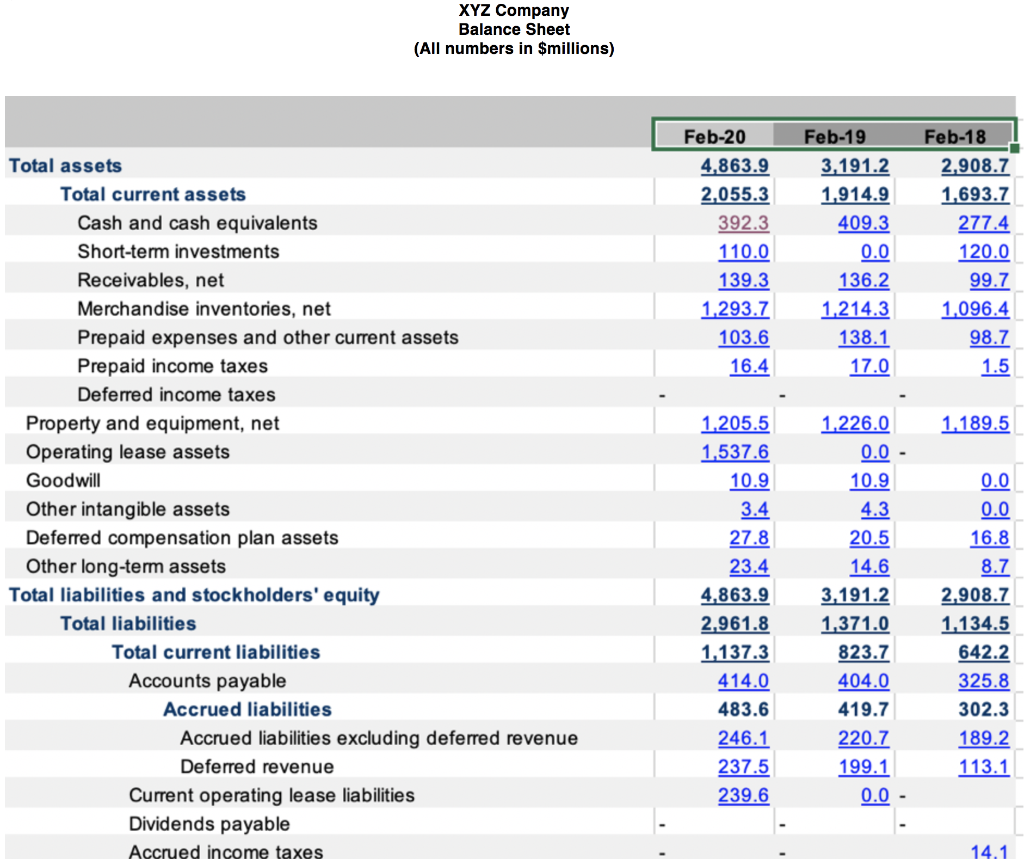

For the remaining problems, please refer to the attached company financial statements for XYZ Company. In conjunction with the method used in the text, use average balances (when applicable) in ratio calculations. Note: all dollar figures presented in the questions are in millions, to match the financial statements.

XYZ Share Price as of 2/1/2020: $267.91

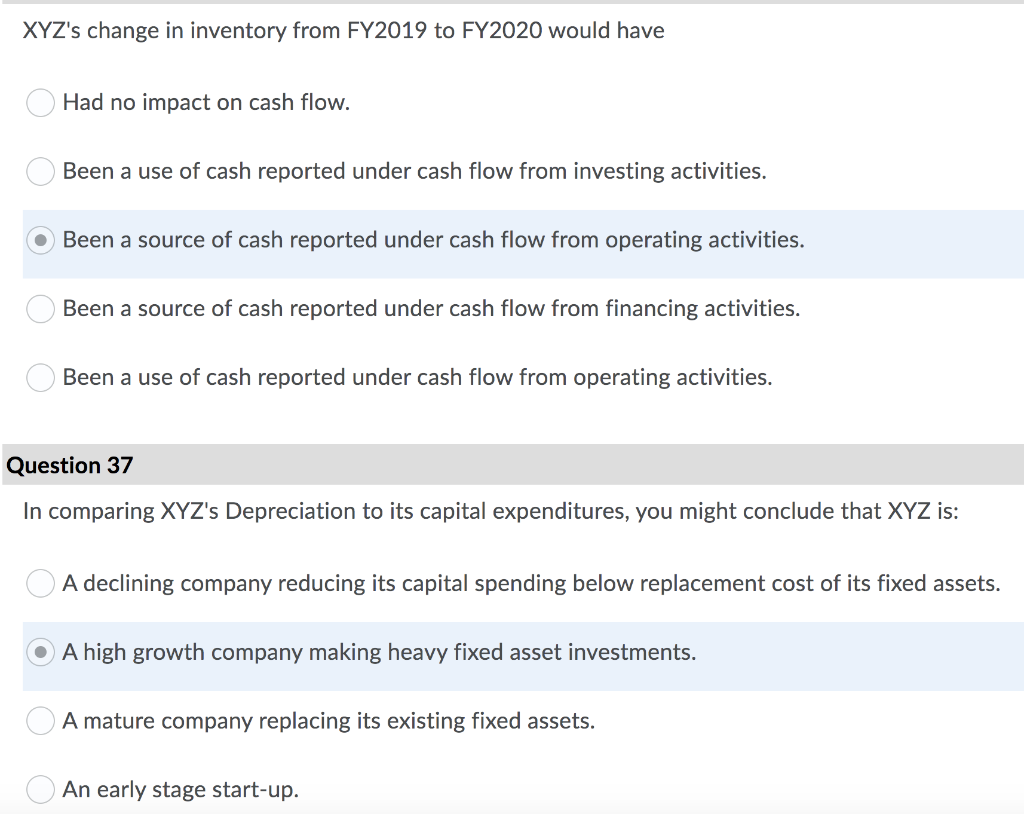

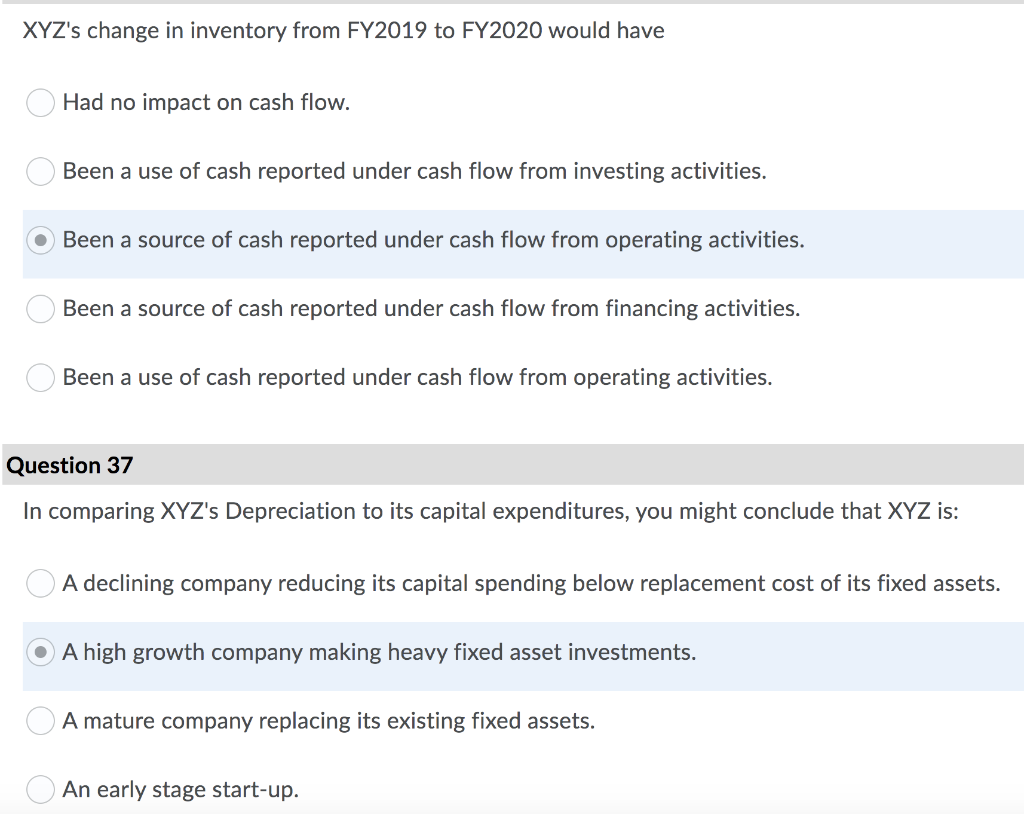

XYZ's Depreciation FY2020 = $295.6 mln, FY2019 = $279.5 mln and FY2018 = $252.7 mln.

XYZ's Capital Expenditures for FY2020 = $298.5 mln, for FY 2019 = $319.4 mln and for FY 2018 = $446.7 mln.

Questions:

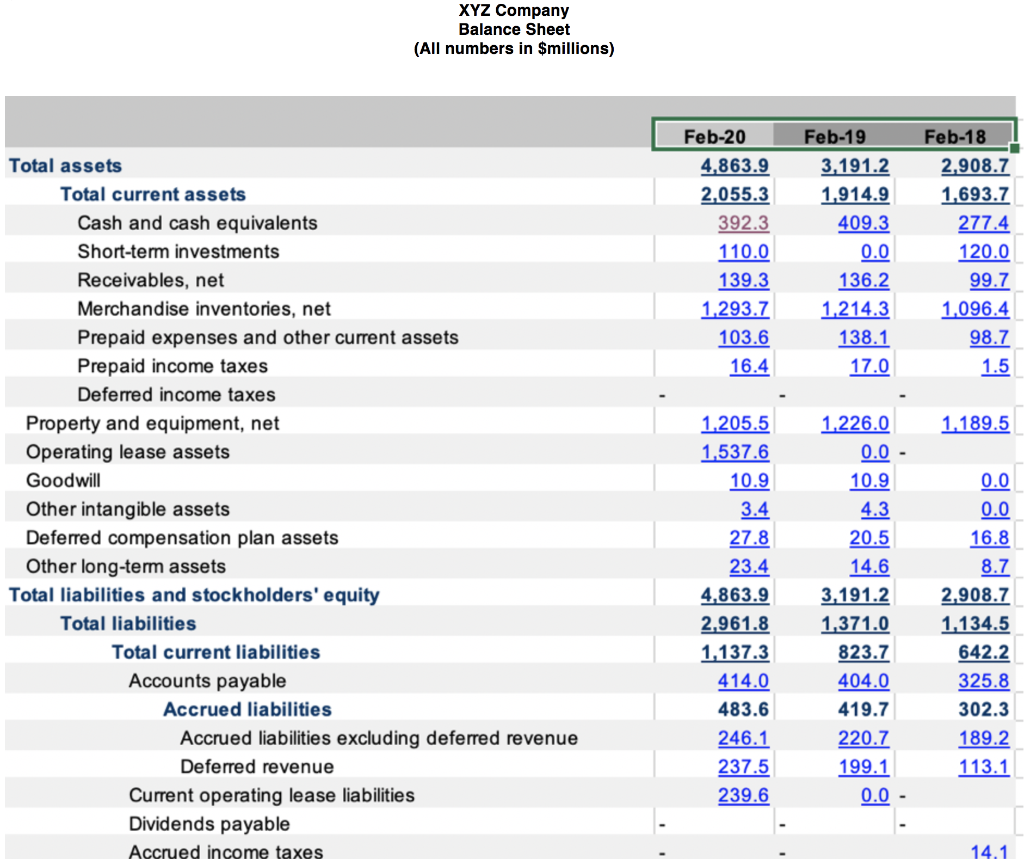

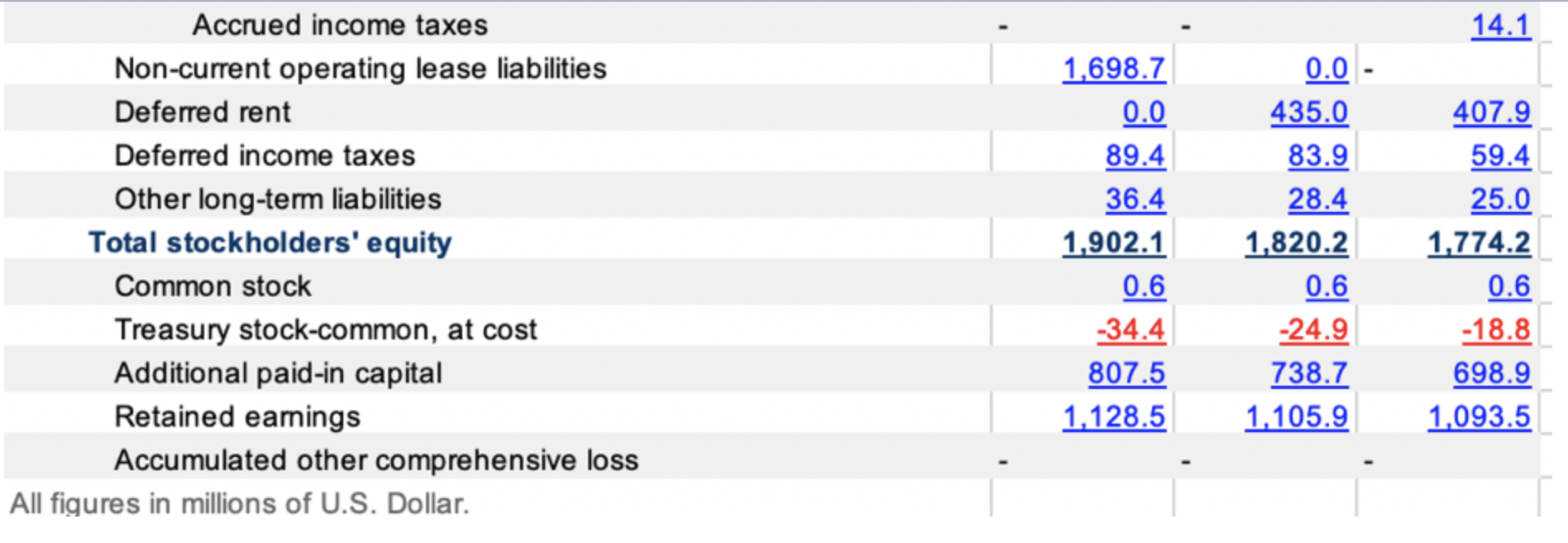

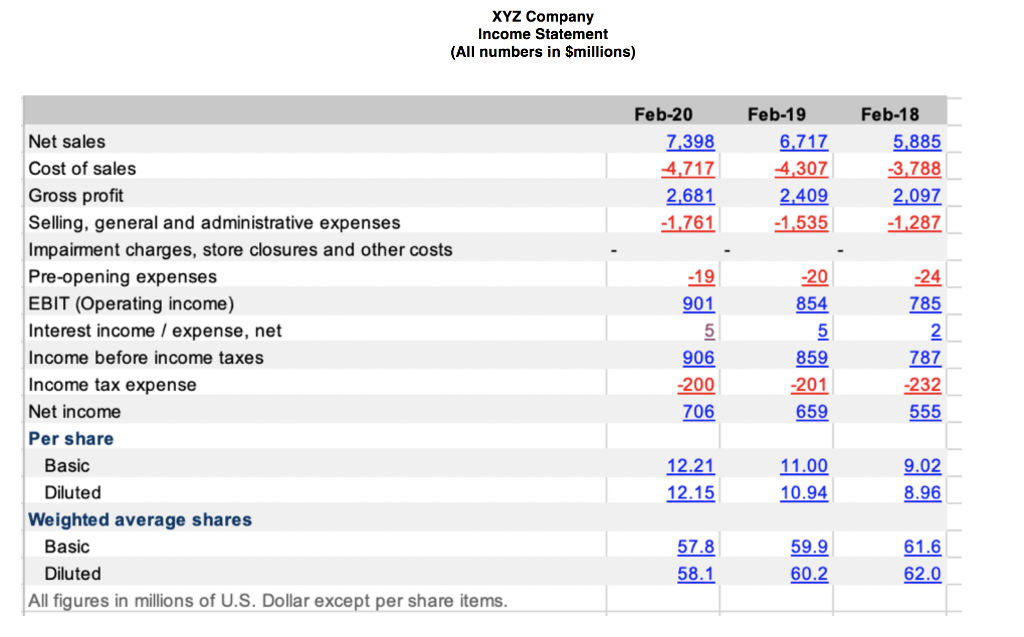

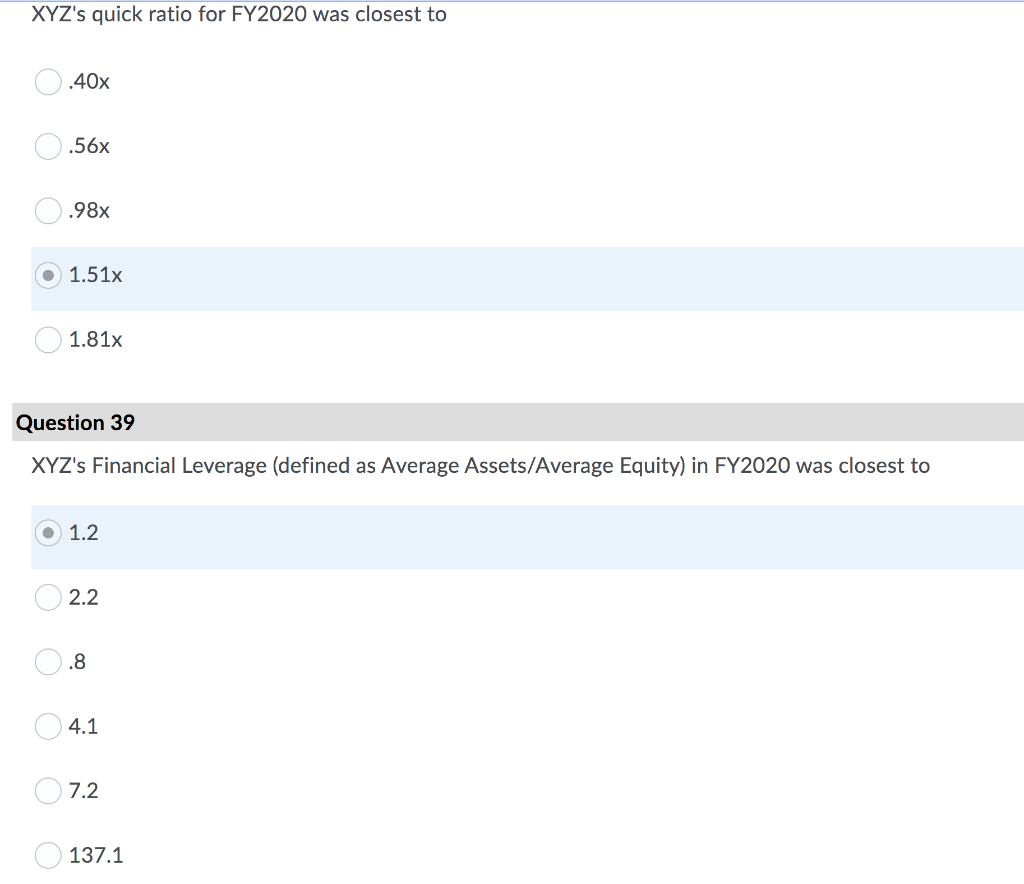

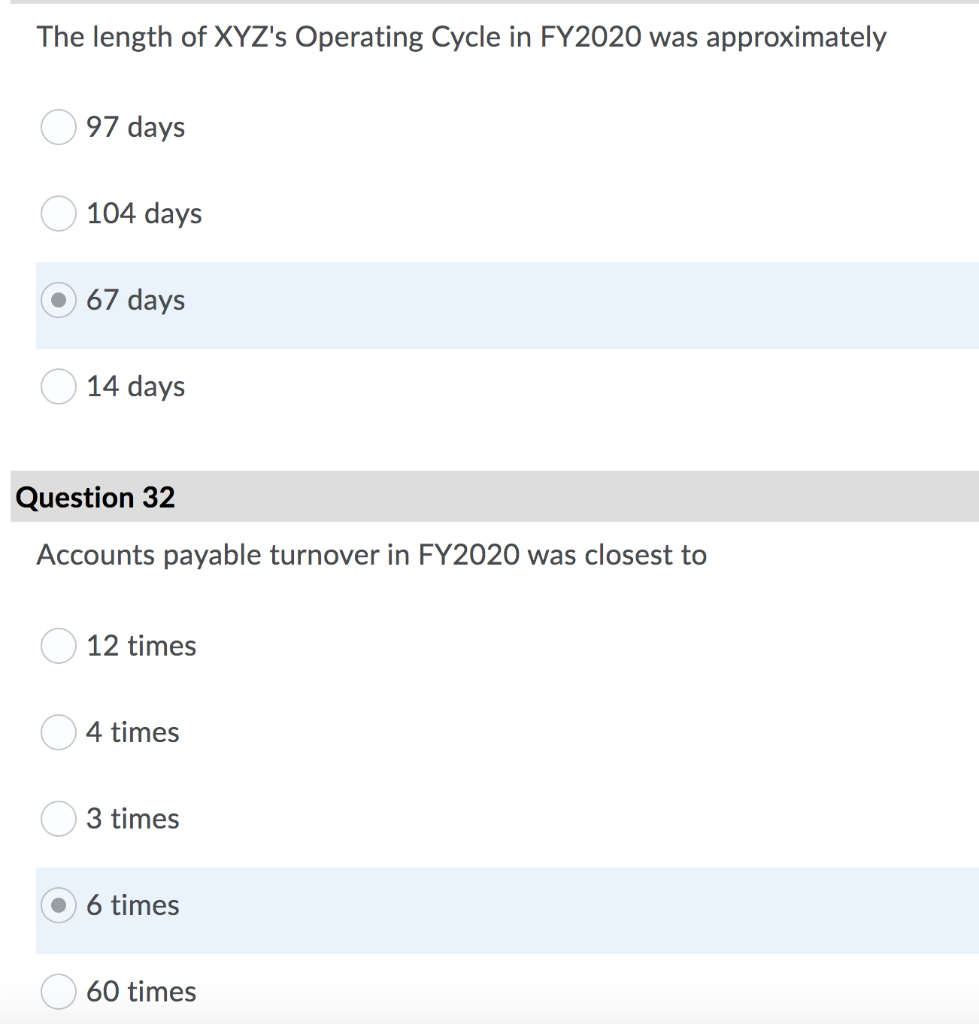

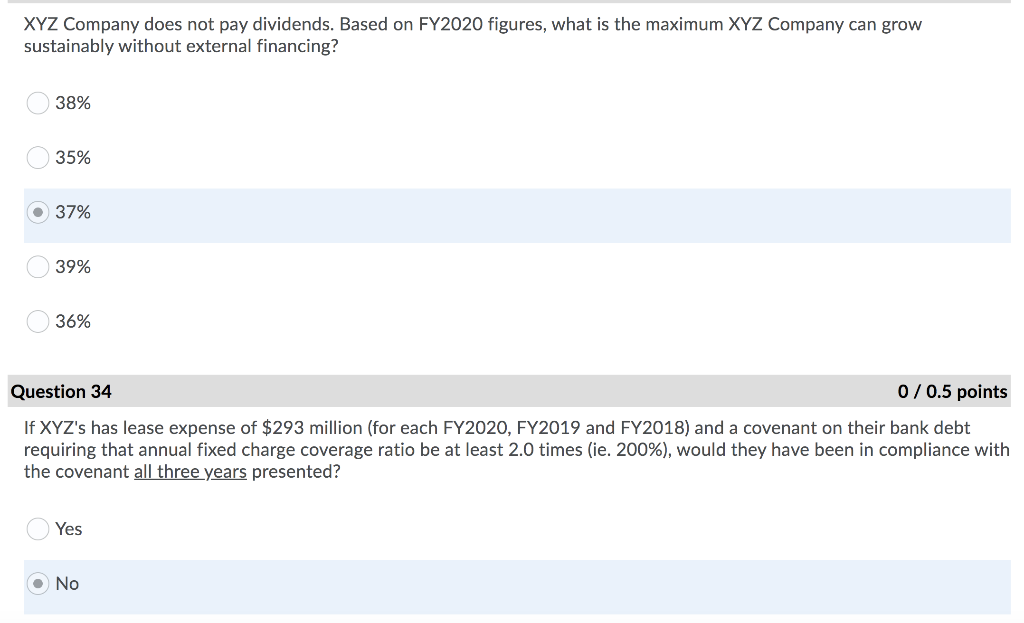

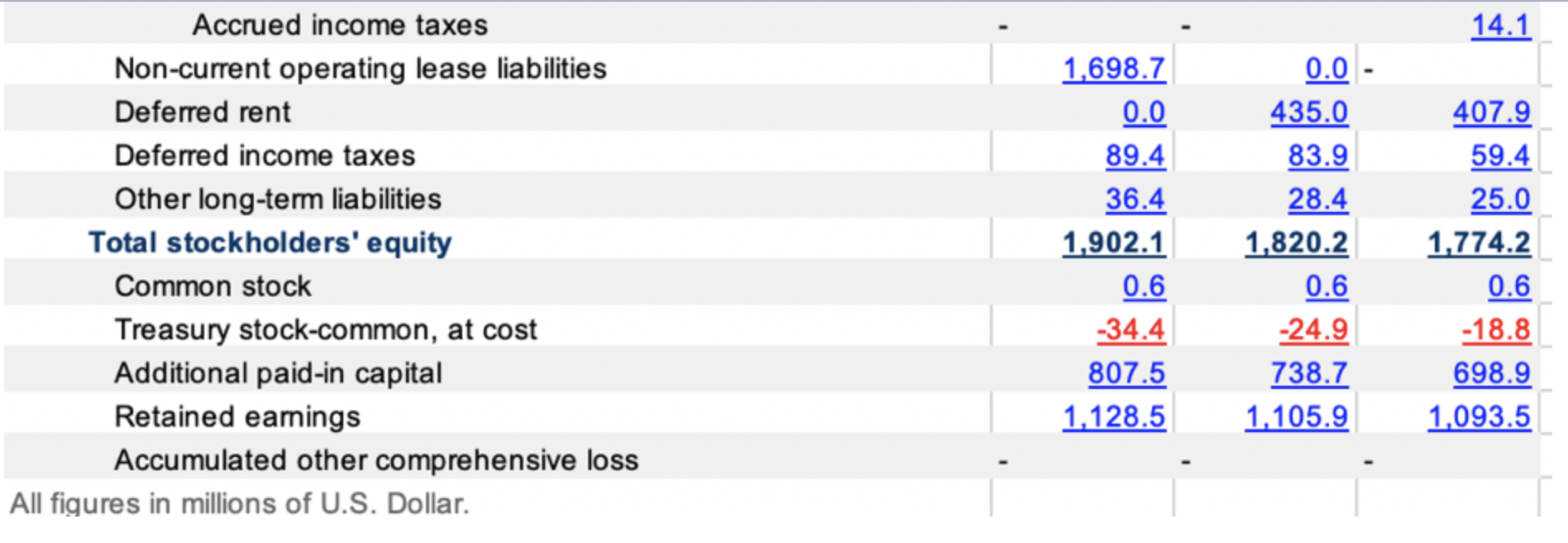

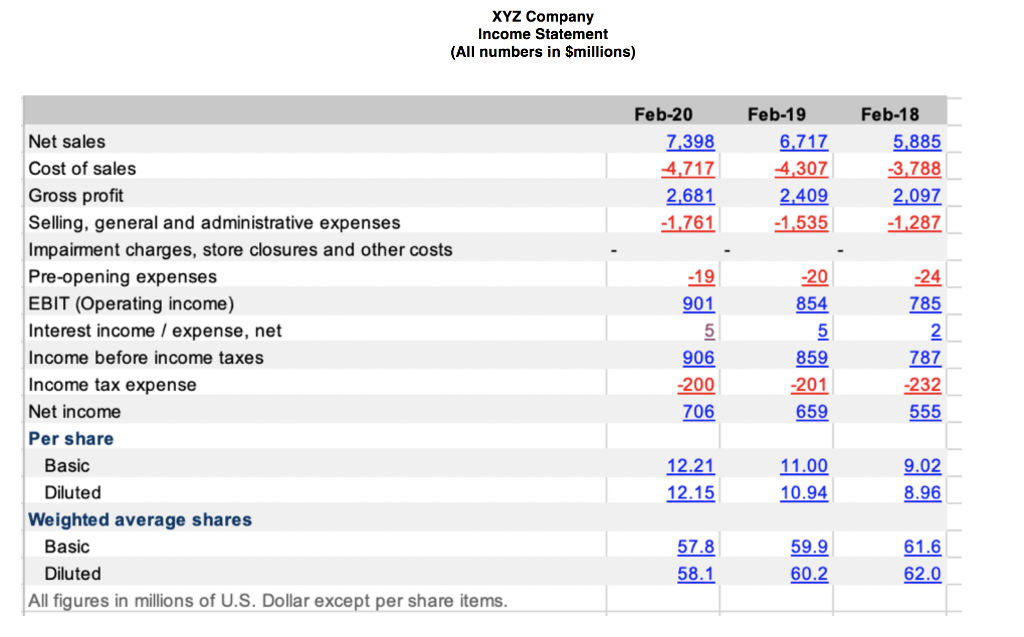

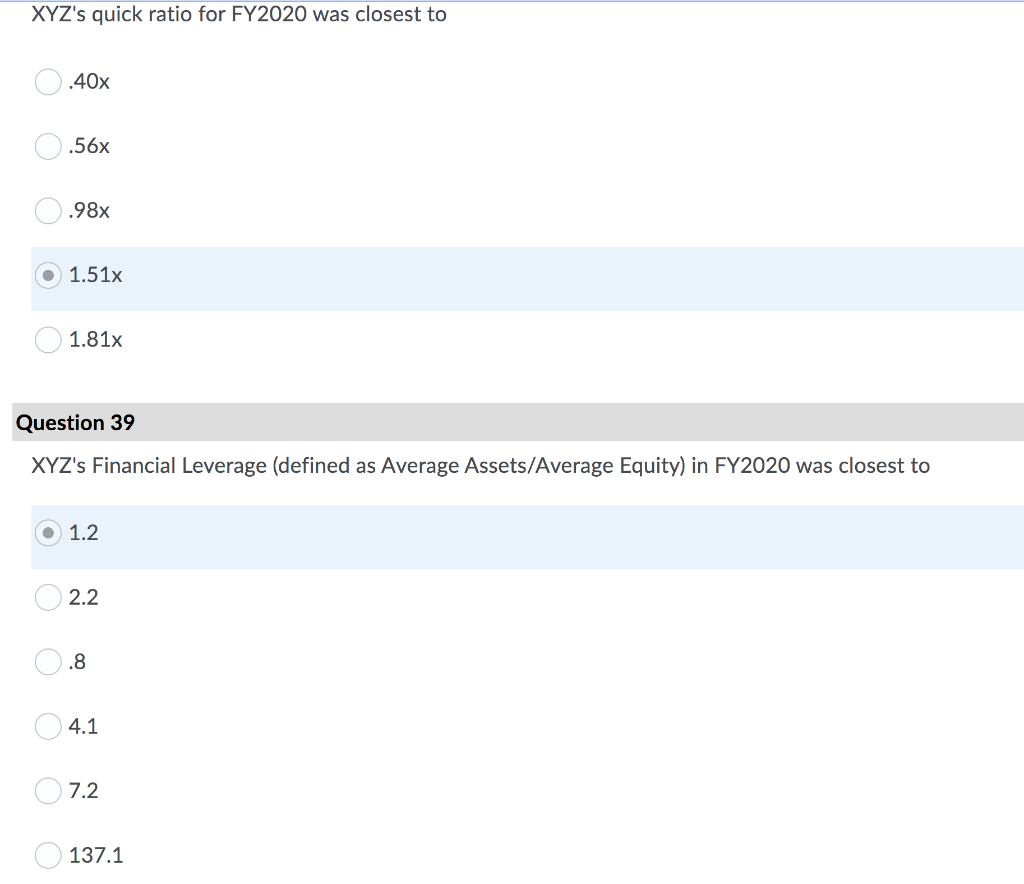

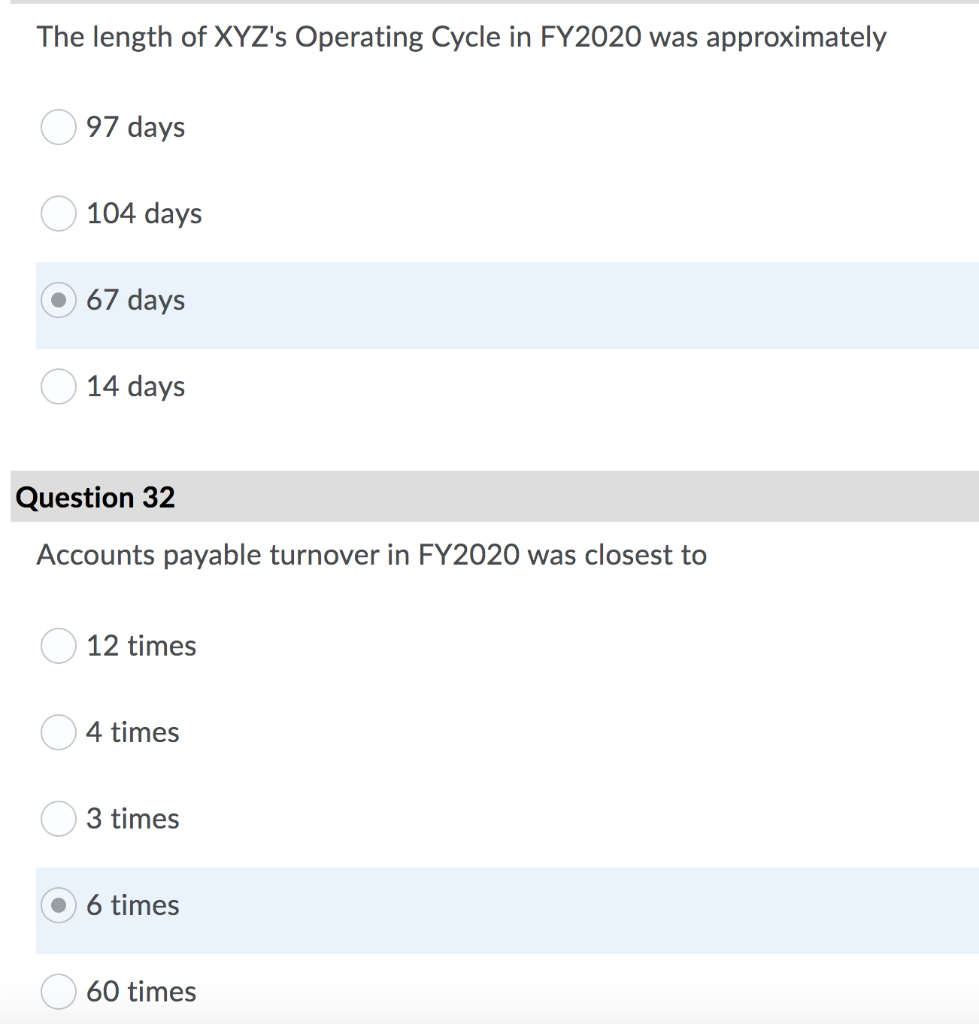

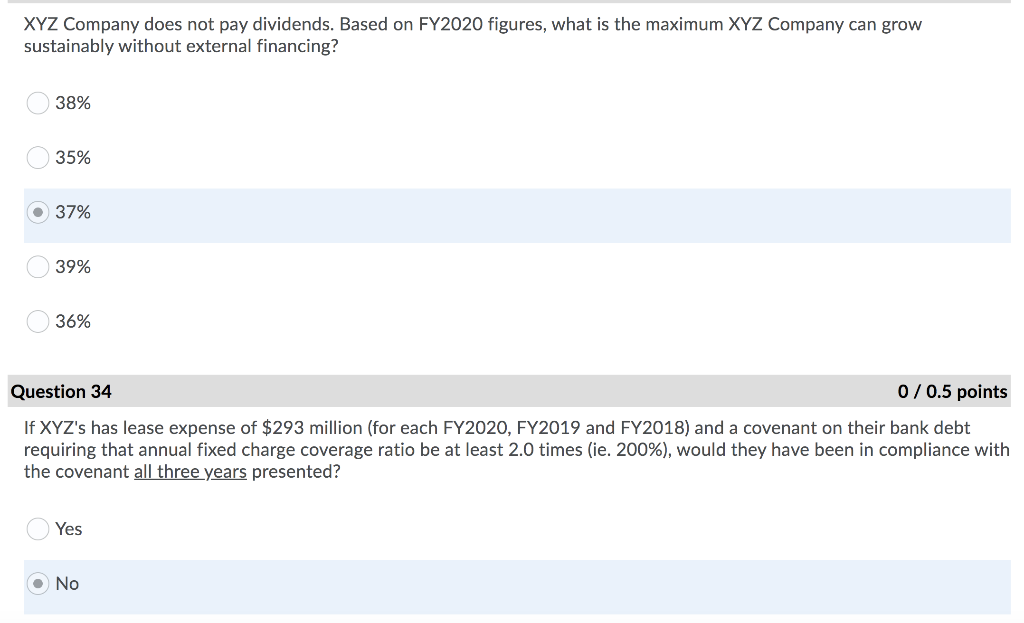

XYZ Company Balance Sheet (All numbers in $millions) Feb-20 4,863.9 2,055.3 392.3 110.0 139.3 1.293.7 103.6 16.4 Feb-19 3,191.2 1,914.9 409.3 0.0 136.2 1.214.3 138.1 17.0 Feb-18 2,908.7 1,693.7 277.4 120.0 99.7 1,096.4 98.7 1.5 1,189.5 Total assets Total current assets Cash and cash equivalents Short-term investments Receivables, net Merchandise inventories, net Prepaid expenses and other current assets Prepaid income taxes Deferred income taxes Property and equipment, net Operating lease assets Goodwill Other intangible assets Deferred compensation plan assets Other long-term assets Total liabilities and stockholders' equity Total liabilities Total current liabilities Accounts payable Accrued liabilities Accrued liabilities excluding deferred revenue Deferred revenue Current operating lease liabilities Dividends payable Accrued income taxes 1,205.5 1,537.6 10.9 3.4 27.8 23.4 4,863.9 2,961.8 1,137.3 414.0 483.6 246.1 237.5 239.6 1.226.0 0.0 - 10.9 4.3 20.5 14.6 3,191.2 1,371.0 823.7 404.0 419.7 220.7 199.1 0.0 0.0 16.8 8.7 2,908.7 1,134.5 642.2 325.8 302.3 189.2 113.1 0.0 - 14.1 14.1 Accrued income taxes Non-current operating lease liabilities Deferred rent Deferred income taxes Other long-term liabilities Total stockholders' equity Common stock Treasury stock-common, at cost Additional paid-in capital Retained earnings Accumulated other comprehensive loss All figures in millions of U.S. Dollar. 1,698.7 0.0 89.4 36.4 1,902.1 0.6 -34.4 807.5 1.128.5 0.0 435.0 83.9 28.4 1,820.2 0.6 -24.9 738.7 1.105.9 407.9 59.4 25.0 1,774.2 0.6 -18.8 698.9 1,093.5 XYZ Company Income Statement (All numbers in $millions) Feb-20 7,398 4,717 2,681 -1.761 Feb-19 6,717 4,307 2.409 -1.535 Feb-18 5.885 -3.788 2,097 -1.287 Net sales Cost of sales Gross profit Selling, general and administrative expenses Impairment charges, store closures and other costs Pre-opening expenses EBIT (Operating income) Interest income / expense, net Income before income taxes Income tax expense Net income Per share Basic Diluted Weighted average shares Basic Diluted All figures in millions of U.S. Dollar except per share items. -19 901 5 906 -200 706 -20 854 5 859 -201 659 -24 785 2 787 -232 555 12.21 12.15 11.00 10.94 9.02 8.96 57.8 58.1 59.9 60.2 61.6 62.0 XYZ's quick ratio for FY2020 was closest to 40x .56x .98% 1.51x 1.81x Question 39 XYZ's Financial Leverage (defined as Average Assets/Average Equity) in FY2020 was closest to 1.2 2.2 .8 4.1 7.2 137.1 The length of XYZ's Operating Cycle in FY2020 was approximately 97 days 104 days 67 days 14 days Question 32 Accounts payable turnover in FY2020 was closest to 12 times 4 times 3 times 6 times 60 times XYZ Company does not pay dividends. Based on FY2020 figures, what is the maximum XYZ Company can grow sustainably without external financing? o 38% u 35% 37% 39% 36% Question 34 0/0.5 points If XYZ's has lease expense of $293 million (for each FY2020, FY2019 and FY2018) and a covenant on their bank debt requiring that annual fixed charge coverage ratio be at least 2.0 times (ie. 200%), would they have been in compliance with the covenant all three years presented? Yes No XYZ's change in inventory from FY2019 to FY2020 would have Had no impact on cash flow. Been a use of cash reported under cash flow from investing activities. Been a source of cash reported under cash flow from operating activities. Been a source of cash reported under cash flow from financing activities. Been a use of cash reported under cash flow from operating activities. Question 37 In comparing XYZ's Depreciation to its capital expenditures, you might conclude that XYZ is: A declining company reducing its capital spending below replacement cost of its fixed assets. A high growth company making heavy fixed asset investments. A mature company replacing its existing fixed assets. An early stage start-up