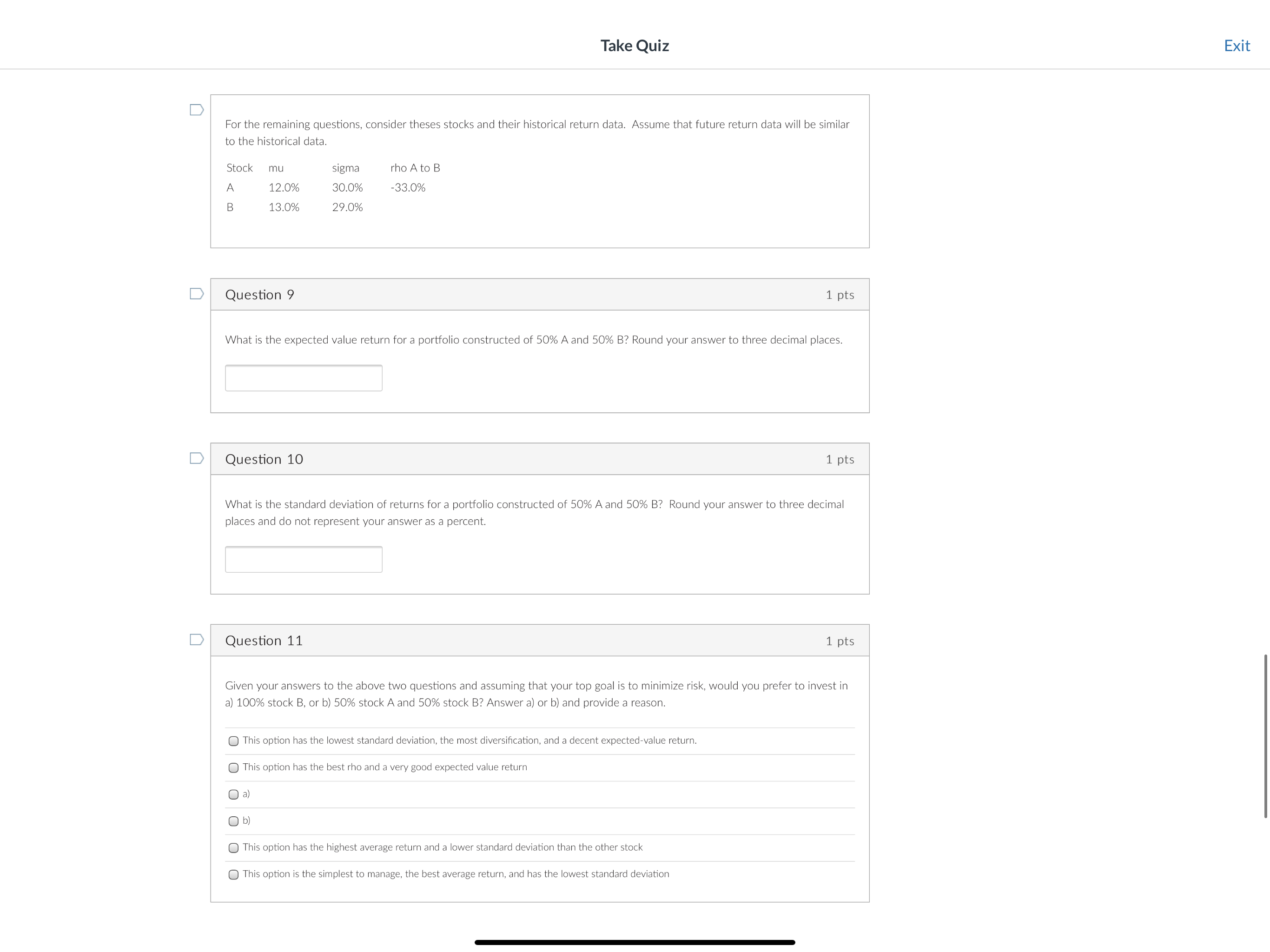

For the remaining questions, consider theses stocks and their historical return data. Assume that future return data will be similar to the historical data. Question 9 1 pts What is the expected value return for a portfolio constructed of 50%A and 50% B? Round your answer to three decimal places. Question 10 1 pts What is the standard deviation of returns for a portfolio constructed of 50% A and 50% B? Round your answer to three decimal places and do not represent your answer as a percent. Question 11 1 pts Given your answers to the above two questions and assuming that your top goal is to minimize risk, would you prefer to invest in a) 100% stock B, or b) 50% stock A and 50% stock B? Answer a) or b) and provide a reason. This option has the lowest standard deviation, the most diversification, and a decent expected-value return. This option has the best rho and a very good expected value return a) b) This option has the highest average return and a lower standard deviation than the other stock This option is the simplest to manage, the best average return, and has the lowest standard deviation For the remaining questions, consider theses stocks and their historical return data. Assume that future return data will be similar to the historical data. Question 9 1 pts What is the expected value return for a portfolio constructed of 50%A and 50% B? Round your answer to three decimal places. Question 10 1 pts What is the standard deviation of returns for a portfolio constructed of 50% A and 50% B? Round your answer to three decimal places and do not represent your answer as a percent. Question 11 1 pts Given your answers to the above two questions and assuming that your top goal is to minimize risk, would you prefer to invest in a) 100% stock B, or b) 50% stock A and 50% stock B? Answer a) or b) and provide a reason. This option has the lowest standard deviation, the most diversification, and a decent expected-value return. This option has the best rho and a very good expected value return a) b) This option has the highest average return and a lower standard deviation than the other stock This option is the simplest to manage, the best average return, and has the lowest standard deviation