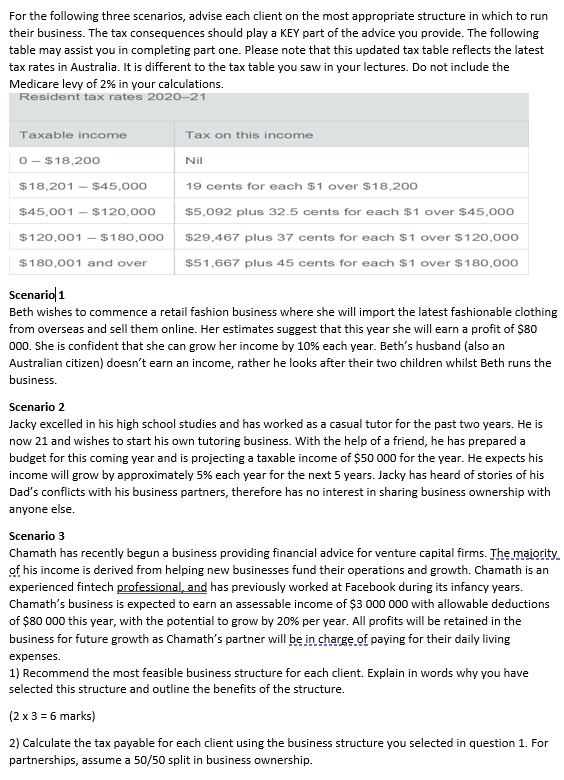

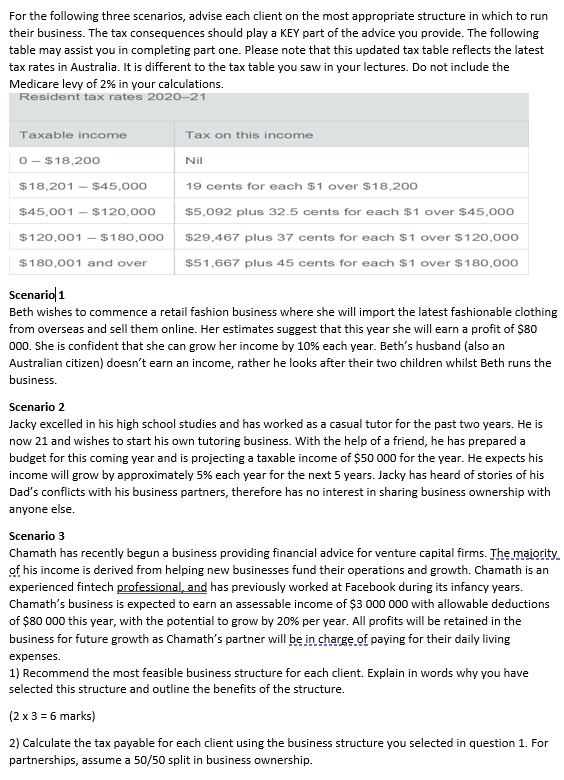

For the following three scenarios, advise each client on the most appropriate structure in which to run their business. The tax consequences should play a key part of the advice you provide. The following table may assist you in completing part one. Please note that this updated tax table reflects the latest tax rates in Australia. It is different to the tax table you saw in your lectures. Do not include the Medicare levy of 2% in your calculations. Resident tax rates 2020-21 Taxable income Tax on this income 0 - $18,200 Nil $18,201 - $45.000 19 cents for each $1 over $18,200 $45,001 - $120,000 $5,092 plus 32.5 cents for each $1 over $45,000 $120,001 - $ 180,000 $29,467 plus 37 cents for each $1 over $120,000 $180,001 and over $51,667 plus 45 cents for each $1 over $180,000 Scenario1 Beth wishes to commence a retail fashion business where she will import the latest fashionable clothing from overseas and sell them online. Her estimates suggest that this year she will earn a profit of $80 000. She is confident that she can grow her income by 10% each year. Beth's husband (also an Australian citizen) doesn't earn an income, rather he looks after their two children whilst Beth runs the business. Scenario 2 Jacky excelled in his high school studies and has worked as a casual tutor for the past two years. He is now 21 and wishes to start his own tutoring business. With the help of a friend, he has prepared a budget for this coming year and is projecting a taxable income of $50 000 for the year. He expects his income will grow by approximately 5% each year for the next 5 years. Jacky has heard of stories of his Dad's conflicts with his business partners, therefore has no interest in sharing business ownership with anyone else. Scenario 3 Chamath has recently begun a business providing financial advice for venture capital firms. The majority. of his income is derived from helping new businesses fund their operations and growth. Chamath is an experienced fintech professional, and has previously worked at Facebook during its infancy years. Chamath's business is expected to earn an assessable income of $3 000 000 with allowable deductions of $80 000 this year, with the potential to grow by 20% per year. All profits will be retained in the business for future growth as Chamath's partner will be in charge of paying for their daily living expenses. 1) Recommend the most feasible business structure for each client. Explain in words why you have selected this structure and outline the benefits of the structure. (2 x 3 = 6 marks) 2) Calculate the tax payable for each client using the business structure you selected in question 1. For partnerships, assume a 50/50 split in business ownership. For the following three scenarios, advise each client on the most appropriate structure in which to run their business. The tax consequences should play a key part of the advice you provide. The following table may assist you in completing part one. Please note that this updated tax table reflects the latest tax rates in Australia. It is different to the tax table you saw in your lectures. Do not include the Medicare levy of 2% in your calculations. Resident tax rates 2020-21 Taxable income Tax on this income 0 - $18,200 Nil $18,201 - $45.000 19 cents for each $1 over $18,200 $45,001 - $120,000 $5,092 plus 32.5 cents for each $1 over $45,000 $120,001 - $ 180,000 $29,467 plus 37 cents for each $1 over $120,000 $180,001 and over $51,667 plus 45 cents for each $1 over $180,000 Scenario1 Beth wishes to commence a retail fashion business where she will import the latest fashionable clothing from overseas and sell them online. Her estimates suggest that this year she will earn a profit of $80 000. She is confident that she can grow her income by 10% each year. Beth's husband (also an Australian citizen) doesn't earn an income, rather he looks after their two children whilst Beth runs the business. Scenario 2 Jacky excelled in his high school studies and has worked as a casual tutor for the past two years. He is now 21 and wishes to start his own tutoring business. With the help of a friend, he has prepared a budget for this coming year and is projecting a taxable income of $50 000 for the year. He expects his income will grow by approximately 5% each year for the next 5 years. Jacky has heard of stories of his Dad's conflicts with his business partners, therefore has no interest in sharing business ownership with anyone else. Scenario 3 Chamath has recently begun a business providing financial advice for venture capital firms. The majority. of his income is derived from helping new businesses fund their operations and growth. Chamath is an experienced fintech professional, and has previously worked at Facebook during its infancy years. Chamath's business is expected to earn an assessable income of $3 000 000 with allowable deductions of $80 000 this year, with the potential to grow by 20% per year. All profits will be retained in the business for future growth as Chamath's partner will be in charge of paying for their daily living expenses. 1) Recommend the most feasible business structure for each client. Explain in words why you have selected this structure and outline the benefits of the structure. (2 x 3 = 6 marks) 2) Calculate the tax payable for each client using the business structure you selected in question 1. For partnerships, assume a 50/50 split in business ownership