For the standard deductions, there are specified contribution tables to be followed as discussed in the previous modules. More examples: 1. Compute for Tita

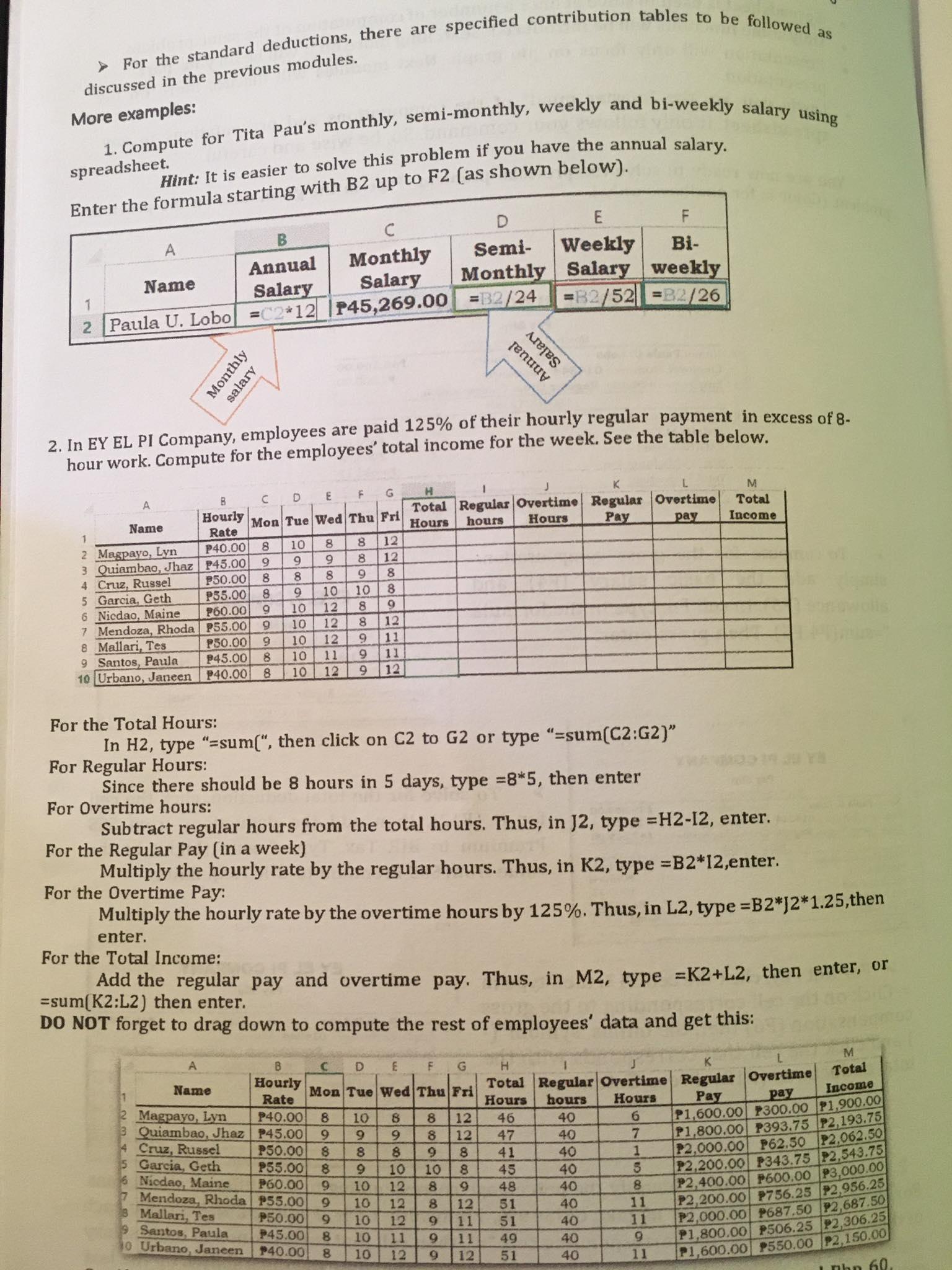

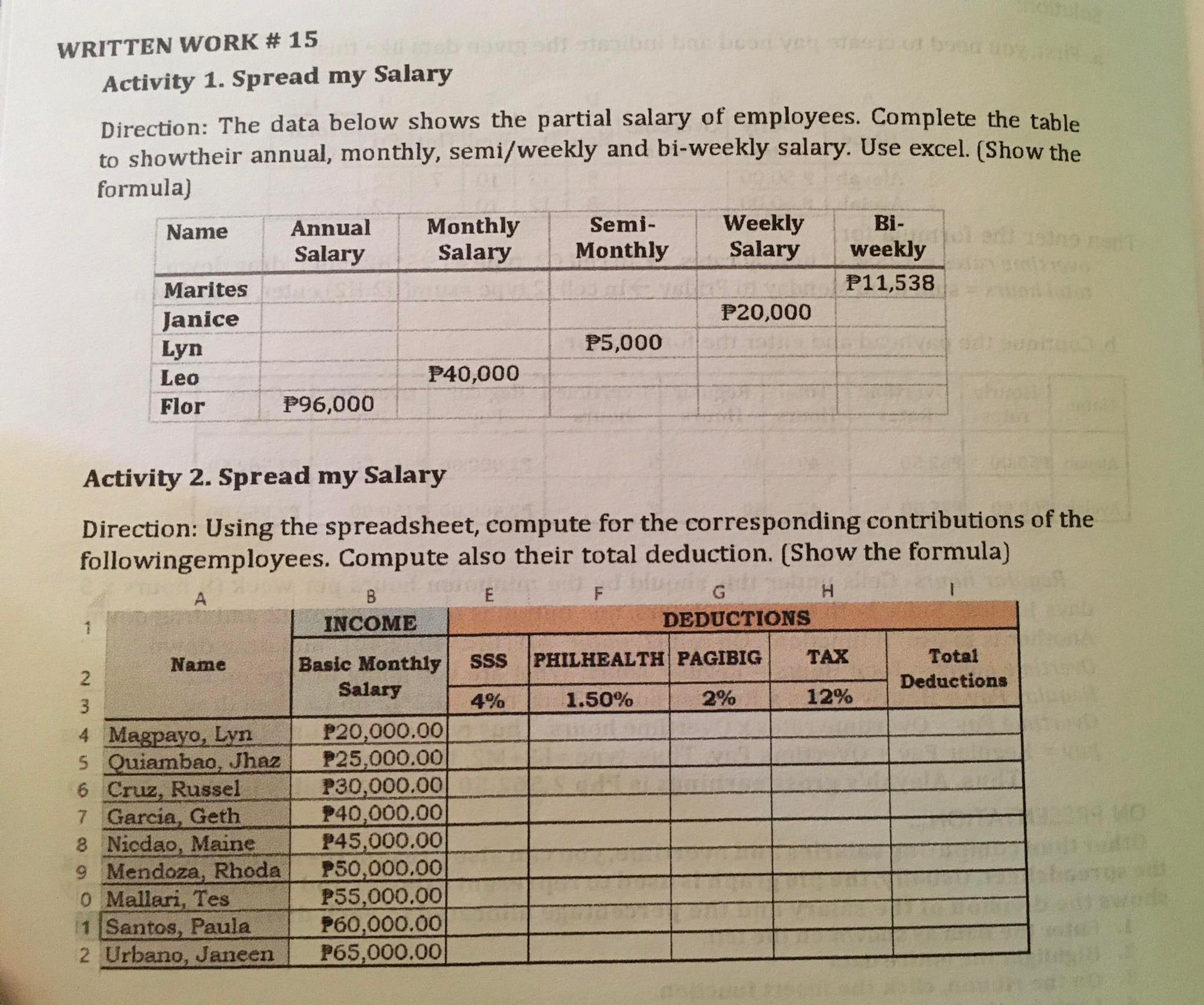

For the standard deductions, there are specified contribution tables to be followed as discussed in the previous modules. More examples: 1. Compute for Tita Pau's monthly, semi-monthly, weekly and bi-weekly salary using Hint: It is easier to solve this problem if you have the annual salary. Enter the formula starting with B2 up to F2 (as shown below). spreadsheet. B Name Annual Salary Monthly Salary 2 Paula U. Lobo =C2*12 P45,269.00 A A Name 1 2 Magpayo, Lyn 3 Quiambao, Jhaz 4 Cruz, Russel 5 Garcia, Geth 6 Nicdao, Maine 7 Mendoza, Rhoda 8 Mallari, Tes 9 Santos, Paula 10 Urbano, Janeen 2. In EY EL PI Company, employees are paid 125% of their hourly regular payment in excess of 8- hour work. Compute for the employees' total income for the week. See the table below. Monthly salary B 10 9 Hourly Rate 8 P40.00 9 P45.00 150.00 8 8 P55.00 8 9 P60.00 P55.00 P50.00 9 10 12 P45.00 8 10 11 P40.00 8 10 For Overtime hours: D F G E C Mon Tue Wed Thu Fri 12 8 8 12 9 8 10 8 8 A Name 0006 2 Magpayo, Lyn 3 Quiambao, Jhaz 4 Cruz, Russel 5 Garcia, Geth 8 Mallari, Tes 9 Santos, Paula 10 Urbano, Janeen 9 10 12 8 9 8 10 9 10 12 C2220 B Hourly Rate 6 Nicdao, Maine P60.00 Mendoza, Rhoda P55.00 150.00 P45.00 P40.00 For the Total Hours: In H2, type "=sum(", then click on C2 to G2 or type "=sum(C2:G2)" For Regular Hours: Since there should be 8 hours in 5 days, type =8*5, then enter 18 L P40.00 8 P45.00 P50.00| P55.00 11 12 9 12 00.00 Subtract regular hours from the total hours. Thus, in J2, type =H2-12, enter. For the Regular Pay (in a week) Multiply the hourly rate by the regular hours. Thus, in K2, type =B2*12,enter. For the Overtime Pay: Multiply the hourly rate by the overtime hours by 125%. Thus, in L2, type=B2*12*1.25,then enter. For the Total Income: Add the regular pay and overtime pay. Thus, in M2, type =K2+L2, then enter, or =sum(K2:L2) then enter. 10. DO NOT forget to drag down to compute the rest of employees' data and get this: 000000000006 9 8 12 9 11 8 C D E F G Mon Tue Wed Thu Fri 10 9 10 98989999 Summ Y olololole 10 10 10 10 D Semi- Monthly =B2/24 8980 H K Total Regular Overtime Regular Overtime Pay hours Hours pay Hours 17 8 8 9 10 10 12 8 48 12 8 12 51 12 9 11 51 11 49 12 51 BO 12 + Annual Salary 22889 lolo E F Weekly Bi- Salary weekly =B2/52 =B2/26 TTT 2112 9 11 9 M Total Income L H Total Regular Overtime Regular Overtime Hours hours Hours Pay 40 46 47 40 41 40 45 40 40 40 40 40 40 mical M Total Income pay 6 P1,600.00 P300.00 P1,900.00 7 P1,800.00 P393.75 P2,193.75 1 P2,000.00 P62.50 P2,062.50 5 8 11 11 P2,200.00 P343.75 P2,543.75 P2,400.00 P600.00 P3,000.00 P2,200.00 P756.25 P2,956.25 P2,000.00 P687.50 P2,687.50 P1,800.00 P506.25 P2,306.25 P1,600.00 P550.00 2,150.00 1 php 60. 9 11 WRITTEN WORK # 15 1 Name Activity 1. Spread my Salary Direction: The data below shows the partial salary of employees. Complete the table to showtheir annual, monthly, semi/weekly and bi-weekly salary. Use excel. (Show the formula) Marites Janice Lyn Leo Flor Name 2 3 4 Magpayo, Lyn 5 Quiambao, Jhaz 6 Cruz, Russel 7 Garcia, Geth 8 Nicdao, Maine 9 Mendoza, Rhoda Annual Salary 10 Mallari, Tes 11 Santos, Paula 2 Urbano, Janeen P96,000 Monthly Salary B INCOME P40,000 Basic Monthly Salary P20,000.00 P25,000.00 nitial P30,000.00 P40,000.00 P45,000.00 150,000.00 P55,000.00 P60,000.00 P65,000.00 Activity 2. Spread my Salary Direction: Using the spreadsheet, compute for the corresponding contributions of the followingemployees. Compute also their total deduction. (Show the formula) 27 A E F SSS 4% Semi- Monthly P5,000 Weekly Salary P20,000 G DEDUCTIONS Bi- weekly P11,538 PHILHEALTH PAGIBIG 1.50% 2% ich enth TAX 12% itulaz Total Deductions #ed1 14

Step by Step Solution

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started