Answered step by step

Verified Expert Solution

Question

1 Approved Answer

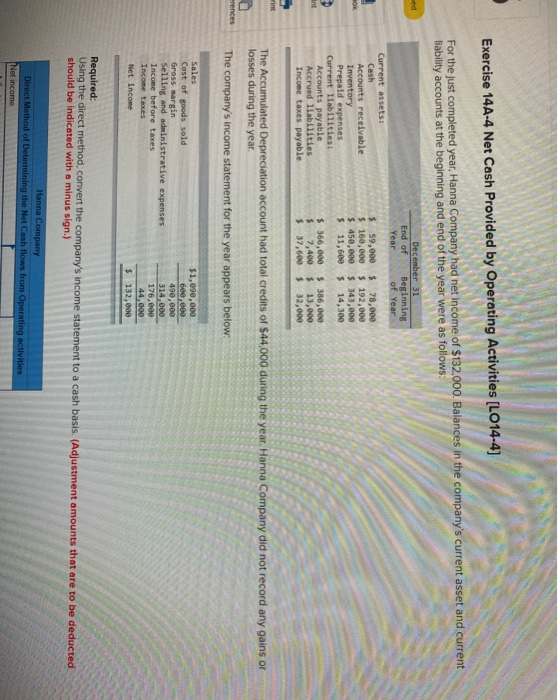

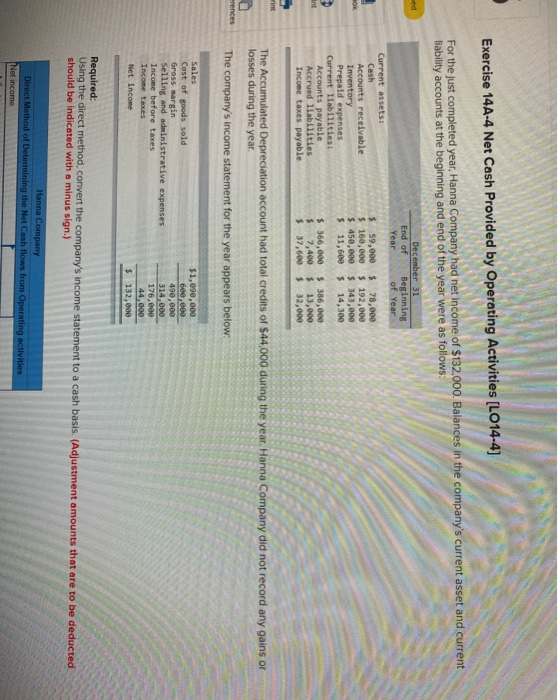

for the just completed year, Hanna company had net income of $132,000. Balances in the company's current assets and current liability accounts at the beginning

for the just completed year, Hanna company had net income of $132,000. Balances in the company's current assets and current liability accounts at the beginning and end of the year were as follows:

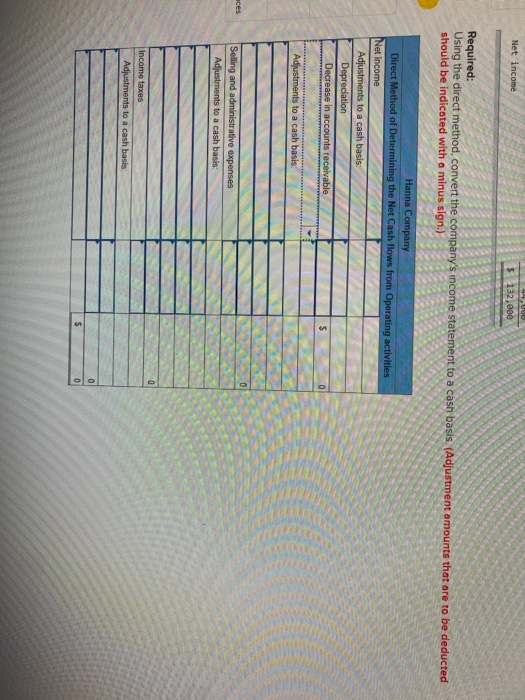

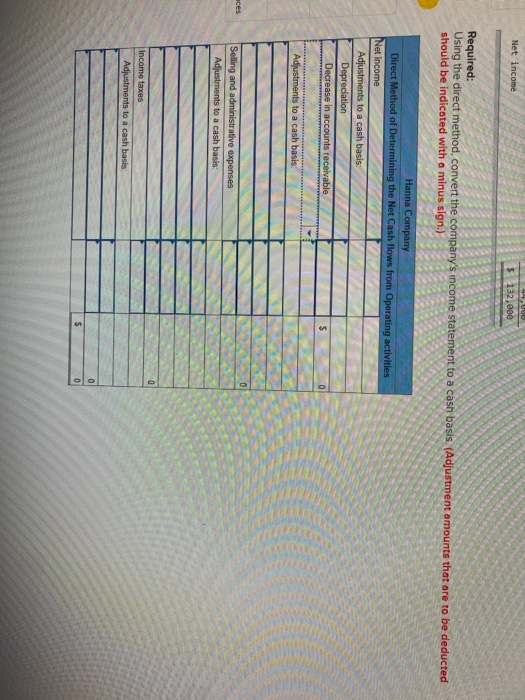

Exercise 14A-4 Net Cash Provided by Operating Activities (L014-4) For the just completed year, Hanna Company had net income of $132,000. Balances in the company's current asset and current liability accounts at the beginning and end of the year were as follows: ed December 31 End of Beginning Year of Year . OK Current assets: Cash Accounts receivable Inventory Prepaid expenses Current liabilities: Accounts payable Accrued liabilities Income taxes payable $ 59,000 $ 160,000 $ 450,000 $ 11,600 $ 78,000 $ 192,000 $ 343,000 s 14,300 A int $366,000 $ 7,400 $ 37,600 $ 386,000 $ 13,000 $ 32,000 The Accumulated Depreciation account had total credits of $44,000 during the year. Hanna Company did not record any gains or losses during the year erences The company's income statement for the year appears below: Sales Cost of goods sold Gross margin Selling and administrative expenses Income before taxes Income taxes Het income $1,090,000 600.000 490,000 314,000 176.00 44,000 $ 132,000 Required: Using the direct method, convert the company's income statement to a cash basis. (Adjustment amounts that are to be deducted should be indicated with a minus sign.) Hanna Company Direct Method of Determining the Net Cash flows from Operating activities Net income Net income $ 132,000 Required: Using the direct method, convert the company's income statement to a cash basis. (Adjustment amounts that are to be deducted should be indicated with a minus sign.) Hanna Company Direct Method of Determining the Net Cash flows from Operating activities Net Income Adjustments to a cash basis Depreciation Decrease in accounts receivable Adjustments to a cash basis 0 aces Selling and administrative expenses Adjustments to a cash basis: Income taxes Adjustments to a cash basis $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started