Question

For the taxation year ending December 31, 2015, Rude Ltd., a Canadian public company, recorded the following information: Net Business Loss Canadian Source Interest

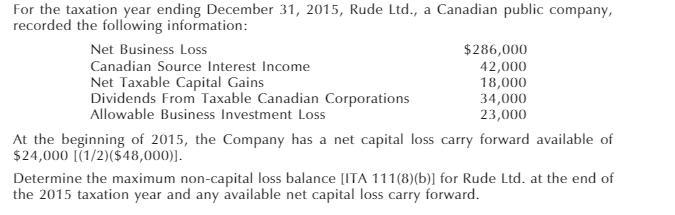

For the taxation year ending December 31, 2015, Rude Ltd., a Canadian public company, recorded the following information: Net Business Loss Canadian Source Interest Income Net Taxable Capital Gains Dividends From Taxable Canadian Corporations Allowable Business Investment Loss $286,000 42,000 18,000 34,000 23,000 At the beginning of 2015, the Company has a net capital loss carry forward available of $24,000 [(1/2)($48,000)]. Determine the maximum non-capital loss balance [ITA 111(8)(b)] for Rude Ltd. at the end of the 2015 taxation year and any available net capital loss carry forward.

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Don Maximum 2460...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Survey of Accounting

Authors: Carl S. Warren

8th edition

1305961889, 978-1337517386, 1337517380, 978-1305961883

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App