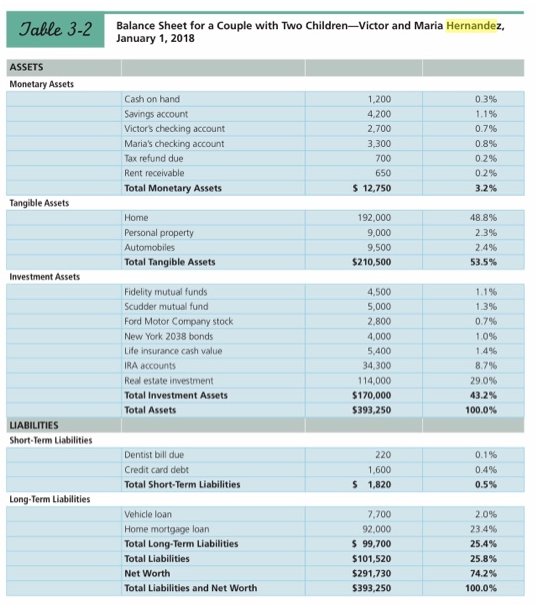

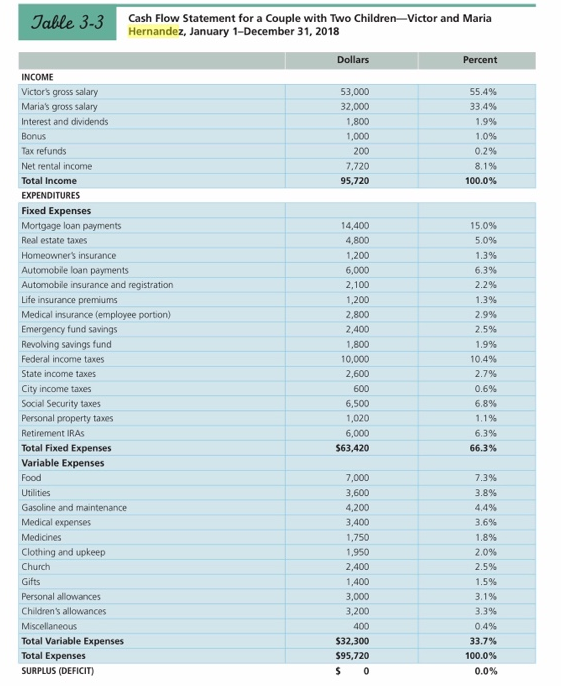

For the following calculation, please use Tables 3.2 and 3.3 in the book on pages 82and 86 respectively.

Please calculate Hernandez's asset-to-debt ratio.

Tahle 3.2 Balance Sheet for a couple with Two Children-Victor and Maria Hernandez, January 1, 2018 ASSETS Monetary Assets 03% Cash on hand Savings account Victor's checking account Maria's checking account Tax refund due Rent receivable Total Monetary Assets 1,200 4,200 2.700 3,300 700 650 $ 12.750 1.1% 0.7% 0.8% 0.2% 0.2% 3.2% Tangible Assets Home Personal property Automobiles Total Tangible Assets 192,000 9,000 9,500 $210,500 48 8% 2.3% 2.4% 53.5% Investment Assets Fidelity mutual funds Scudder mutual fund Ford Motor Company stock New York 2038 bonds Life insurance cash value IRA accounts Real estate investment Total Investment Assets Total Assets 4.500 5,000 2,800 4,000 5,400 34,300 114,000 $170,000 $393.250 1.1% 1.3% 0.7% 1.0% 1.4% 8.7% 29.0% 43.2% 100.0% LIABILITIES Short-Term Liabilities Dentist bill due Credit card debt Total Short-Term Liabilities 220 1,600 1,820 0.1% 0.4% 0.5% $ Long-Term Liabilities Vehicle loan Home mortgage loan Total Long-Term Liabilities Total Liabilities Net Worth Total Liabilities and Net Worth 7.700 92.000 $ 99,700 $101,520 $291,730 $393.250 2.0% 23.4% 25.4% 25.8% 74.2% 100.0% Table 3.3 Cash Flow Statement for a couple with Two Children-Victor and Maria Hernandez, January 1-December 31, 2018 Dollars Percent 53,000 32,000 1,800 1,000 55.4% 33.4% 1.9% 1.0% 0.2% 8.1% 100.0% 200 7.720 95,720 INCOME Victor's gross salary Maria's gross salary Interest and dividends Bonus Tax refunds Net rental income Total Income EXPENDITURES Fixed Expenses Mortgage loan payments Real estate taxes Homeowner's insurance Automobile loan payments Automobile insurance and registration Life insurance premiums Medical insurance (employee portion) Emergency fund savings Revolving savings fund Federal income taxes State income taxes City income taxes Social Security taxes Personal property taxes Retirement IRAS Total Fixed Expenses Variable Expenses Food Utilities Gasoline and maintenance Medical expenses Medicines Clothing and upkeep Church Gifts Personal allowances Children's allowances Miscellaneous Total Variable Expenses Total Expenses SURPLUS (DEFICIT) 14,400 4,800 1.200 6,000 2,100 1,200 2,800 2,400 1,800 10,000 2,600 600 6,500 1,020 6,000 563.420 15.0% 5.0% 1.3% 6.3% 2.2% 1.3% 2.9% 2.5% 1.9% 10,4% 2.7% 0.6% 6.89 1.1% 6.3% 66.3% 7,000 3,600 4,200 3.400 1,750 1.950 2.400 1,400 3,000 3,200 400 $32.300 595,720 $ 0 7.3% 3.8% 4.4% 3.6% 1.8% 20% 2.5% 1.5% 3.1% 3.3% 0.4% 33.7% 100.0% 0.0% Tahle 3.2 Balance Sheet for a couple with Two Children-Victor and Maria Hernandez, January 1, 2018 ASSETS Monetary Assets 03% Cash on hand Savings account Victor's checking account Maria's checking account Tax refund due Rent receivable Total Monetary Assets 1,200 4,200 2.700 3,300 700 650 $ 12.750 1.1% 0.7% 0.8% 0.2% 0.2% 3.2% Tangible Assets Home Personal property Automobiles Total Tangible Assets 192,000 9,000 9,500 $210,500 48 8% 2.3% 2.4% 53.5% Investment Assets Fidelity mutual funds Scudder mutual fund Ford Motor Company stock New York 2038 bonds Life insurance cash value IRA accounts Real estate investment Total Investment Assets Total Assets 4.500 5,000 2,800 4,000 5,400 34,300 114,000 $170,000 $393.250 1.1% 1.3% 0.7% 1.0% 1.4% 8.7% 29.0% 43.2% 100.0% LIABILITIES Short-Term Liabilities Dentist bill due Credit card debt Total Short-Term Liabilities 220 1,600 1,820 0.1% 0.4% 0.5% $ Long-Term Liabilities Vehicle loan Home mortgage loan Total Long-Term Liabilities Total Liabilities Net Worth Total Liabilities and Net Worth 7.700 92.000 $ 99,700 $101,520 $291,730 $393.250 2.0% 23.4% 25.4% 25.8% 74.2% 100.0% Table 3.3 Cash Flow Statement for a couple with Two Children-Victor and Maria Hernandez, January 1-December 31, 2018 Dollars Percent 53,000 32,000 1,800 1,000 55.4% 33.4% 1.9% 1.0% 0.2% 8.1% 100.0% 200 7.720 95,720 INCOME Victor's gross salary Maria's gross salary Interest and dividends Bonus Tax refunds Net rental income Total Income EXPENDITURES Fixed Expenses Mortgage loan payments Real estate taxes Homeowner's insurance Automobile loan payments Automobile insurance and registration Life insurance premiums Medical insurance (employee portion) Emergency fund savings Revolving savings fund Federal income taxes State income taxes City income taxes Social Security taxes Personal property taxes Retirement IRAS Total Fixed Expenses Variable Expenses Food Utilities Gasoline and maintenance Medical expenses Medicines Clothing and upkeep Church Gifts Personal allowances Children's allowances Miscellaneous Total Variable Expenses Total Expenses SURPLUS (DEFICIT) 14,400 4,800 1.200 6,000 2,100 1,200 2,800 2,400 1,800 10,000 2,600 600 6,500 1,020 6,000 563.420 15.0% 5.0% 1.3% 6.3% 2.2% 1.3% 2.9% 2.5% 1.9% 10,4% 2.7% 0.6% 6.89 1.1% 6.3% 66.3% 7,000 3,600 4,200 3.400 1,750 1.950 2.400 1,400 3,000 3,200 400 $32.300 595,720 $ 0 7.3% 3.8% 4.4% 3.6% 1.8% 20% 2.5% 1.5% 3.1% 3.3% 0.4% 33.7% 100.0% 0.0%