For the following problems do not work them out. Identify the type of problem each one is. 1. Starting on their 18th birthday, and

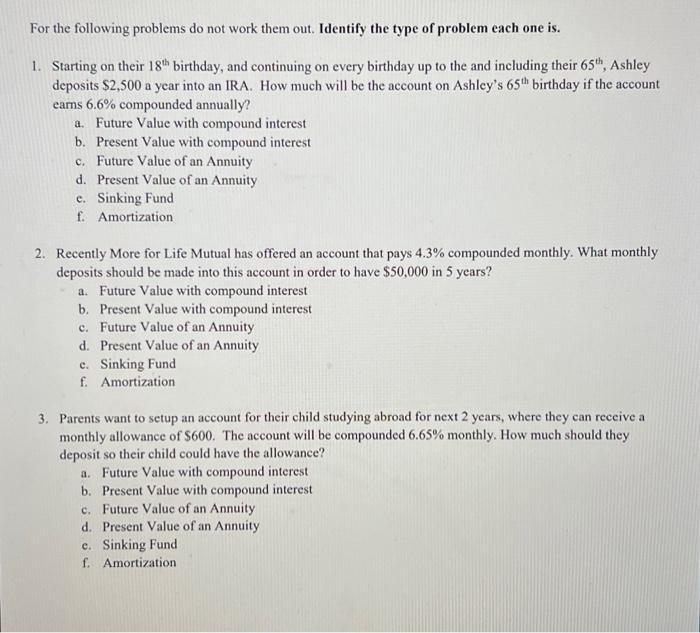

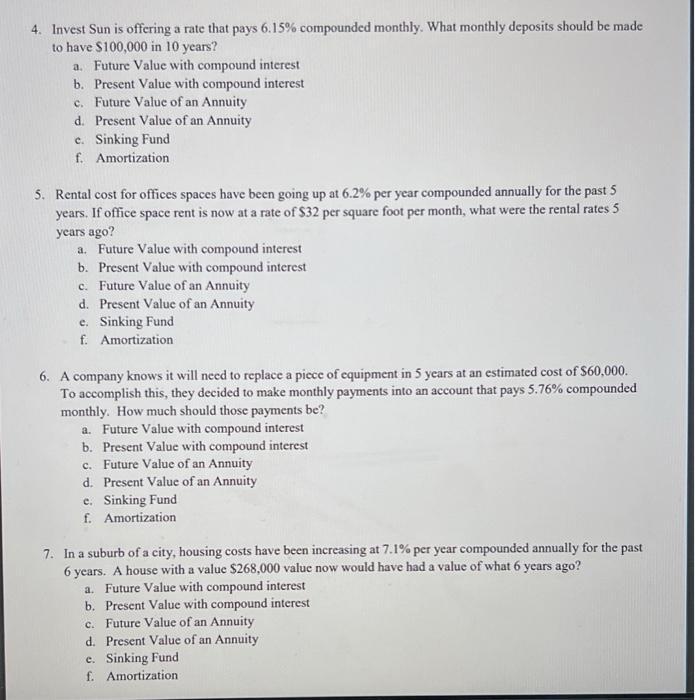

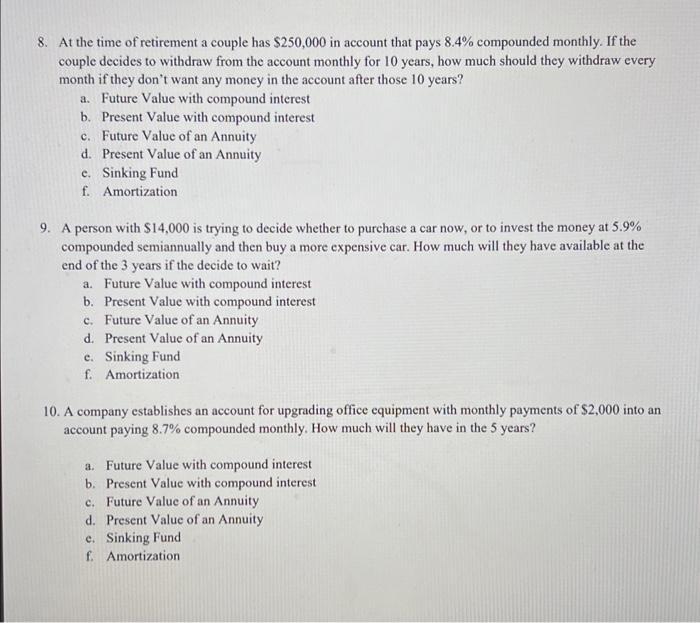

For the following problems do not work them out. Identify the type of problem each one is. 1. Starting on their 18th birthday, and continuing on every birthday up to the and including their 65th, Ashley deposits $2,500 a year into an IRA. How much will be the account on Ashley's 65th birthday if the account earns 6.6% compounded annually? a. Future Value with compound interest b. Present Value with compound interest c. Future Value of an Annuity d. e. Sinking Fund f. Amortization Present Value of an Annuity 2. Recently More for Life Mutual has offered an account that pays 4.3% compounded monthly. What monthly deposits should be made into this account in order to have $50,000 in 5 years? a. Future Value with compound interest b. Present Value with compound interest c. Future Value of an Annuity d. Present Value of an Annuity e. Sinking Fund f. Amortization 3. Parents want to setup an account for their child studying abroad for next 2 years, where they can receive a monthly allowance of $600. The account will be compounded 6.65% monthly. How much should they deposit so their child could have the allowance? a. Future Value with compound interest b. Present Value with compound interest c. Future Value of an Annuity d. Present Value of an Annuity e. Sinking Fund f. Amortization 4. Invest Sun is offering a rate that pays 6.15% compounded monthly. What monthly deposits should be made to have $100,000 in 10 years? a. Future Value with compound interest b. Present Value with compound interest c. Future Value of an Annuity d. Present Value of an Annuity e. Sinking Fund f. Amortization 5. Rental cost for offices spaces have been going up at 6.2% per year compounded annually for the past 5 years. If office space rent is now at a rate of $32 per square foot per month, what were the rental rates 5 years ago? a. Future Value with compound interest b. Present Value with compound interest c. Future Value of an Annuity d. Present Value of an Annuity e. Sinking Fund f. Amortization 6. A company knows it will need to replace a piece of equipment in 5 years at an estimated cost of $60,000. To accomplish this, they decided to make monthly payments into an account that pays 5.76% compounded monthly. How much should those payments be? a. Future Value with compound interest b. Present Value with compound interest c. Future Value of an Annuity d. Present Value of an Annuity e. Sinking Fund f. Amortization 7. In a suburb of a city, housing costs have been increasing at 7.1% per year compounded annually for the past 6 years. A house with a value $268,000 value now would have had a value of what 6 years ago? a. Future Value with compound interest b. Present Value with compound interest c. Future Value of an Annuity d. Present Value of an Annuity e. Sinking Fund f. Amortization 8. At the time of retirement a couple has $250,000 in account that pays 8.4% compounded monthly. If the couple decides to withdraw from the account monthly for 10 years, how much should they withdraw every month if they don't want any money in the account after those 10 years? a. Future Value with compound interest b. Present Value with compound interest c. Future Value of an Annuity d. Present Value of an Annuity e. Sinking Fund f. Amortization 9. A person with $14,000 is trying to decide whether to purchase a car now, or to invest the money at 5.9% compounded semiannually and then buy a more expensive car. How much will they have available at the end of the 3 years if the decide to wait? a. Future Value with compound interest b. Present Value with compound interest c. Future Value of an Annuity d. Present Value of an Annuity e. Sinking Fund f. Amortization 10. A company establishes an account for upgrading office equipment with monthly payments of $2,000 into an account paying 8.7% compounded monthly. How much will they have in the 5 years? a. Future Value with compound interest b. Present Value with compound interest c. Future Value of an Annuity d. Present Value of an Annuity e. Sinking Fund f. Amortization

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Future Value with compound interest 2 Future Value of an Annuity 3 Present Value of an Annuity 4 Future Value of an Annuity 5 Future Value with compound interest 6 Future Value of an Annuity ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started