Answered step by step

Verified Expert Solution

Question

1 Approved Answer

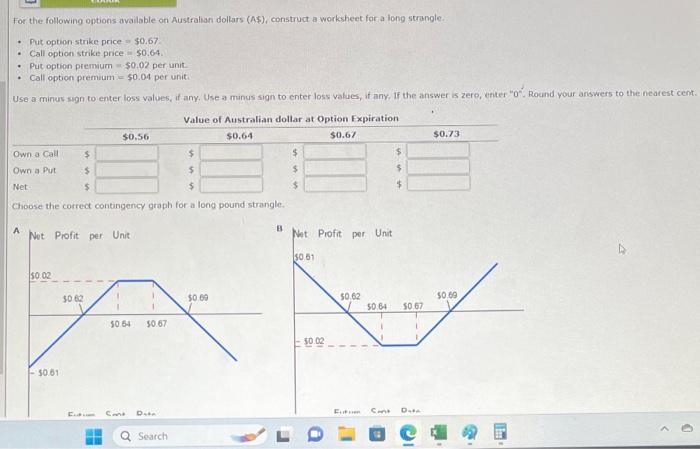

For the following options available on Australian dollars (A$), construct a worksheet for a long strangle.. Put option strike price $0.67. Call option strike

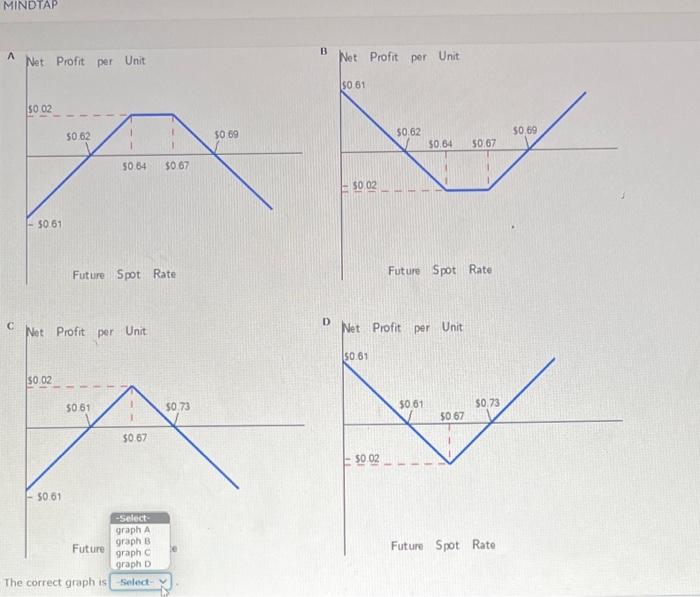

For the following options available on Australian dollars (A$), construct a worksheet for a long strangle.. Put option strike price $0.67. Call option strike price $0.64. Put option premium $0.02 per unit. Call option premium $0.04 per unit. Use a minus sign to enter loss values, if any. Use a minus sign to enter loss values, if any, If the answer is zero, enter "0". Round your answers to the nearest cent. Own a Call Own a Put Net $ $ $ $ $ $ Choose the correct contingency graph for a long pound strangle. A Net Profit per Unit $0.02 $0.56 - 50.61 50 62 50.64 30.67 Cont o Value of Australian dollar at Option Expiration $0.64 $0.67 Search $0.69 B $ $ $ Net Profit per Unit $0.61 $0.02 50.62 50.64 I $ $ $ 50.67 L 1 Fution Cant Data $0.73 $0.69 MINDTAP A C Net Profit per Unit $0 02 50.61 $0.02 50.62 50.61 Net Profit per Unit Future Spot Rate 50.64 $0.67 $0.61 Future $0.67 -Select- graph A graph B graph C graph D The correct graph is-Select- $0.73 $0.69 B D Net Profit per Unit $0.61 HE $0.02 50.61 H $0.62 Net Profit per Unit $0.02 Future Spot Rate $0.64 50,67 $0.61 E 50.67 $0.73 Future Spot Rate $0.69

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

we have Put option strike price 067 Call option strike price 069 Put option premium 002 per unit Call option premium 004 per unit For a long strangle the investor pays the premiums on both the call an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started