Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the holidays, Marty gave a watch worth $25,000 to Emily and jewelry worth $40,000 to Natalie. Required: a. Has Marty made any taxable gifts

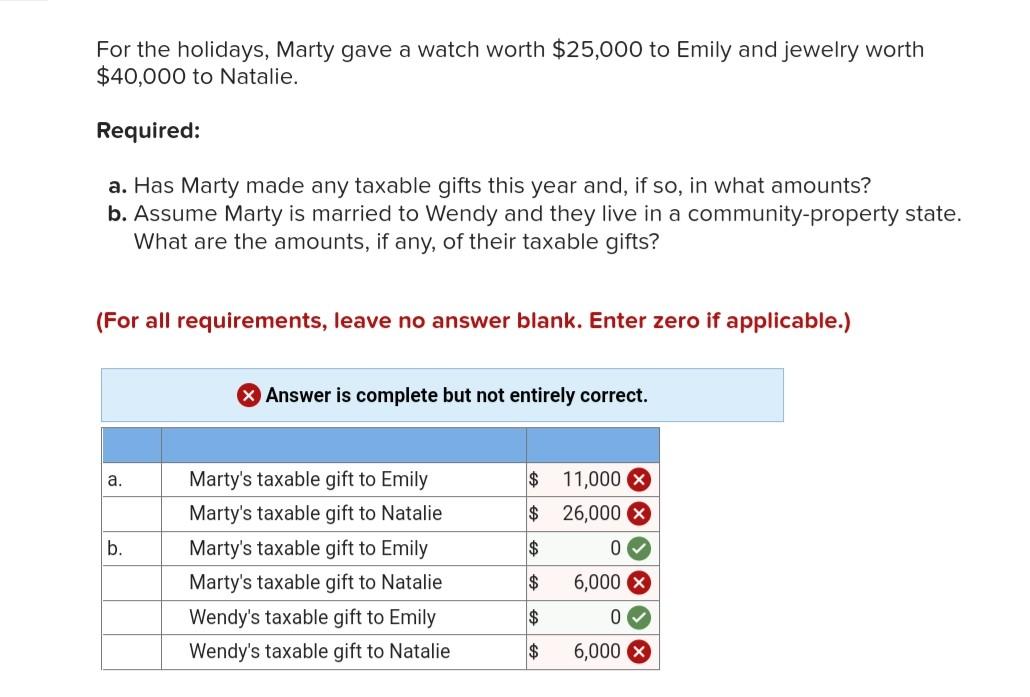

For the holidays, Marty gave a watch worth $25,000 to Emily and jewelry worth $40,000 to Natalie. Required: a. Has Marty made any taxable gifts this year and, if so, in what amounts? b. Assume Marty is married to Wendy and they live in a community-property state. What are the amounts, if any, of their taxable gifts? (For all requirements, leave no answer blank. Enter zero if applicable.) Answer is complete but not entirely correct. a. $ 11,000 X $ 26,000 X b. $ 0 Marty's taxable gift to Emily Marty's taxable gift to Natalie Marty's taxable gift to Emily Marty's taxable gift to Natalie Wendy's taxable gift to Emily Wendy's taxable gift to Natalie $ 6,000 X $ 0 $ 6,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started