Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the second half of 2023, APTB Capital expects the 10-year U.S. Treasury bill to average 4%, and the Dow Jones Industrial Average (DJIA)

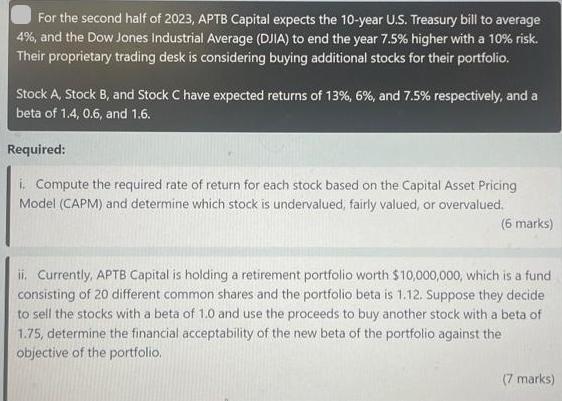

For the second half of 2023, APTB Capital expects the 10-year U.S. Treasury bill to average 4%, and the Dow Jones Industrial Average (DJIA) to end the year 7.5% higher with a 10% risk. Their proprietary trading desk is considering buying additional stocks for their portfolio. Stock A, Stock B, and Stock C have expected returns of 13%, 6%, and 7.5 % respectively, and a beta of 1.4, 0.6, and 1.6. Required: i. Compute the required rate of return for each stock based on the Capital Asset Pricing Model (CAPM) and determine which stock is undervalued, fairly valued, or overvalued. (6 marks) ii. Currently, APTB Capital is holding a retirement portfolio worth $10,000,000, which is a fund consisting of 20 different common shares and the portfolio beta is 1.12. Suppose they decide to sell the stocks with a beta of 1.0 and use the proceeds to buy another stock with a beta of 1.75, determine the financial acceptability of the new beta of the portfolio against the objective of the portfolio. (7 marks)

Step by Step Solution

★★★★★

3.46 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION i To compute the required rate of return for each stock based on the Capital Asset Pricing Model CAPM we can use the following formula Required Rate of Return RiskFree Rate Beta Market Return ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started