Question

KDS is an engineering company which is organised for managementpurposes in the form of several autonomous divisions. The performance ofeach division is currently measured by

KDS is an engineering company which is organised for managementpurposes in the form of several autonomous divisions. The performance ofeach division is currently measured by calculation of its return oninvestment (ROI). KDS's existing accounting policy is to calculate ROIby dividing the net assets of each division at the end of the year intothe operating profit generated by the division during the year. Cash isexcluded from net assets since all divisions share a bank accountcontrolled by KDS's head office. Depreciation is on a straight-linebasis.

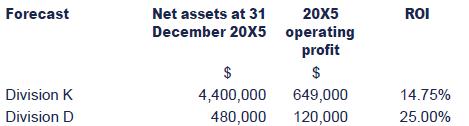

The divisional management teams are paid a performance-relatedbonus conditional upon achievement of a 15% ROI target. On 20 December20X5 the divisional managers were provided with performance forecastsfor 20X5 which included the following:

Subsequently, the manager of Division K invited members of hermanagement team to offer advice. The responses she received included thefollowing:

- From the divisional administrator:

- From the works manager:

- From the financial controller:

‘We can achieve our 20X5 target by deferring payment of a $90,000 trade debt payable on 20 December until 1 January. I should add that we will thereby immediately incur a $2,000 late payment penalty.'

‘We should replace a number of our oldest machine tools (which have nil book value) at a cost of $320,000. The new equipment will have a life of eight years and generate cost savings of $76,000 per year. The new equipment can be on site and operational by 31 December 20X5.'

‘The existing method of performance appraisal is unfair. We should ask head office to adopt residual income (RI) as the key performance indicator, using the company's average 12% cost of money for a finance charge.'

Required:

(a) Compare and appraise the proposals of thedivisional administrator and the works manager, having regard to theachievement of the ROI performance target in 20X5 and to any longer termfactors you think relevant.

(12 marks)

(b) Explain the extent to which you agree or disagree with the financial controller's proposal.

(8 marks)

(c) Explain how non-financial performance measures could be used to assess the performance of divisions K and D.

Forecast Net assets at 31 December 20X5 $ 20X5 operating profit ROI $ Division K 4,400,000 649,000 14.75% Division D 480,000 120,000 25.00%

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Without specific details about the calculations provided by the client or the nature of the analytic...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started