Answered step by step

Verified Expert Solution

Question

1 Approved Answer

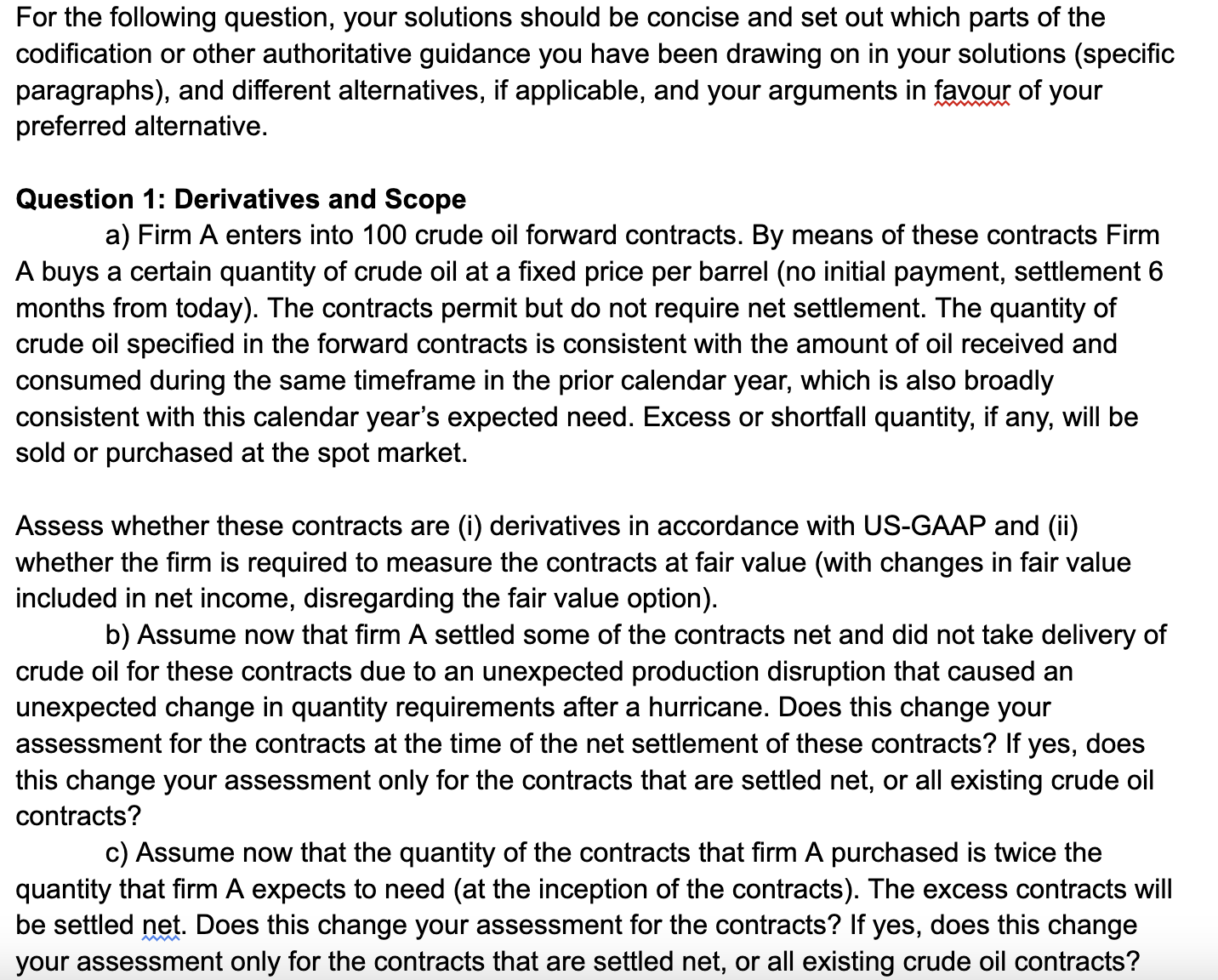

For the following question, your solutions should be concise and set out which parts of the codification or other authoritative guidance you have been

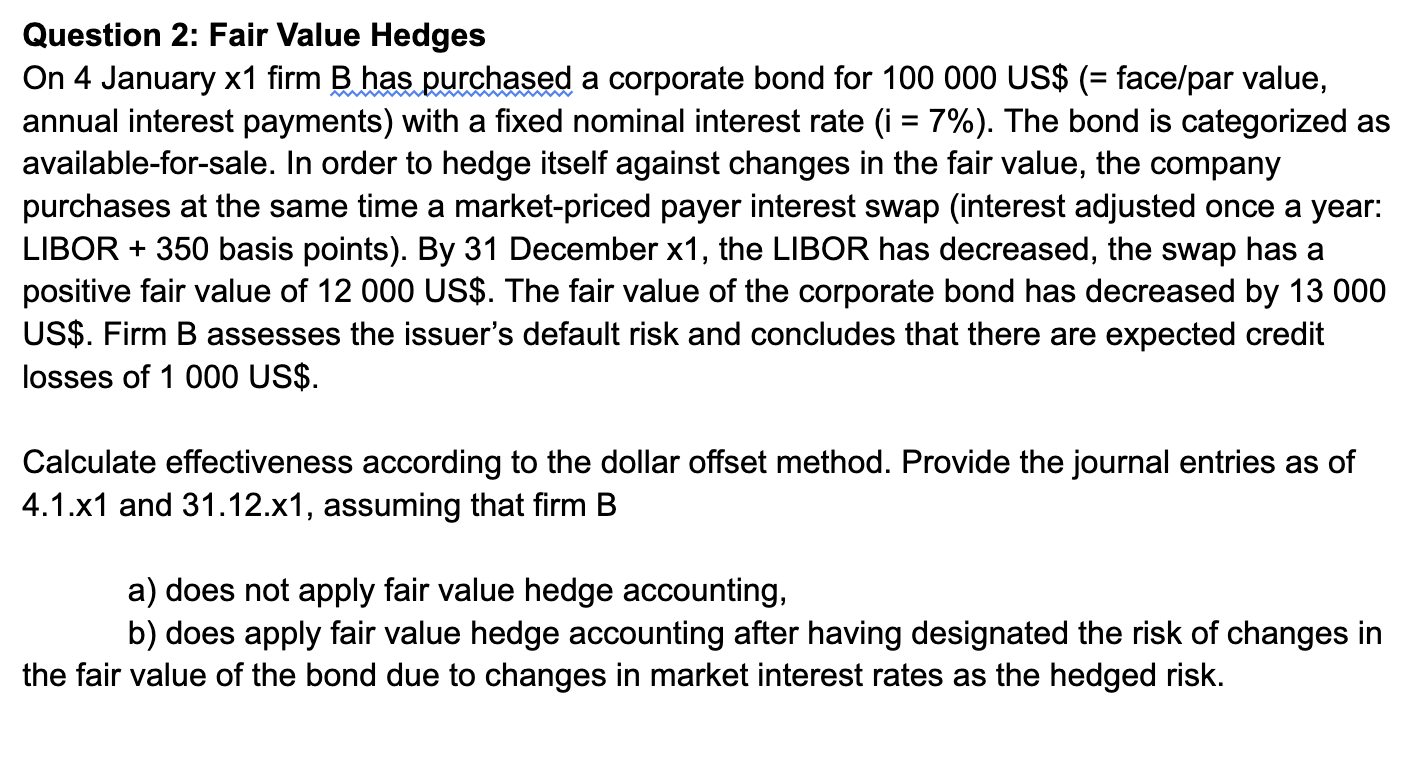

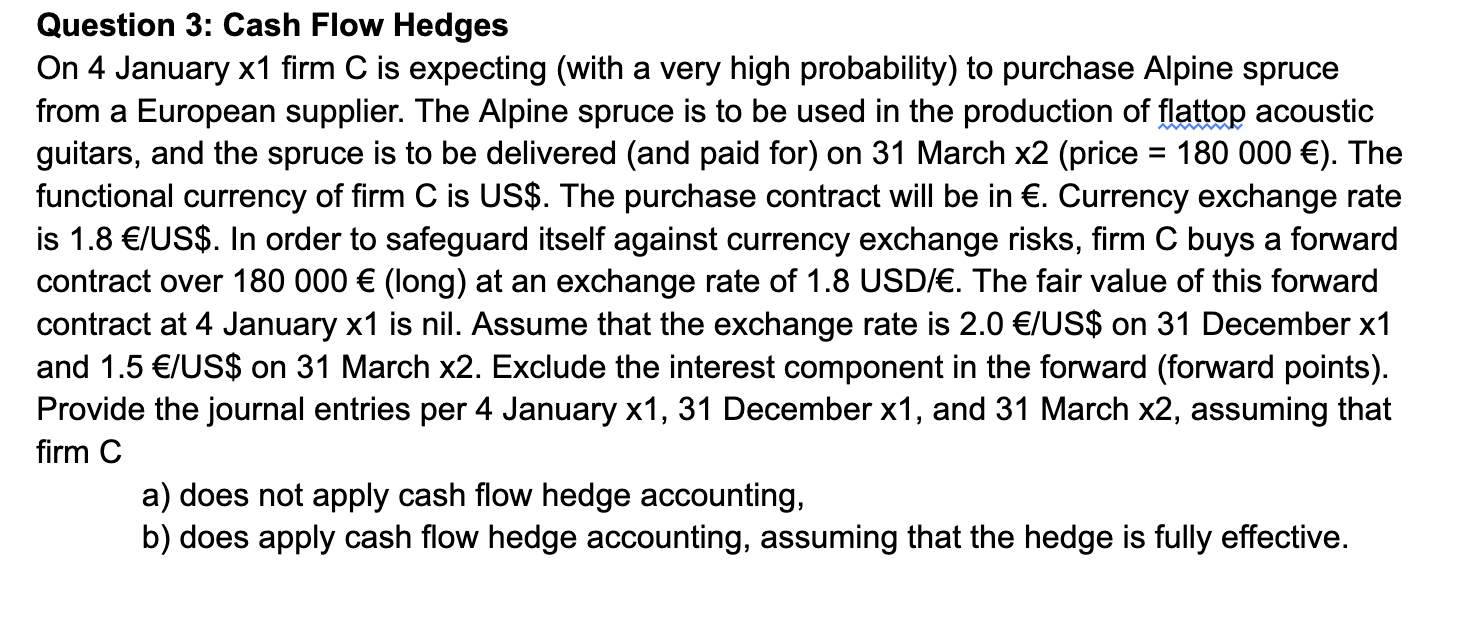

For the following question, your solutions should be concise and set out which parts of the codification or other authoritative guidance you have been drawing on in your solutions (specific paragraphs), and different alternatives, if applicable, and your arguments in favour of your preferred alternative. Question 1: Derivatives and Scope a) Firm A enters into 100 crude oil forward contracts. By means of these contracts Firm A buys a certain quantity of crude oil at a fixed price per barrel (no initial payment, settlement 6 months from today). The contracts permit but do not require net settlement. The quantity of crude oil specified in the forward contracts is consistent with the amount of oil received and consumed during the same timeframe in the prior calendar year, which is also broadly consistent with this calendar year's expected need. Excess or shortfall quantity, if any, will be sold or purchased at the spot market. Assess whether these contracts are (i) derivatives in accordance with US-GAAP and (ii) whether the firm is required to measure the contracts at fair value (with changes in fair value included in net income, disregarding the fair value option). b) Assume now that firm A settled some of the contracts net and did not take delivery of crude oil for these contracts due to an unexpected production disruption that caused an unexpected change in quantity requirements after a hurricane. Does this change your assessment for the contracts at the time of the net settlement of these contracts? does this change your assessment only for the contracts that are settled net, or all existing crude oil contracts? yes, c) Assume now that the quantity of the contracts that firm A purchased is twice the quantity that firm A expects to need (at the inception of the contracts). The excess contracts will be settled net. Does this change your assessment for the contracts? If yes, does this change your assessment only for the contracts that are settled net, or all existing crude oil contracts? Question 2: Fair Value Hedges On 4 January x1 firm B has purchased a corporate bond for 100 000 US$ (= face/par value, annual interest payments) with a fixed nominal interest rate (i = 7%). The bond is categorized as available-for-sale. In order to hedge itself against changes in the fair value, the company purchases at the same time a market-priced payer interest swap (interest adjusted once a year: LIBOR + 350 basis points). By 31 December x1, the LIBOR has decreased, the swap has a positive fair value of 12 000 US$. The fair value of the corporate bond has decreased by 13 000 US$. Firm B assesses the issuer's default risk and concludes that there are expected credit losses of 1000 US$. Calculate effectiveness according to the dollar offset method. Provide the journal entries as of 4.1.x1 and 31.12.x1, assuming that firm B a) does not apply fair value hedge accounting, b) does apply fair value hedge accounting after having designated the risk of changes in the fair value of the bond due to changes in market interest rates as the hedged risk. Question 3: Cash Flow Hedges On 4 January x1 firm C is expecting (with a very high probability) to purchase Alpine spruce from a European supplier. The Alpine spruce is to be used in the production of flattop acoustic guitars, and the spruce is to be delivered (and paid for) on 31 March x2 (price = 180 000 ). The functional currency of firm C is US$. The purchase contract will be in . Currency exchange rate is 1.8 /US$. In order to safeguard itself against currency exchange risks, firm C buys a forward contract over 180 000 (long) at an exchange rate of 1.8 USD/. The fair value of this forward contract at 4 January x1 is nil. Assume that the exchange rate is 2.0 /US$ on 31 December x1 and 1.5 /US$ on 31 March x2. Exclude the interest component in the forward (forward points). Provide the journal entries per 4 January x1, 31 December x1, and 31 March x2, assuming that firm C a) does not apply cash flow hedge accounting, b) does apply cash flow hedge accounting, assuming that the hedge is fully effective.

Step by Step Solution

★★★★★

3.42 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

a According to USGAAP ASC 8151015126 derivatives are defined as financial instruments or other contr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started