Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the group of stocks assigned to you, form the minimum variance frontier. What is the minimum attainable annualised standard deviation of the portfolio (using

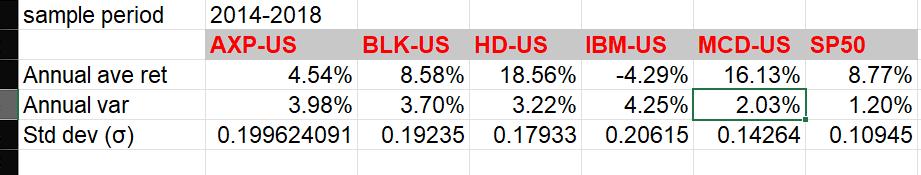

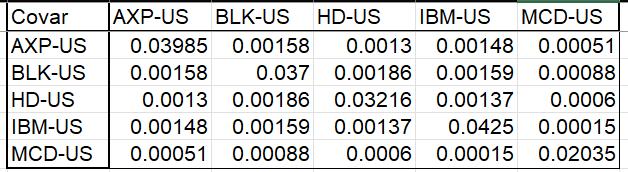

For the group of stocks assigned to you, form the minimum variance frontier. What is the minimum attainable annualised standard deviation of the portfolio (using the 2014-2018 data pool):

Q2: at an annualised average return level of 0%

Q3: at an annualised average return level of 15%

Q4: at an annualised average return level of 30%

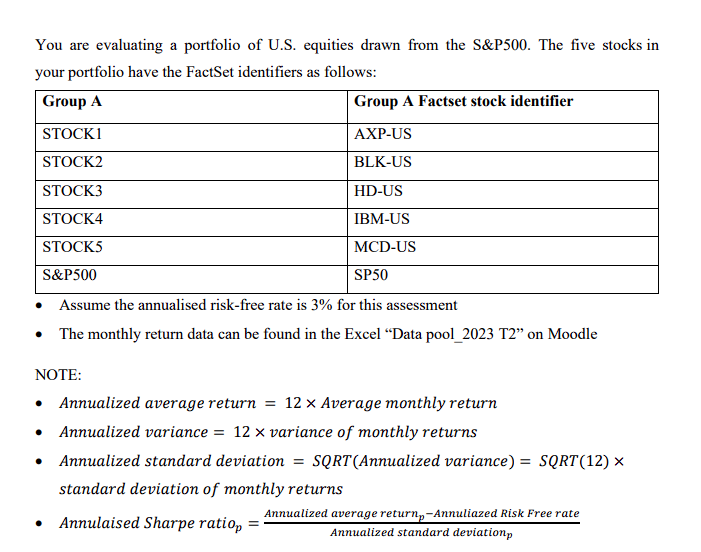

You are evaluating a portfolio of U.S. equities drawn from the S&P500. The five stocks in your portfolio have the FactSet identifiers as follows: Group A Group A Factset stock identifier AXP-US BLK-US HD-US IBM-US MCD-US SP50 Assume the annualised risk-free rate is 3% for this assessment The monthly return data can be found in the Excel "Data pool_2023 T2" on Moodle STOCK1 STOCK2 STOCK3 STOCK4 STOCK5 S&P500 NOTE: Annualized average return = 12 x Average monthly return Annualized variance = 12 x variance of monthly returns Annualized standard deviation = SQRT (Annualized variance) = SQRT (12) standard deviation of monthly returns Annulaised Sharpe ratiop = Annualized average return-Annuliazed Risk Free rate Annualized standard deviation,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Minimum Variance Frontier for the Given Portfolio I understand your request and can help you calculate the minimum variance frontier for the given por...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started