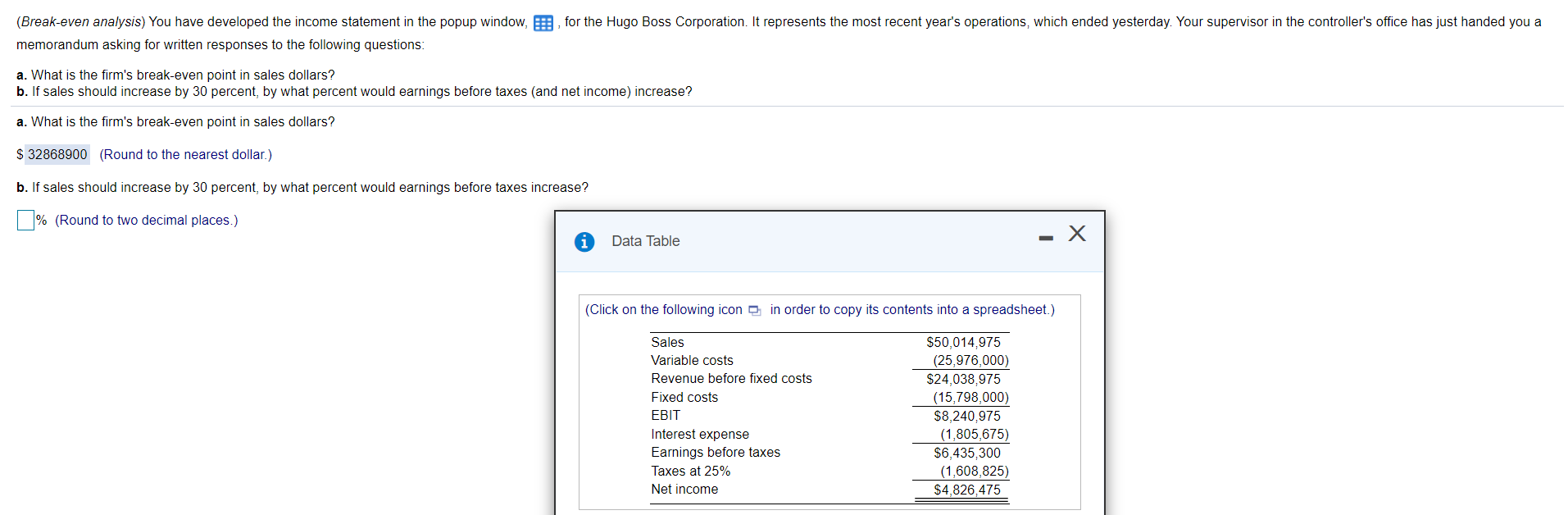

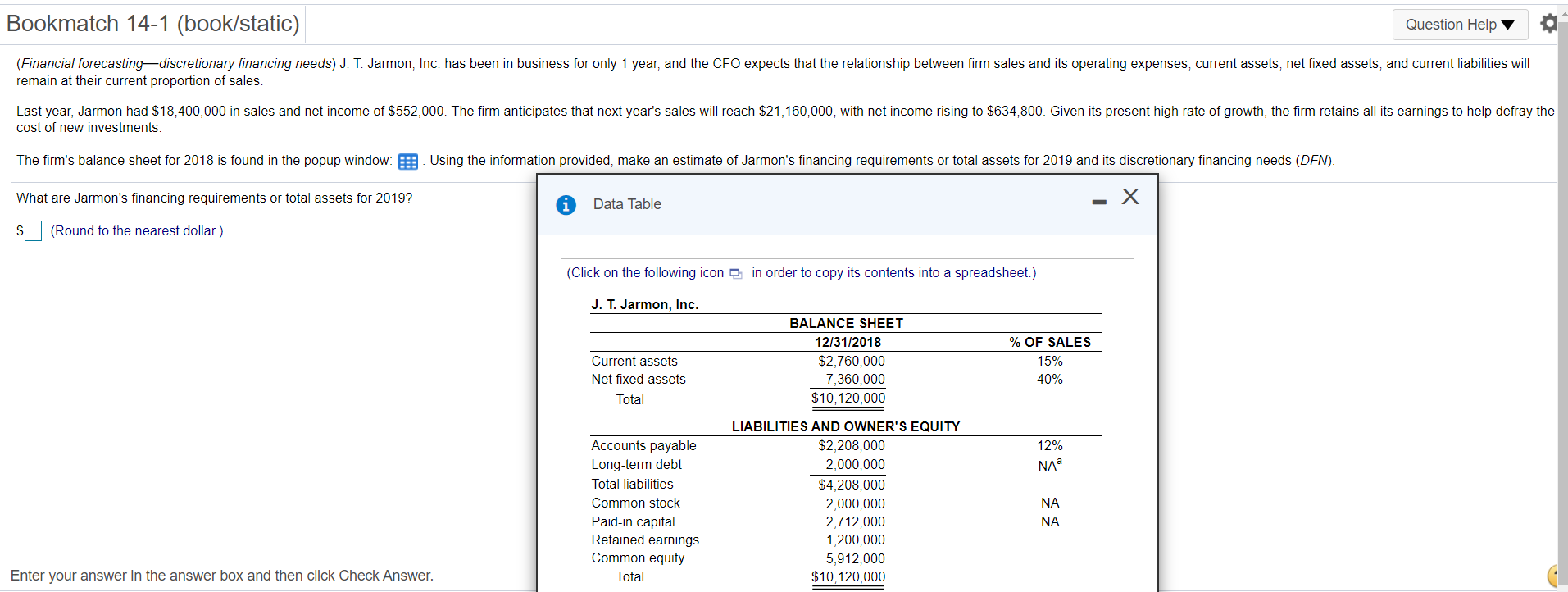

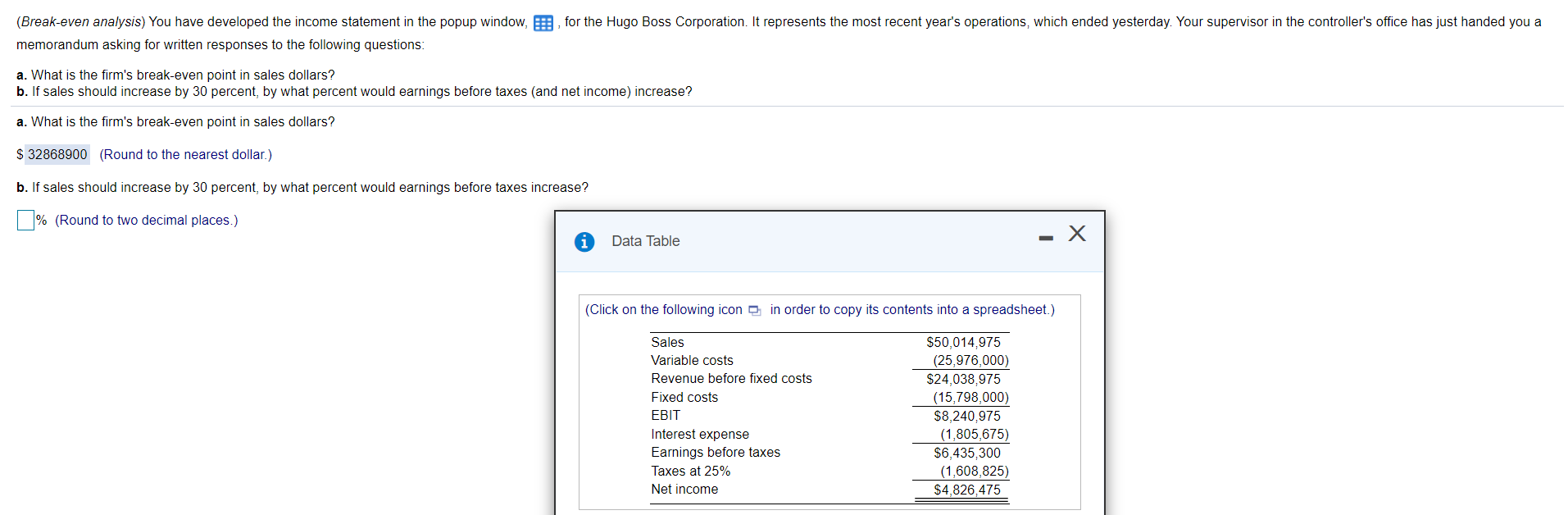

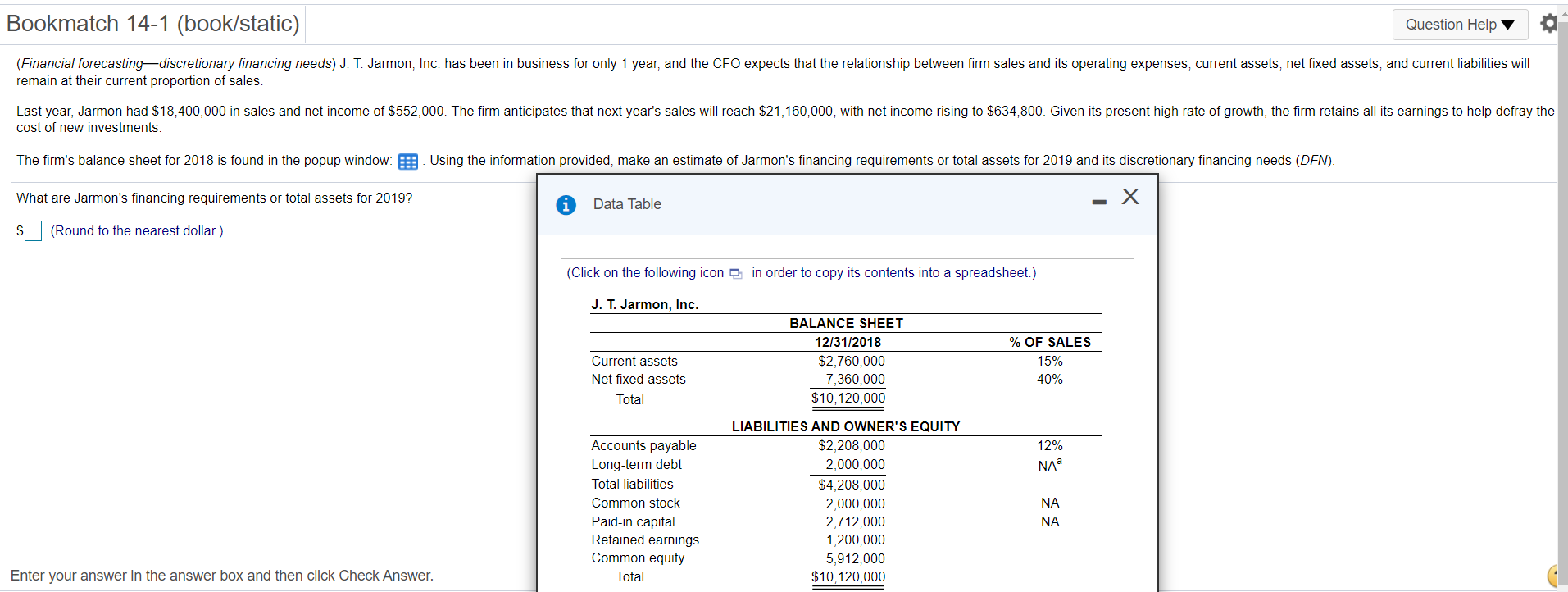

for the Hugo Boss Corporation. It represents the most recent year's operations, which ended yesterday. Your supervisor in the controller's office has just handed you a (Break-even analysis) You have developed the income statement in the popup window, E memorandum asking for written responses to the following questions: a. What is the firm's break-even point in sales dollars? b. If sales should increase by 30 percent, by what percent would earnings before taxes (and net income) increase? a. What is the firm's break-even point in sales dollars? $ 32868900 (Round to the nearest dollar.) b. If sales should increase by 30 percent, by what percent would earnings before taxes increase? % (Round to two decimal places.) x Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Sales Variable costs Revenue before fixed costs Fixed costs EBIT Interest expense Earnings before taxes Taxes at 25% Net income $50,014,975 (25,976,000) $24,038,975 (15,798,000) $8,240,975 (1,805,675) $6,435,300 (1,608,825) $4,826,475 Bookmatch 14-1 (book/static) Question Help (Financial forecasting-discretionary financing needs) J. T. Jarmon, Inc. has been in business for only 1 year, and the CFO expects that the relationship between firm sales and its operating expenses, current assets, net fixed assets, and current liabilities will remain at their current proportion of sales. Last year, Jarmon had $18,400,000 in sales and net income of $552,000. The firm anticipates that next year's sales will reach $21,160,000, with net income rising to $634,800. Given its present high rate of growth, the firm retains all its earnings to help defray the cost of new investments. The firm's balance sheet for 2018 is found in the popup window: EE. Using the information provided, make an estimate of Jarmon's financing requirements or total assets for 2019 and its discretionary financing needs (DEN). What are Jarmon's financing requirements or total assets for 2019? Data Table $ (Round to the nearest dollar.) (Click on the following icon in order to copy its contents into a spreadsheet.) J. T. Jarmon, Inc. Current assets Net fixed assets Total BALANCE SHEET 12/31/2018 $2,760,000 7,36 000 $10,120,000 % OF SALES 15% 40% 12% NA Accounts payable Long-term debt Total liabilities Common stock Paid-in capital Retained earnings Common equity Total LIABILITIES AND OWNER'S EQUITY $2,208,000 2,000,000 $4,208,000 2,000,000 2,712,000 1,200,000 5,912,000 $10,120,000 NA NA Enter your answer in the answer box and then click Check