Question

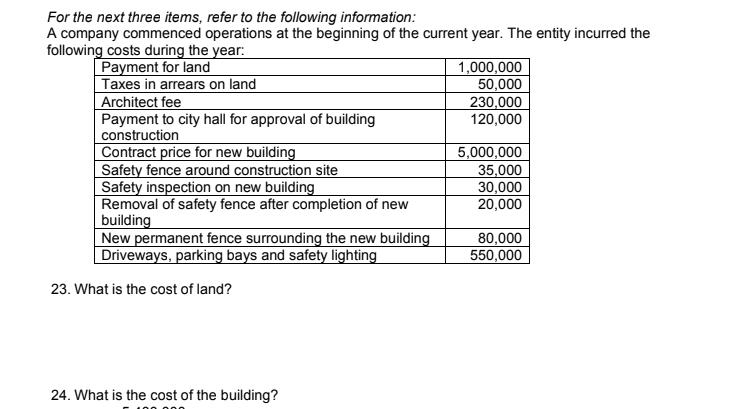

For the next three items, refer to the following information: A company commenced operations at the beginning of the current year. The entity incurred

For the next three items, refer to the following information: A company commenced operations at the beginning of the current year. The entity incurred the following costs during the year: Payment for land Taxes in arrears on land Architect fee Payment to city hall for approval of building construction Contract price for new building Safety fence around construction site Safety inspection on new building Removal of safety fence after completion of new building New permanent fence surrounding the new building Driveways, parking bays and safety lighting 23. What is the cost of land? 24. What is the cost of the building? 1,000,000 50,000 230,000 120,000 5,000,000 35,000 30,000 20,000 80,000 550,000

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

23 The cost of land can be calculated by adding the p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Management Accounting

Authors: Kim Langfield Smith, Helen Thorne, David Alan Smith, Ronald W. Hilton

7th Edition

978-1760421144, 1760421146

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App