Answered step by step

Verified Expert Solution

Question

1 Approved Answer

for the year 2019 Sara, age 38, has been preparing her 2019 tax return. Her filing status is single. She comes to you and tells

for the year 2019

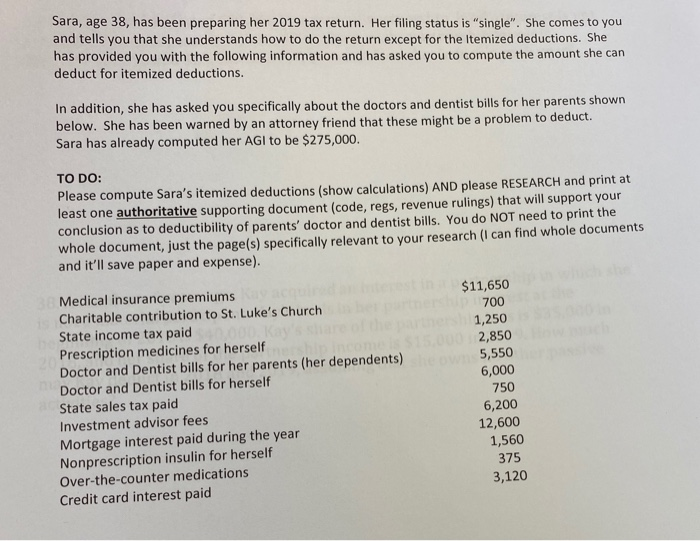

Sara, age 38, has been preparing her 2019 tax return. Her filing status is "single". She comes to you and tells you that she understands how to do the return except for the itemized deductions. She has provided you with the following information and has asked you to compute the amount she can deduct for itemized deductions. In addition, she has asked you specifically about the doctors and dentist bills for her parents shown below. She has been warned by an attorney friend that these might be a problem to deduct. Sara has already computed her AGI to be $275,000. TO DO: Please compute Sara's itemized deductions (show calculations) AND please RESEARCH and print at least one authoritative supporting document (code, regs, revenue rulings) that will support your conclusion as to deductibility of parents' doctor and dentist bills. You do NOT need to print the whole document, just the page(s) specifically relevant to your research (I can find whole documents and it'll save paper and expense). $11,650 700 1,250 2,850 5,550 6,000 750 Medical insurance premiums Charitable contribution to St. Luke's Church State income tax paid Prescription medicines for herself Doctor and Dentist bills for her parents (her dependents) Doctor and Dentist bills for herself State sales tax paid Investment advisor fees Mortgage interest paid during the year Nonprescription insulin for herself Over-the-counter medications Credit card interest paid 6,200 12,600 1,560 375 3,120 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started