Question

For the Logic-based Financial Advisor example: As a final example of the use of first-order logic to represent and reason about problem domains, we design

For the Logic-based Financial Advisor example:

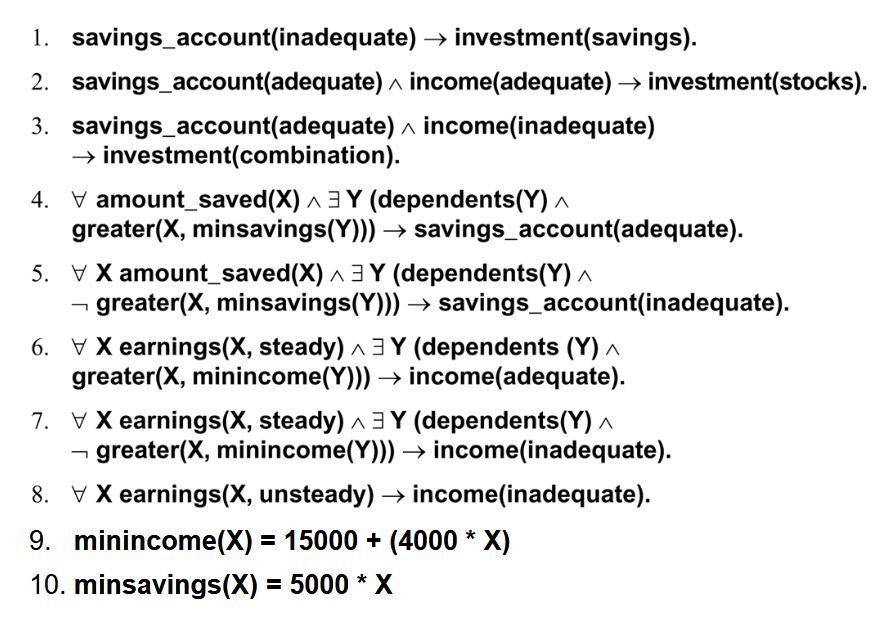

As a final example of the use of first-order logic to represent and reason about problem domains, we design a financial advisor using predicate calculus. The function of the advisor is to help a user decide whether to invest in a savings account or the stock market. Some investors may want to split their money between the two. The investment that will be recommended for individual investors depends on their income and the current amount they have saved according to the following criteria:

- Individuals with an inadequate savings account should always make increasing the amount saved their first priority, regardless of their income.

- Individuals with an adequate savings account and an adequate income should consider a riskier but potentially more profitable investment in the stock market.

- Individuals with a lower income who already have an adequate savings account may want to consider splitting their surplus income between savings and stocks, to increase the cushion in savings while attempting to increase their income through stocks.

The adequacy of both savings and income is determined by the number of dependents an individual must support. Our rule is to have at least $5,000 in savings for each dependent. An adequate income must be a steady income and supply at least $15,000 per year plus an additional $4,000 for each dependent. To automate this advice, we translate these guidelines into sentences in the predicate calculus.

Assume John has four dependents, $22,000 in savings, and a steady income of $30,000.

(1) What should we conclude? Please use the forward-chaining (or a tree-like inference graph) to conduct the inference process.

(2) Use resolution to answer the query: what is the right investment choice for John? Hint: To answer the query, you may need to make an assumption about which investment choice may be right for John, then prove it to be true or false.

1. savings account(inadequate) investment(savings). 2. savings account(adequate) ^ income(adequate) investment(stocks). 3. savings account(adequate) ^ income (inadequate) investment(combination). 4. Vamount_saved(X)^3 Y (dependents(Y) ^ greater(X, minsavings(Y))) savings account(adequate). 5. V X amount_saved(X)^ 3 Y (dependents(Y) ^ greater(x, minsavings(Y))) savings account(inadequate). 6. V X earnings(X, steady) ^ 3 Y (dependents (Y) ^ greater(x, minincome(Y))) income(adequate). 7. VX earnings(X, steady) ^ 3 Y (dependents(Y) ^ - greater(x, minincome(Y))) income (inadequate). 8. V X earnings(X, unsteady) income inadequate). 9. minincome(X) = 15000 + (4000 * X) 10. minsavings(X) = 5000 * X 1. savings account(inadequate) investment(savings). 2. savings account(adequate) ^ income(adequate) investment(stocks). 3. savings account(adequate) ^ income (inadequate) investment(combination). 4. Vamount_saved(X)^3 Y (dependents(Y) ^ greater(X, minsavings(Y))) savings account(adequate). 5. V X amount_saved(X)^ 3 Y (dependents(Y) ^ greater(x, minsavings(Y))) savings account(inadequate). 6. V X earnings(X, steady) ^ 3 Y (dependents (Y) ^ greater(x, minincome(Y))) income(adequate). 7. VX earnings(X, steady) ^ 3 Y (dependents(Y) ^ - greater(x, minincome(Y))) income (inadequate). 8. V X earnings(X, unsteady) income inadequate). 9. minincome(X) = 15000 + (4000 * X) 10. minsavings(X) = 5000 * XStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started