Employee earnings records for Slaymaker Company reveal the following gross earnings for four employees through the pay period of December 15. ? For the pay

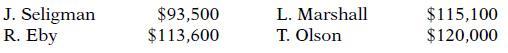

Employee earnings records for Slaymaker Company reveal the following gross earnings for four employees through the pay period of December 15. ?

For the pay period ending December 31, each employee’s gross earnings is $4,500. The FICA tax rate is 6.2% on gross earnings of $117,000, plus an additional 1.45% on all salaries and wages without limitation.

Compute the FICA withholdings that should be made for each employee for the December 31 pay period.?

J. Seligman R. Eby L. Marshall T. Olson $93,500 $115,100 $113,600 $120,000

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a b c d e f g h EMPLOYEE EARNINGS LIMITATION differenc...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started