Answered step by step

Verified Expert Solution

Question

1 Approved Answer

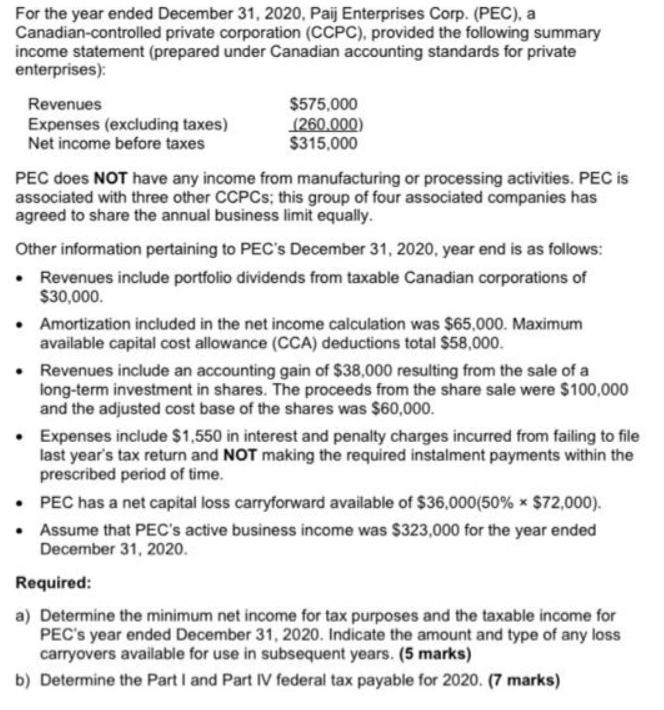

For the year ended December 31, 2020, Paij Enterprises Corp. (PEC), a Canadian-controlled private corporation (CCPC), provided the following summary income statement (prepared under

For the year ended December 31, 2020, Paij Enterprises Corp. (PEC), a Canadian-controlled private corporation (CCPC), provided the following summary income statement (prepared under Canadian accounting standards for private enterprises): Revenues Expenses (excluding taxes) Net income before taxes $575,000 (260.000) $315,000 PEC does NOT have any income from manufacturing or processing activities. PEC is associated with three other CCPCS; this group of four associated companies has agreed to share the annual business limit equally. Other information pertaining to PEC's December 31, 2020, year end is as follows: Revenues include portfolio dividends from taxable Canadian corporations of $30,000. Amortization included in the net income calculation was $65,000. Maximum available capital cost allowance (CCA) deductions total $58,000. Revenues include an accounting gain of $38,000 resulting from the sale of a iong-term investment in shares. The proceeds from the share sale were $100,000 and the adjusted cost base of the shares was $60,000. Expenses include $1,550 in interest and penalty charges incurred from failing to file last year's tax return and NOT making the required instalment payments within the prescribed period of time. PEC has a net capital loss carryforward available of $36,000(50% * $72,000). Assume that PEC's active business income was $323,000 for the year ended December 31, 2020. Required: a) Determine the minimum net income for tax purposes and the taxable income for PEC's year ended December 31, 2020. Indicate the amount and type of any loss carryovers available for use in subsequent years. (5 marks) b) Determine the Part I and Part IV federal tax payable for 2020. (7 marks)

Step by Step Solution

★★★★★

3.30 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Net Income Revenues 575000 Expenses 260000 Gross income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started