Answered step by step

Verified Expert Solution

Question

1 Approved Answer

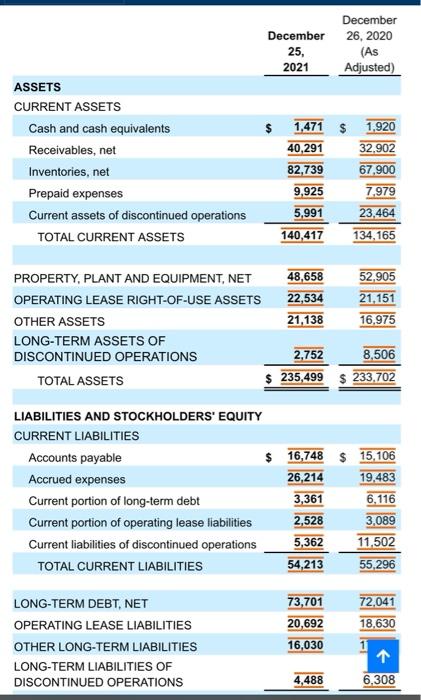

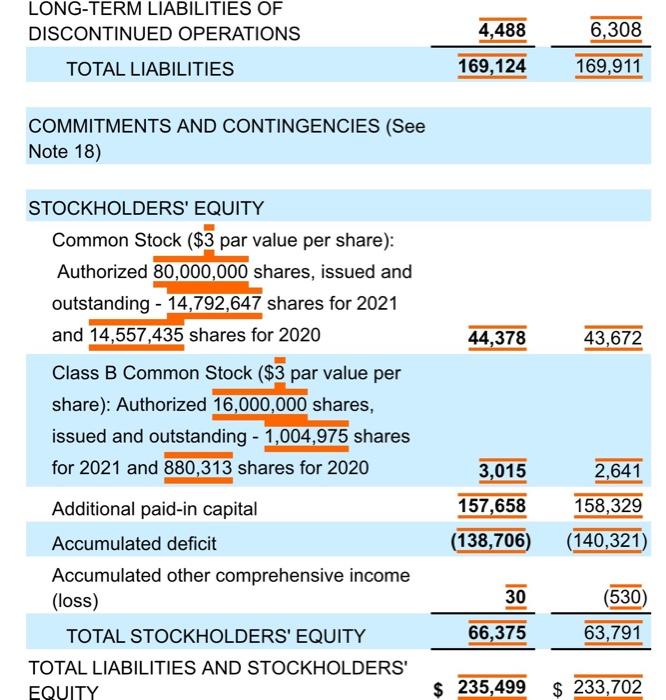

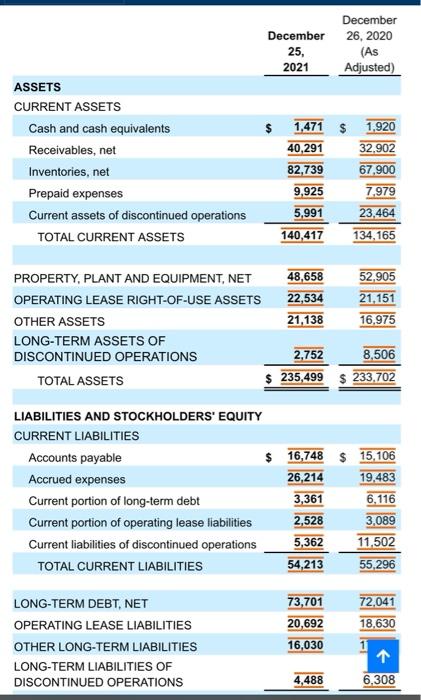

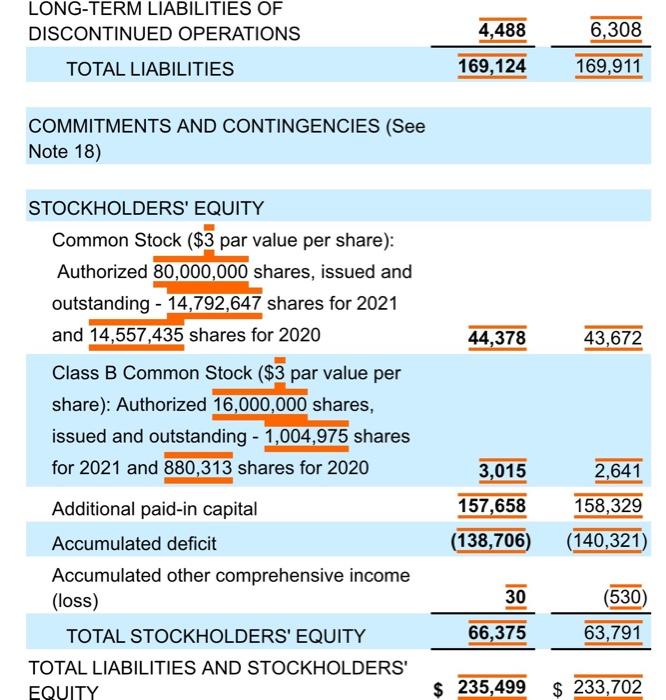

For the last two fiscal years, what is The Dixie Group Inc.'s reported LIFO reserve balance? December 25, 2021 December 26, 2020 (As Adjusted) ASSETS

For the last two fiscal years, what is The Dixie Group Inc.'s reported LIFO reserve balance?

December 25, 2021 December 26, 2020 (As Adjusted) ASSETS CURRENT ASSETS Cash and cash equivalents Receivables, net Inventories, net Prepaid expenses Current assets of discontinued operations TOTAL CURRENT ASSETS $ 1,471 $ 1.920 40,291 32.902 82,739 67,900 9,925 7.979 5,991 23,464 140,417 134,165 PROPERTY, PLANT AND EQUIPMENT, NET 48,658 52,905 OPERATING LEASE RIGHT-OF-USE ASSETS 22,534 21,151 OTHER ASSETS 21,138 16,975 LONG-TERM ASSETS OF DISCONTINUED OPERATIONS 2,752 8,506 TOTAL ASSETS $ 235,499 $ 233,702 $ 15,106 19.483 LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES Accounts payable $ Accrued expenses Current portion of long-term debt Current portion of operating lease liabilities Current liabilities of discontinued operations TOTAL CURRENT LIABILITIES 16,748 26,214 3,361 2,528 5,362 54,213 6,116 3,089 11,502 55,296 LONG-TERM DEBT, NET OPERATING LEASE LIABILITIES OTHER LONG-TERM LIABILITIES LONG-TERM LIABILITIES OF DISCONTINUED OPERATIONS 73,701 20,692 16,030 72,041 18.630 4,488 6,308 4,488 6,308 LONG-TERM LIABILITIES OF DISCONTINUED OPERATIONS TOTAL LIABILITIES 169,124 169,911 COMMITMENTS AND CONTINGENCIES (See Note 18) STOCKHOLDERS' EQUITY Common Stock ($3 par value per share): Authorized 80,000,000 shares, issued and outstanding - 14,792,647 shares for 2021 and 14,557,435 shares for 2020 Class B Common Stock ($3 par value per share): Authorized 16,000,000 shares, issued and outstanding - 1,004,975 shares for 2021 and 880,313 shares for 2020 44,378 43,672 3,015 2,641 157,658 158,329 (138,706) (140,321) Additional paid-in capital Accumulated deficit Accumulated other comprehensive income (loss) TOTAL STOCKHOLDERS' EQUITY TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 30 (530) 66,375 63,791 $ 235,499 $ 233,702 December 25, 2021 December 26, 2020 (As Adjusted) ASSETS CURRENT ASSETS Cash and cash equivalents Receivables, net Inventories, net Prepaid expenses Current assets of discontinued operations TOTAL CURRENT ASSETS $ 1,471 $ 1.920 40,291 32.902 82,739 67,900 9,925 7.979 5,991 23,464 140,417 134,165 PROPERTY, PLANT AND EQUIPMENT, NET 48,658 52,905 OPERATING LEASE RIGHT-OF-USE ASSETS 22,534 21,151 OTHER ASSETS 21,138 16,975 LONG-TERM ASSETS OF DISCONTINUED OPERATIONS 2,752 8,506 TOTAL ASSETS $ 235,499 $ 233,702 $ 15,106 19.483 LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES Accounts payable $ Accrued expenses Current portion of long-term debt Current portion of operating lease liabilities Current liabilities of discontinued operations TOTAL CURRENT LIABILITIES 16,748 26,214 3,361 2,528 5,362 54,213 6,116 3,089 11,502 55,296 LONG-TERM DEBT, NET OPERATING LEASE LIABILITIES OTHER LONG-TERM LIABILITIES LONG-TERM LIABILITIES OF DISCONTINUED OPERATIONS 73,701 20,692 16,030 72,041 18.630 4,488 6,308 4,488 6,308 LONG-TERM LIABILITIES OF DISCONTINUED OPERATIONS TOTAL LIABILITIES 169,124 169,911 COMMITMENTS AND CONTINGENCIES (See Note 18) STOCKHOLDERS' EQUITY Common Stock ($3 par value per share): Authorized 80,000,000 shares, issued and outstanding - 14,792,647 shares for 2021 and 14,557,435 shares for 2020 Class B Common Stock ($3 par value per share): Authorized 16,000,000 shares, issued and outstanding - 1,004,975 shares for 2021 and 880,313 shares for 2020 44,378 43,672 3,015 2,641 157,658 158,329 (138,706) (140,321) Additional paid-in capital Accumulated deficit Accumulated other comprehensive income (loss) TOTAL STOCKHOLDERS' EQUITY TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 30 (530) 66,375 63,791 $ 235,499 $ 233,702

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started