Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the year 2021, Exxon Mobil (XOM) paid 4 quarterly dividends totaling $3.48/share. Due to increased investments in renewable energy, such as solar, biofuels,

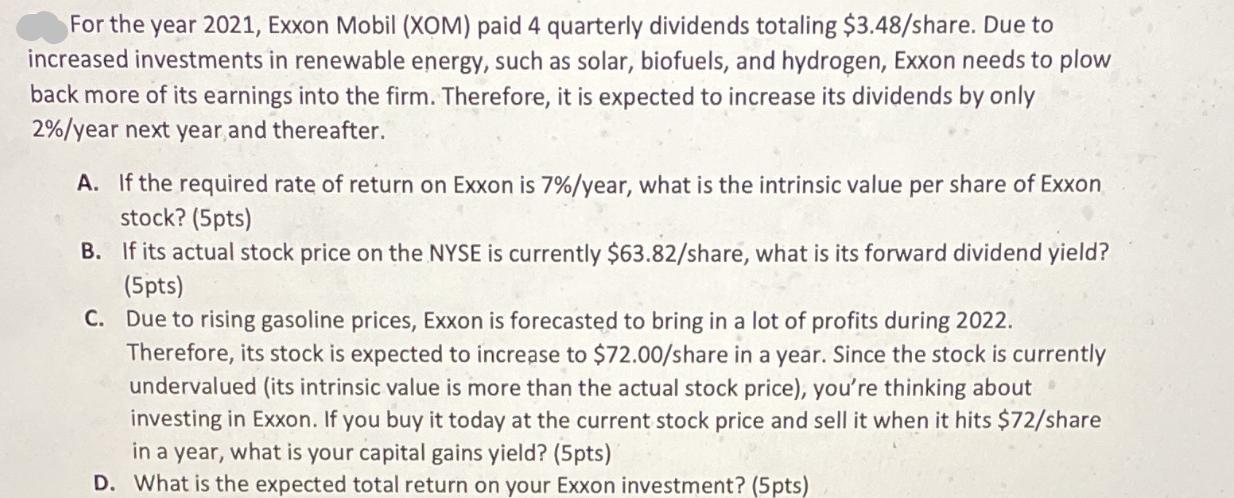

For the year 2021, Exxon Mobil (XOM) paid 4 quarterly dividends totaling $3.48/share. Due to increased investments in renewable energy, such as solar, biofuels, and hydrogen, Exxon needs to plow back more of its earnings into the firm. Therefore, it is expected to increase its dividends by only 2%/year next year and thereafter. A. If the required rate of return on Exxon is 7%/year, what is the intrinsic value per share of Exxon stock? (5pts) B. If its actual stock price on the NYSE is currently $63.82/share, what is its forward dividend yield? (5pts) C. Due to rising gasoline prices, Exxon is forecasted to bring in a lot of profits during 2022. Therefore, its stock is expected to increase to $72.00/share in a year. Since the stock is currently undervalued (its intrinsic value is more than the actual stock price), you're thinking about investing in Exxon. If you buy it today at the current stock price and sell it when it hits $72/share in a year, what is your capital gains yield? (5pts) D. What is the expected total return on your Exxon investment? (5pts)

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

A To calculate the intrinsic value per share of Exxon stock we can use the dividend discount model D...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started