Answered step by step

Verified Expert Solution

Question

1 Approved Answer

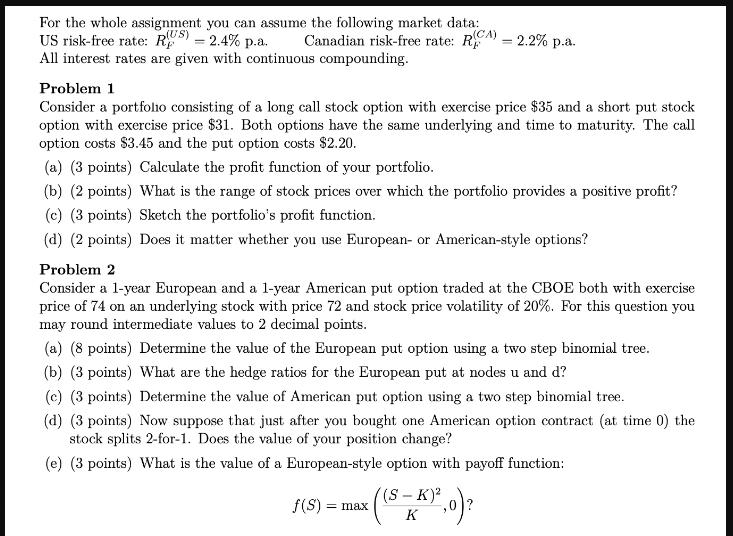

For the whole assignment you can assume the following market data: US risk-free rate: R) = 2.4% p.a. Canadian risk-free rate: R(CA) = 2.2%

For the whole assignment you can assume the following market data: US risk-free rate: R) = 2.4% p.a. Canadian risk-free rate: R(CA) = 2.2% p.a. == All interest rates are given with continuous compounding. Problem 1 Consider a portfolio consisting of a long call stock option with exercise price $35 and a short put stock option with exercise price $31. Both options have the same underlying and time to maturity. The call option costs $3.45 and the put option costs $2.20. (a) (3 points) Calculate the profit function of your portfolio. (b) (2 points) What is the range of stock prices over which the portfolio provides a positive profit? (c) (3 points) Sketch the portfolio's profit function. (d) (2 points) Does it matter whether you use European- or American-style options? Problem 2 Consider a 1-year European and a 1-year American put option traded at the CBOE both with exercise price of 74 on an underlying stock with price 72 and stock price volatility of 20%. For this question you may round intermediate values to 2 decimal points. (a) (8 points) Determine the value of the European put option using a two step binomial tree. (b) (3 points) What are the hedge ratios for the European put at nodes u and d? (c) (3 points) Determine the value of American put option using a two step binomial tree. (d) (3 points) Now suppose that just after you bought one American option contract (at time 0) the stock splits 2-for-1. Does the value of your position change? (e) (3 points) What is the value of a European-style option with payoff function: (S-K) f(S) = max K (2,0)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Problem 1 Portfolio with Long Call and Short Put a Profit Function Let S be the stock price at maturity Profit from call option MaxS 35 0 345 intrinsi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started