Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for the following five years, Discount rate is 5. A firm that is 40% bond financed and 60% equity financed requires information from you on

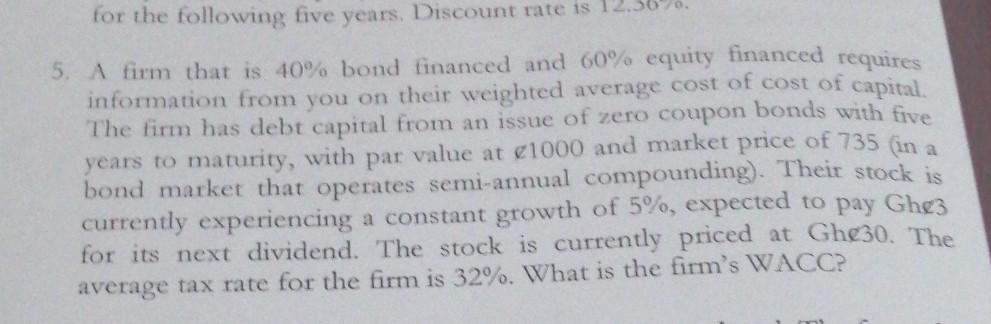

for the following five years, Discount rate is 5. A firm that is 40% bond financed and 60% equity financed requires information from you on their weighted average cost of cost of capital The firm has debt capital from an issue of zero coupon bonds with five years to maturity, with par value at 1000 and market price of 735 (in a bond market that operates semi-annual compounding). Their stock is currently experiencing a constant growth of 5%, expected to pay Ghe3 for its next dividend. The stock is currently priced at Ghc30. The average tax rate for the firm is 32%. What is the firm's WACCP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started