Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the questions in this section, refer to the detailed report on the Automotive segment that begins on page 39 of the 10-K. 1.

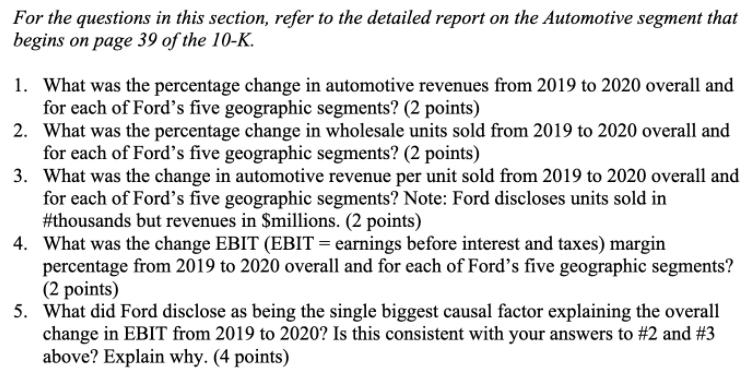

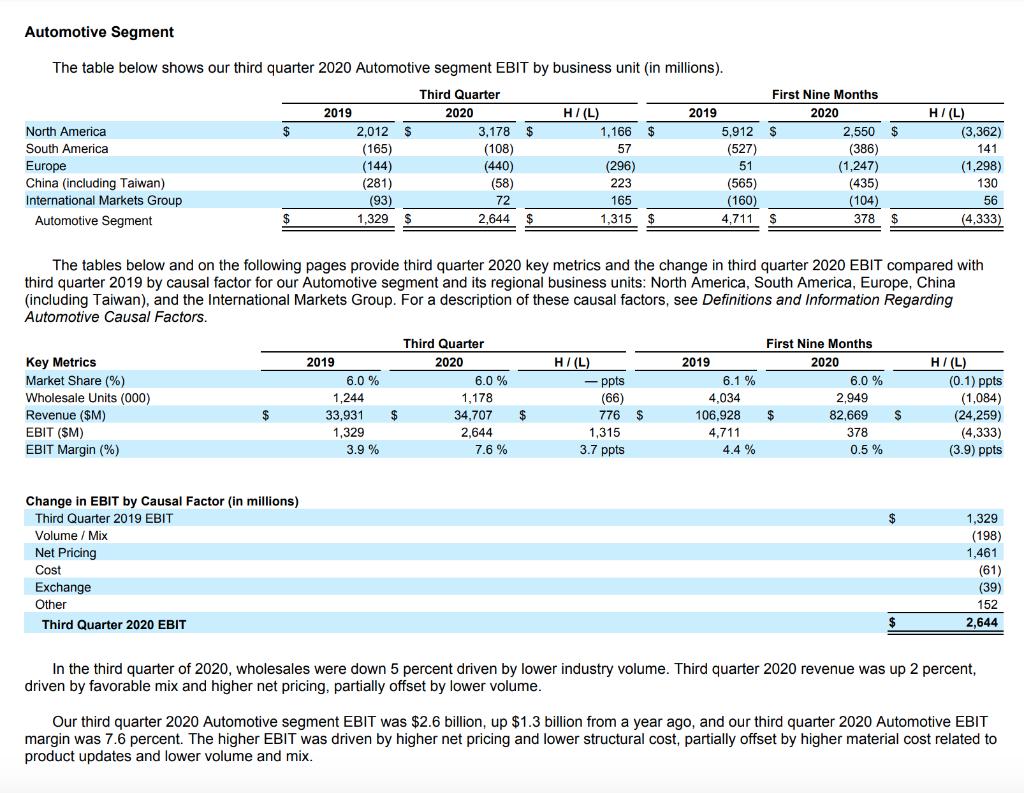

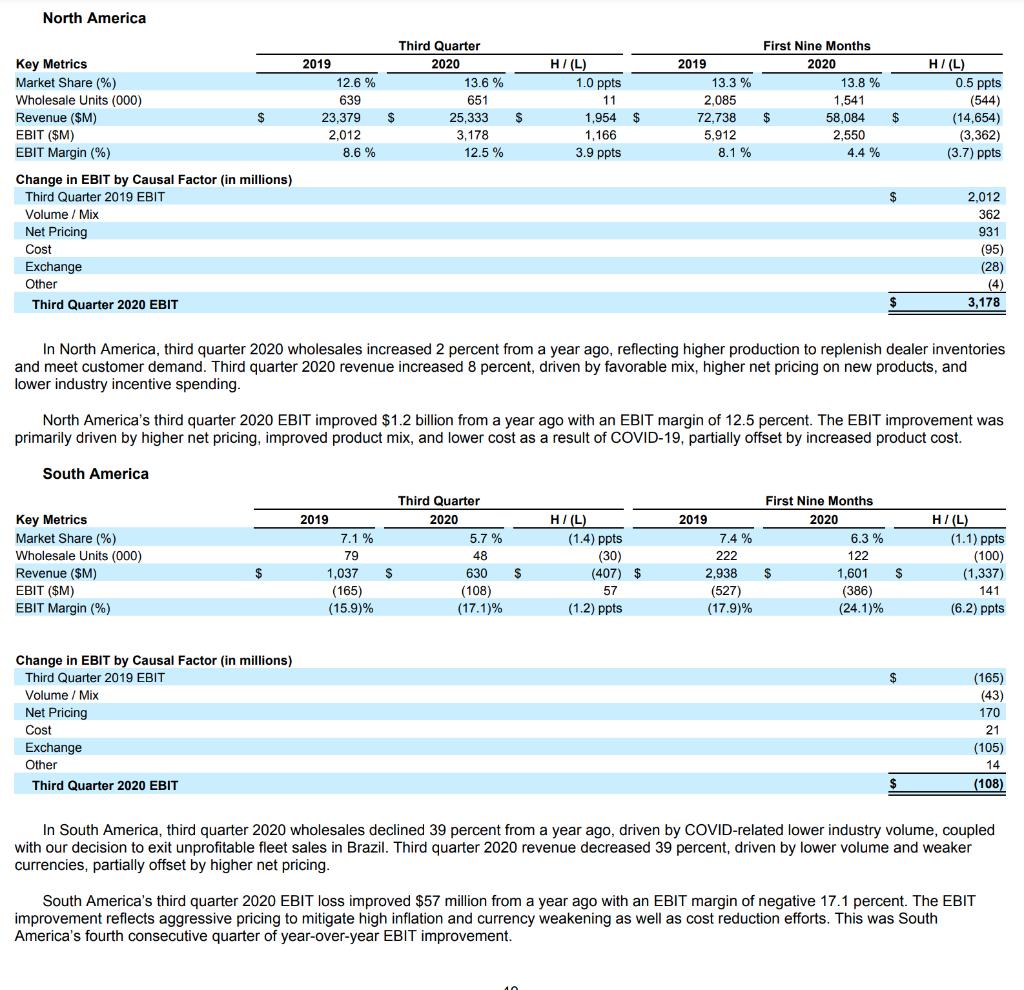

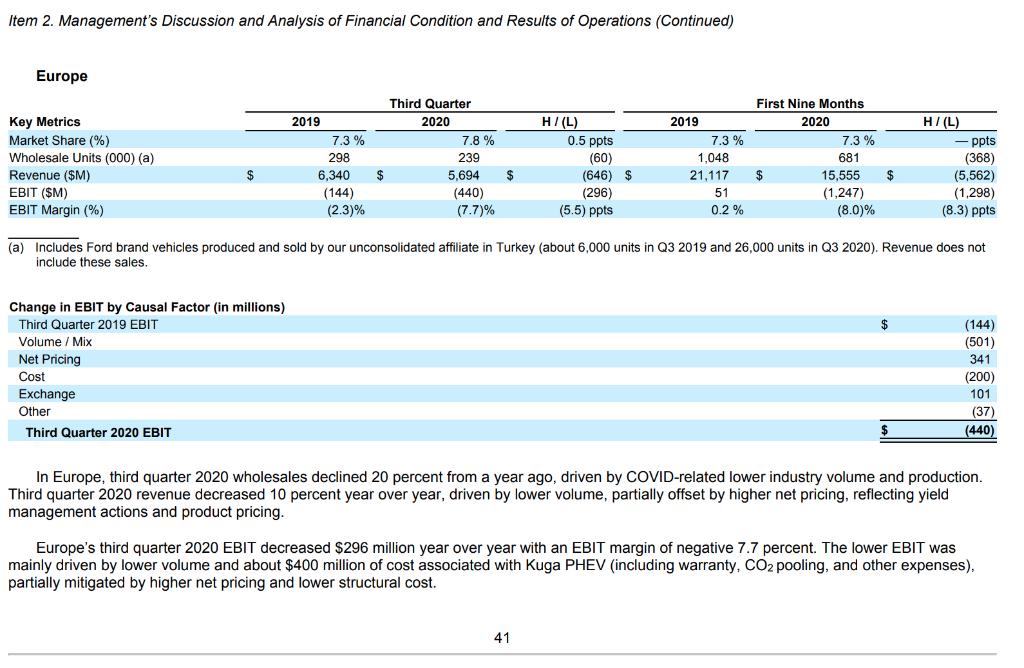

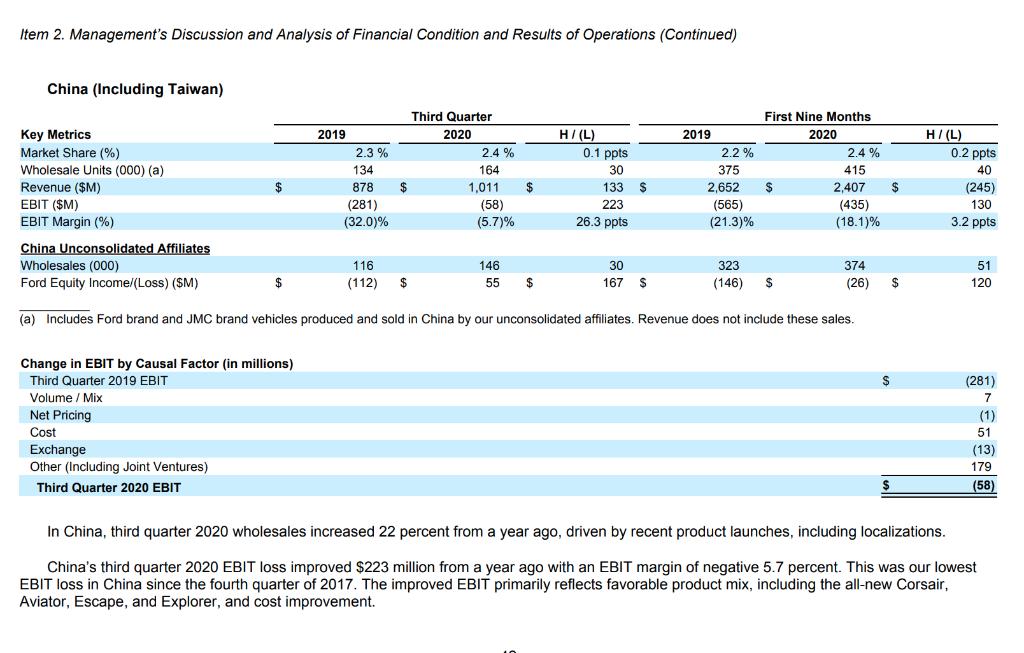

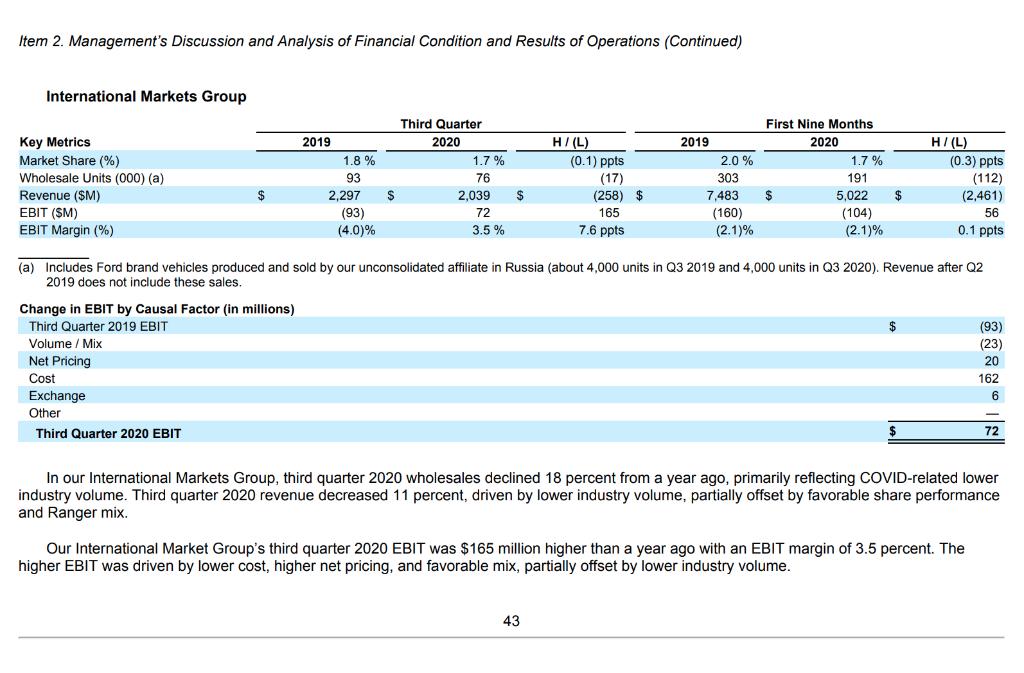

For the questions in this section, refer to the detailed report on the Automotive segment that begins on page 39 of the 10-K. 1. What was the percentage change in automotive revenues from 2019 to 2020 overall and for each of Ford's five geographic segments? (2 points) 2. What was the percentage change in wholesale units sold from 2019 to 2020 overall and for each of Ford's five geographic segments? (2 points) 3. What was the change in automotive revenue per unit sold from 2019 to 2020 overall and for each of Ford's five geographic segments? Note: Ford discloses units sold in #thousands but revenues in Smillions. (2 points) 4. What was the change EBIT (EBIT = earnings before interest and taxes) margin percentage from 2019 to 2020 overall and for each of Ford's five geographic segments? (2 points) 5. What did Ford disclose as being the single biggest causal factor explaining the overall change in EBIT from 2019 to 2020? Is this consistent with your answers to #2 and #3 above? Explain why. (4 points) Automotive Segment The table below shows our third quarter 2020 Automotive segment EBIT by business unit (in millions). Third Quarter 2020 North America South America Europe China (including Taiwan) International Markets Group Automotive Segment Key Metrics Market Share (%) Wholesale Units (000) Revenue ($M) EBIT (SM) EBIT Margin (%) $ Net Pricing Cost $ Change in EBIT by Causal Factor (in millions) Third Quarter 2019 EBIT Volume / Mix Exchange Other Third Quarter 2020 EBIT 2019 2,012 $ (165) (144) (281) (93) 1,329 $ 2019 3,178 $ (108) 6.0% 1,244 33.931 $ 1,329 3.9 % (440) (58) 72 2,644 $ Third Quarter 2020 6.0 % 1,178 34,707 2,644 7.6% H/(L) $ The tables below and on the following pages provide third quarter 2020 key metrics and the change in third quarter 2020 EBIT compared with third quarter 2019 by causal factor for our Automotive segment and its regional business units: North America, South America, Europe, China (including Taiwan), and the International Markets Group. For a description of these causal factors, see Definitions and Information Regarding Automotive Causal Factors. 1,166 $ 57 (296) 223 165 1,315 $ H/(L) 2019 - ppts (66) 776 $ 1,315 3.7 ppts 2019 5,912 $ (527) 51 (565) (160) 4,711 S First Nine Months 2020 6.1 % 4,034 106,928 4,711 4.4% 2,550 $ (386) (1,247) (435) (104) 378 $ First Nine Months 2020 6.0 % 2,949 82,669 378 $ 0.5% $ H/(L) $ (3,362) 141 (1,298) 130 56 (4,333) H/(L) (0.1) ppts (1,084) (24,259) (4,333) (3.9) ppts 1,329 (198) 1,461 (61) (39) 152 2,644 In the third quarter of 2020, wholesales were down 5 percent driven by lower industry volume. Third quarter 2020 revenue was up 2 percent, driven by favorable mix and higher net pricing, partially offset by lower volume. Our third quarter 2020 Automotive segment EBIT was $2.6 billion, up $1.3 billion from a year ago, and our third quarter 2020 Automotive EBIT margin was 7.6 percent. The higher EBIT was driven by higher net pricing and lower structural cost, partially offset by higher material cost related to product updates and lower volume and mix. North America Key Metrics Market Share (%) Wholesale Units (000) Revenue ($M) EBIT (SM) EBIT Margin (%) Change in EBIT by Causal Factor (in millions) Third Quarter 2019 EBIT Volume / Mix Net Pricing Cost Exchange Other Third Quarter 2020 EBIT South America Key Metrics Market Share (%) Wholesale Units (000) Revenue ($M) $ EBIT (SM) EBIT Margin (%) Change in EBIT by Causal Factor (in millions) Third Quarter 2019 EBIT Volume / Mix Net Pricing Cost 2019 Exchange Other Third Quarter 2020 EBIT 12.6% 639 23,379 2.012 8.6 % 2019 7.1 % $ 79 1,037 (165) (15.9)% Third Quarter 2020 13.6% 651 25,333 3,178 12.5% S Third Quarter 2020 S 5.7 % 48 630 (108) (17.1)% H/(L) In North America, third quarter 2020 wholesales increased 2 percent from a year ago, reflecting higher production to replenish dealer inventories and meet customer demand. Third quarter 2020 revenue increased 8 percent, driven by favorable mix, higher net pricing on new products, and lower industry incentive spending. 1.0 ppts 11 1,954 $ 1,166 3.9 ppts North America's third quarter 2020 EBIT improved $1.2 billion from a year ago with an EBIT margin of 12.5 percent. The EBIT improvement was primarily driven by higher net pricing, improved product mix, and lower cost as a result of COVID-19, partially offset by increased product cost. $ 2019 H/(L) (1.4) ppts (30) (407) $ 57 (1.2) ppts 13.3 % 2,085 72,738 5,912 8.1 % 2019 First Nine Months 2020 7.4% $ 222 2,938 (527) (17.9)% 13.8 % 1,541 58,084 2,550 4.4 % First Nine Months 2020 $ $ 6.3% $ 122 1,601 (386) (24.1)% H/(L) 0.5 ppts (544) (14,654) (3,362) (3.7) ppts $ 2,012 362 931 (95) (28) (4) 3,178 H/(L) (1.1) ppts (100) (1,337) 141 (6.2) ppts (165) (43) 170 21 (105) 14 (108) In South America, third quarter 2020 wholesales declined 39 percent from a year ago, driven by COVID-related lower industry volume, coupled with our decision to exit unprofitable fleet sales in Brazil. Third quarter 2020 revenue decreased 39 percent, driven by lower volume and weaker currencies, partially offset by higher net pricing. South America's third quarter 2020 EBIT loss improved $57 million from a year ago with an EBIT margin of negative 17.1 percent. The EBIT improvement reflects aggressive pricing to mitigate high inflation and currency weakening as well as cost reduction efforts. This was South America's fourth consecutive quarter of year-over-year EBIT improvement. Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations (Continued) Europe Key Metrics Market Share (%) Wholesale Units (000) (a) Revenue ($M) EBIT (SM) EBIT Margin (%) $ Change in EBIT by Causal Factor (in millions) Third Quarter 2019 EBIT Volume / Mix Net Pricing Cost Exchange Other Third Quarter 2020 EBIT 2019 7.3% 298 6,340 (144) (2.3)% $ Third Quarter 2020 7.8% 239 5,694 (440) (7.7)% $ H/(L) 0.5 ppts (60) (646) $ (296) (5.5) ppts 2019 41 7.3% 1,048 21,117 51 0.2% First Nine Months 2020 $ 7.3% 681 15,555 (1,247) (8.0)% $ (a) Includes Ford brand vehicles produced and sold by our unconsolidated affiliate in Turkey (about 6,000 units in Q3 2019 and 26,000 units in Q3 2020). Revenue does not include these sales. H/(L) - ppts (368) (5,562) (1,298) (8.3) ppts (144) (501) 341 (200) 101 (37) (440) In Europe, third quarter 2020 wholesales declined 20 percent from a year ago, driven by COVID-related lower industry volume and production. Third quarter 2020 revenue decreased 10 percent year over year, driven by lower volume, partially offset by higher net pricing, reflecting yield management actions and product pricing. Europe's third quarter 2020 EBIT decreased $296 million year over year with an EBIT margin of negative 7.7 percent. The lower EBIT was mainly driven by lower volume and about $400 million of cost associated with Kuga PHEV (including warranty, CO2 pooling, and other expenses), partially mitigated by higher net pricing and lower structural cost. Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations (Continued) China (Including Taiwan) Key Metrics Market Share (%) Wholesale Units (000) (a) Revenue ($M) EBIT ($M) EBIT Margin (%) $ Net Pricing Cost Change in EBIT by Causal Factor (in millions) Third Quarter 2019 EBIT Volume / Mix Exchange Other (Including Joint Ventures) Third Quarter 2020 EBIT $ 2019 2.3% 134 878 (281) (32.0)% $ Third Quarter 2020 116 (112) $ 2.4% 164 1,011 (58) (5.7)% $ 146 55 H/(L) $ 0.1 ppts 30 133 $ 223 26.3 ppts China Unconsolidated Affiliates Wholesales (000) 323 (146) $ Ford Equity Income/(Loss) ($M) (a) Includes Ford brand and JMC brand vehicles produced and sold in China by our unconsolidated affiliates. Revenue does not include these sales. 2019 30 167 $ 2.2% 375 2,652 (565) (21.3)% First Nine Months 2020 $ 2.4% 415 2,407 (435) (18.1)% 374 (26) $ $ $ H/(L) 0.2 ppts 40 (245) 130 3.2 ppts 51 120 (281) 7 (1) 51 (13) 179 (58) In China, third quarter 2020 wholesales increased 22 percent from a year ago, driven by recent product launches, including localizations. China's third quarter 2020 EBIT loss improved $223 million from a year ago with an EBIT margin of negative 5.7 percent. This was our lowest EBIT loss in China since the fourth quarter of 2017. The improved EBIT primarily reflects favorable product mix, including the all-new Corsair, Aviator, Escape, and Explorer, and cost improvement. Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations (Continued) International Markets Group Key Metrics Market Share (%) Wholesale Units (000) (a) Revenue (SM) EBIT (SM) EBIT Margin (%) $ Change in EBIT by Causal Factor (in millions) Third Quarter 2019 EBIT Volume / Mix Net Pricing Cost Exchange Other Third Quarter 2020 EBIT 2019 1.8% 93 2,297 (93) (4.0)% $ Third Quarter 2020 1.7% 76 2,039 72 3.5% $ H/(L) (0.1) ppts (17) (258) $ 165 7.6 ppts 43 2019 2.0% 303 7,483 (160) (2.1)% First Nine Months 2020 $ 1.7% 191 5,022 (104) (2.1)% $ (a) Includes Ford brand vehicles produced and sold by our unconsolidated affiliate in Russia (about 4,000 units in Q3 2019 and 4,000 units in Q3 2020). Revenue after Q2 2019 does not include these sales. H/(L) $ (0.3) ppts (112) (2,461) 56 0.1 ppts Our International Market Group's third quarter 2020 EBIT was $165 million higher than a year ago with an EBIT margin of 3.5 percent. The higher EBIT was driven by lower cost, higher net pricing, and favorable mix, partially offset by lower industry volume. (93) (23) 20 162 6 In our International Markets Group, third quarter 2020 wholesales declined 18 percent from a year ago, primarily reflecting COVID-related lower industry volume. Third quarter 2020 revenue decreased 11 percent, driven by lower industry volume, partially offset by favorable share performance and Ranger mix. 72 Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations (Continued) Definitions and Information Regarding Automotive Causal Factors In general, we measure year-over-year change in Automotive segment EBIT using the causal factors listed below, with net pricing and cost variances calculated at present-period volume and mix and exchange: Market Factors (exclude the impact of unconsolidated affiliate wholesale units): Volume and Mix - primarily measures EBIT variance from changes in wholesale unit volumes (at prior-year average contribution margin per unit) driven by changes in industry volume, market share, and dealer stocks, as well as the EBIT variance resulting from changes in product mix, including mix among vehicle lines and mix of trim levels and options within a vehicle line Net Pricing - primarily measures EBIT variance driven by changes in wholesale unit prices to dealers and marketing incentive programs such as rebate programs, low-rate financing offers, special lease offers, and stock adjustments on dealer inventory 0 Cost: 0 Contribution Costs - primarily measures EBIT variance driven by per-unit changes in cost categories that typically vary with volume, such as material costs (including commodity and component costs), warranty expense, and freight and duty costs Structural Costs - primarily measures EBIT variance driven by absolute change in cost categories that typically do not have a directly proportionate relationship to production volume. Structural costs include the following cost categories: Manufacturing, Including Volume-Related consists primarily of costs for hourly and salaried manufacturing personnel, plant overhead (such as utilities and taxes), and new product launch expense. These costs could be affected by volume for operating pattern actions such as overtime, line-speed, and shift schedules Engineering - consists primarily f costs for engineering personnel, prototype materials, testing, and outside engineering services Spending-Related consists primarily of depreciation and amortization of our manufacturing and engineering assets, but also includes asset retirements and operating leases Advertising and Sales Promotions - includes costs for advertising, marketing programs, brand promotions, customer mailings and promotional events, and auto shows Administrative and Selling - includes primarily costs for salaried personnel and purchased services related to our staff activities and selling functions, as well as associated information technology costs Pension and OPEB - consists primarily of past service pension costs and other postretirement employee benefit costs Exchange - primarily measures EBIT variance driven by one or more of the following: (i) transactions denominated in currencies other than the functional currencies of the relevant entities, (ii) effects of converting functional currency income to U.S. dollars, (iii) effects of remeasuring monetary assets and liabilities of the relevant entities in currencies other than their functional currency, or (iv) results of our foreign currency hedging Other - includes a variety of items, such as parts and services earnings, royalties, government incentives, and compensation-related changes In addition, definitions and calculations used in this report include: Wholesales and Revenue - wholesale unit volumes include all Ford and Lincoln badged units (whether produced by Ford or by an unconsolidated affiliate) that are sold to dealerships, units manufactured by Ford that are sold to other manufacturers, units distributed by Ford for other manufacturers, and local brand units produced by our China joint venture, Jiangling Motors Corporation, Ltd. ("JMC"), that are sold to dealerships. Vehicles sold to daily rental car companies that are subject to a guaranteed repurchase option (i.e., rental repurchase), as well as other sales of finished vehicles for which the recognition of revenue is deferred (e.g., consignments), also are included in wholesale unit volumes. Revenue from certain vehicles in wholesale unit volumes (specifically, Ford badged vehicles produced and distributed by our unconsolidated affiliates, as well as JMC brand vehicles) are not included in our revenue Industry Volume and Market Share-based, in part, on estimated vehicle registrations; includes medium and heavy duty trucks SAAR - seasonally adjusted annual rate Mobility Segment Our Mobility segment primarily includes development costs related to our autonomous vehicles and our investment in mobility through Ford Smart Mobility LLC ("FSM"). Autonomous vehicles includes self-driving systems development and vehicle integration, autonomous vehicle research and advanced engineering, autonomous vehicle transportation-as-a-service network development, user experience, and business strategy and business development teams. FSM designs and builds mobility products and subscription services on its own, and collaborates with service providers and technology companies. In our Mobility segment, our third quarter 2020 EBIT loss was $281 million, a $9 million improvement from a year ago.

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 What was the percentage change in automotive revenues from 2019 to 2020 overall and for each of Fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started