Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for the total investment in part (a), can I know why x1(STK) is 0.4 and x2(BD) is 0.6? shouldn't it be the other way round?

for the total investment in part (a), can I know why x1(STK) is 0.4 and x2(BD) is 0.6? shouldn't it be the other way round?

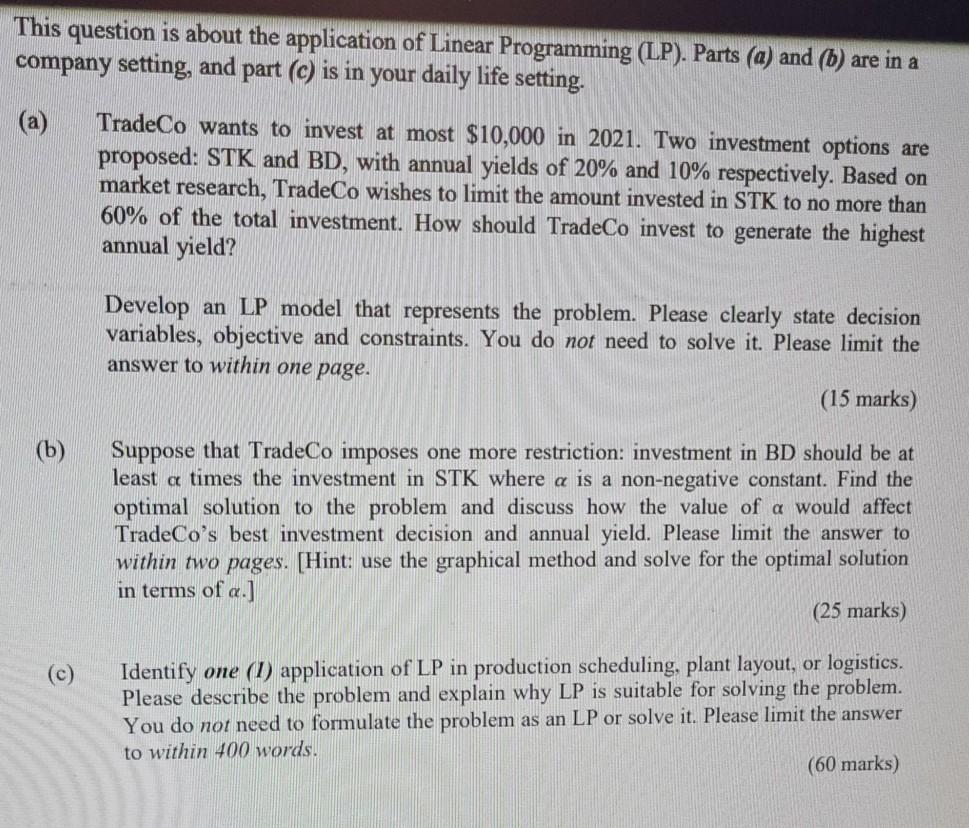

This question is about the application of Linear Programming (LP). Parts (a) and (b) are in a company setting, and part (c) is in your daily life setting. TradeCo wants to invest at most $10,000 in 2021. Two investment options are proposed: STK and BD, with annual yields of 20% and 10% respectively. Based on market research, TradeCo wishes to limit the amount invested in STK to no more than 60% of the total investment. How should TradeCo invest to generate the highest annual yield? Develop an LP model that represents the problem. Please clearly state decision variables, objective and constraints. You do not need to solve it. Please limit the answer to within one page. (15 marks) (b) Suppose that TradeCo imposes one more restriction: investment in BD should be at least a times the investment in STK where a is a non-negative constant. Find the optimal solution to the problem and discuss how the value of a would affect TradeCo's best investment decision and annual yield. Please limit the answer to within two pages. [Hint: use the graphical method and solve for the optimal solution in terms of a.] (25 marks) Identify one (1) application of LP in production scheduling, plant layout, or logistics. Please describe the problem and explain why LP is suitable for solving the problem. You do not need to formulate the problem as an LP or solve it. Please limit the answer to within 400 words. (60 marks) This question is about the application of Linear Programming (LP). Parts (a) and (b) are in a company setting, and part (c) is in your daily life setting. TradeCo wants to invest at most $10,000 in 2021. Two investment options are proposed: STK and BD, with annual yields of 20% and 10% respectively. Based on market research, TradeCo wishes to limit the amount invested in STK to no more than 60% of the total investment. How should TradeCo invest to generate the highest annual yield? Develop an LP model that represents the problem. Please clearly state decision variables, objective and constraints. You do not need to solve it. Please limit the answer to within one page. (15 marks) (b) Suppose that TradeCo imposes one more restriction: investment in BD should be at least a times the investment in STK where a is a non-negative constant. Find the optimal solution to the problem and discuss how the value of a would affect TradeCo's best investment decision and annual yield. Please limit the answer to within two pages. [Hint: use the graphical method and solve for the optimal solution in terms of a.] (25 marks) Identify one (1) application of LP in production scheduling, plant layout, or logistics. Please describe the problem and explain why LP is suitable for solving the problem. You do not need to formulate the problem as an LP or solve it. Please limit the answer to within 400 words. (60 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started