Question

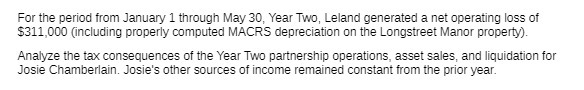

For the period from January 1 through May 30, Year Two, Leland generated a net operating loss of $311,000 (including properly computed MACRS depreciation

For the period from January 1 through May 30, Year Two, Leland generated a net operating loss of $311,000 (including properly computed MACRS depreciation on the Longstreet Manor property). Analyze the tax consequences of the Year Two partnership operations, asset sales, and liquidation for Josie Chamberlain. Josie's other sources of income remained constant from the prior year.

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To analyze the tax consequences of the Year Two partnership operations asset sales and liquidation f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Government and Not for Profit Accounting Concepts and Practices

Authors: Michael Granof, Saleha Khumawala, Thad Calabrese, Daniel Smith

7th edition

1118983270, 978-1119175025, 111917502X, 978-1119175001, 978-1118983270

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App