Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the year ended 31 December 2020 Taunton Company had: 10,000,000 outstanding ordinary shares (no change during 2020). Convertible preference shares, $1.2 cumulative dividend

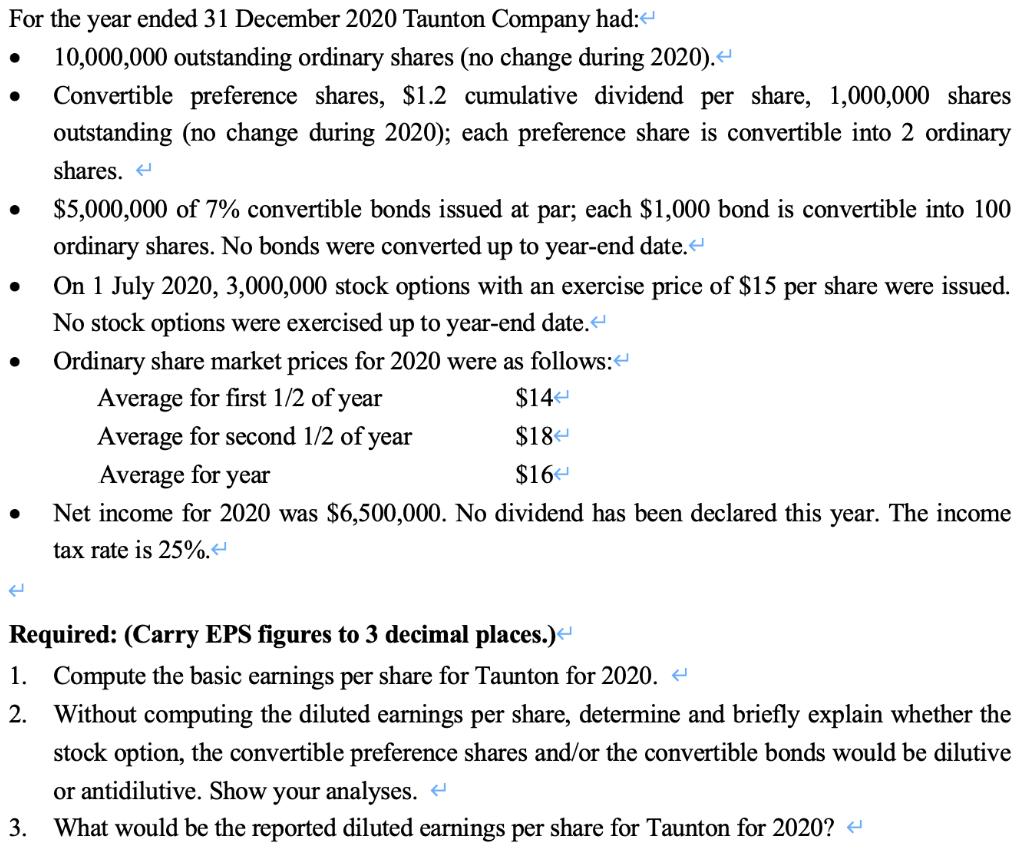

For the year ended 31 December 2020 Taunton Company had: 10,000,000 outstanding ordinary shares (no change during 2020). Convertible preference shares, $1.2 cumulative dividend per share, 1,000,000 shares outstanding (no change during 2020); each preference share is convertible into 2 ordinary shares. $5,000,000 of 7% convertible bonds issued at par; each $1,000 bond is convertible into 100 ordinary shares. No bonds were converted up to year-end date. On 1 July 2020, 3,000,000 stock options with an exercise price of $15 per share were issued. No stock options were exercised up to year-end date. Ordinary share market prices for 2020 were as follows: Average for first 1/2 of year $14 Average for second 1/2 of year $18 Average for year $16 Net income for 2020 was $6,500,000. No dividend has been declared this year. The income tax rate is 25%. Required: (Carry EPS figures to 3 decimal places.)- 1. Compute the basic earnings per share for Taunton for 2020. - 2. Without computing the diluted earnings per share, determine and briefly explain whether the stock option, the convertible preference shares and/or the convertible bonds would be dilutive or antidilutive. Show your analyses. e 3. What would be the reported diluted earnings per share for Taunton for 2020? -

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation 1 Basic earnings per share for Taunton for 2020 is 053 2 Dilutive or anti dilutive Stock option is dilutive When stock options are ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started