Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the next fiscal year, CoolDown Cola is forecasting depreciation expense to be $35,000, EBIT to be $75,000, and interest expense to be $20,000. The

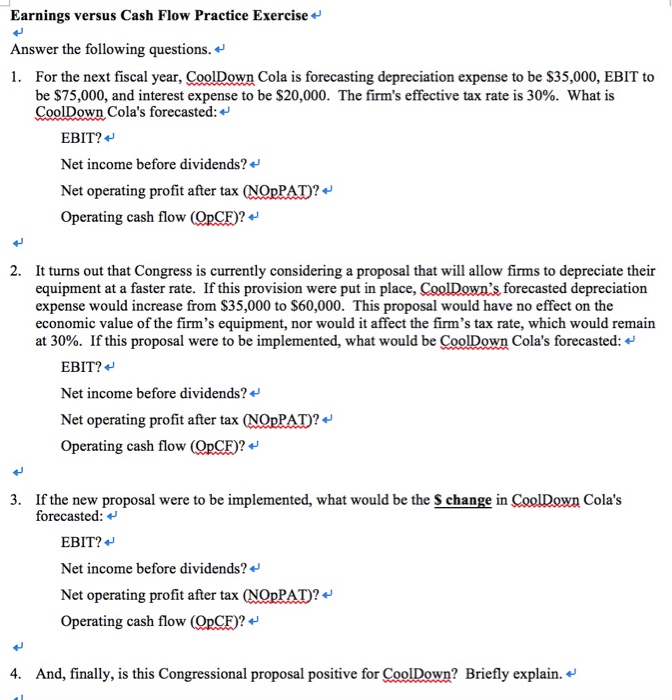

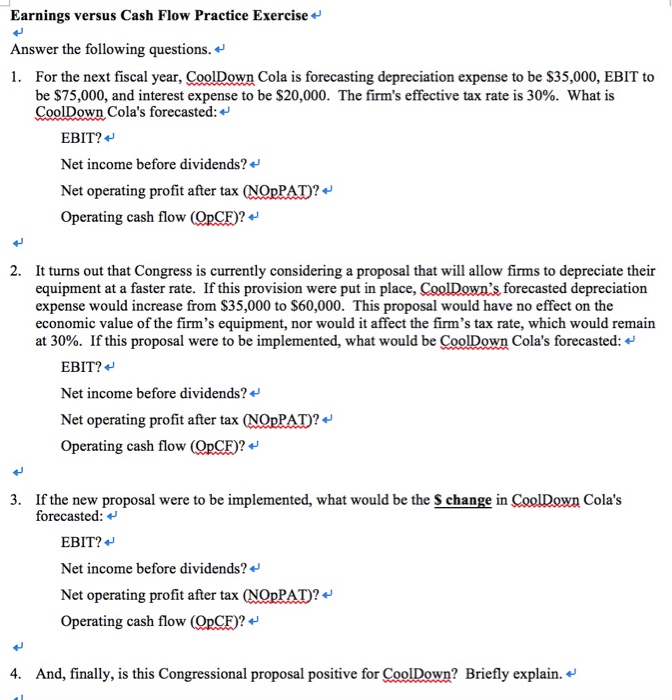

For the next fiscal year, CoolDown Cola is forecasting depreciation expense to be $35,000, EBIT to be $75,000, and interest expense to be $20,000. The firm's effective tax rate is 30%. What is CoolDown Cola's forecasted: EBIT? Net income before dividends? Net operating profit after tax (NOpPAT)? Operating cash flow (OpCF)? It turns out that Congress is currently considering a proposal that will allow firms to depreciate their equipment at a faster rate. If this provision were put in place, CoolDown's forecasted depreciation expense would increase from $35,000 to $60,000. This proposal would have no effect on the economic value of the firm's equipment, nor would it affect the firm's tax rate, which would remain at 30%. If this proposal were to be implemented, what would be CoolDown Cola's forecasted: EBIT? Net income before dividends? Net operating profit after tax (NOpPAT)? Operating cash flow (OpCF)? If the new proposal were to be implemented, what would be the S change in CoolDown Cola's forecasted: EBIT? Net income before dividends? Net operating profit after tax (NOpPAT)? Operating cash flow (OpCF)? And, finally, is this Congressional proposal positive for CoolDown? Briefly explain

For the next fiscal year, CoolDown Cola is forecasting depreciation expense to be $35,000, EBIT to be $75,000, and interest expense to be $20,000. The firm's effective tax rate is 30%. What is CoolDown Cola's forecasted: EBIT? Net income before dividends? Net operating profit after tax (NOpPAT)? Operating cash flow (OpCF)? It turns out that Congress is currently considering a proposal that will allow firms to depreciate their equipment at a faster rate. If this provision were put in place, CoolDown's forecasted depreciation expense would increase from $35,000 to $60,000. This proposal would have no effect on the economic value of the firm's equipment, nor would it affect the firm's tax rate, which would remain at 30%. If this proposal were to be implemented, what would be CoolDown Cola's forecasted: EBIT? Net income before dividends? Net operating profit after tax (NOpPAT)? Operating cash flow (OpCF)? If the new proposal were to be implemented, what would be the S change in CoolDown Cola's forecasted: EBIT? Net income before dividends? Net operating profit after tax (NOpPAT)? Operating cash flow (OpCF)? And, finally, is this Congressional proposal positive for CoolDown? Briefly explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started