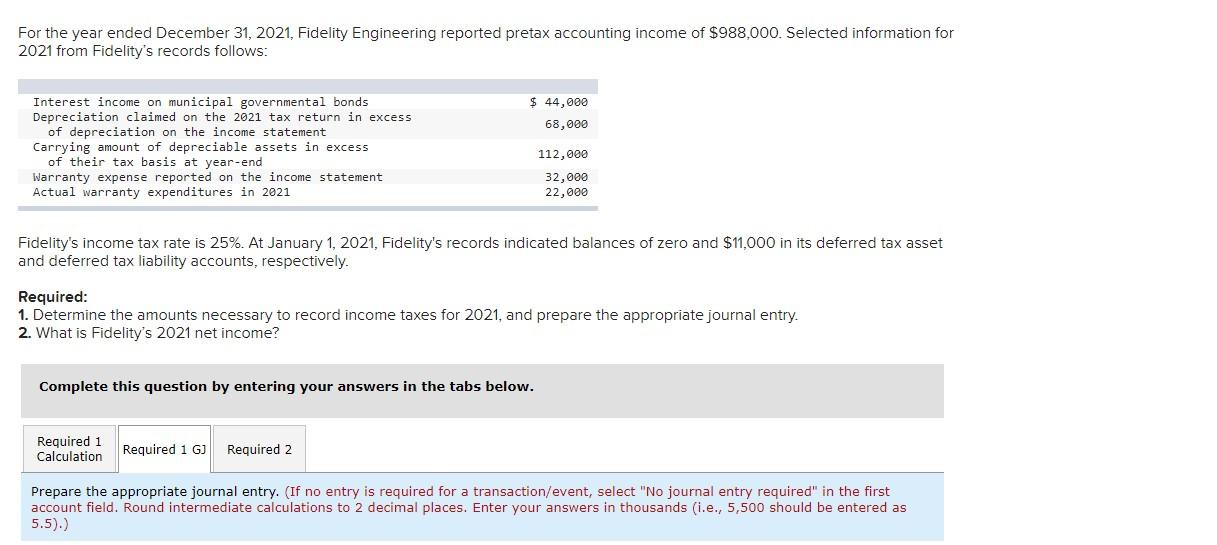

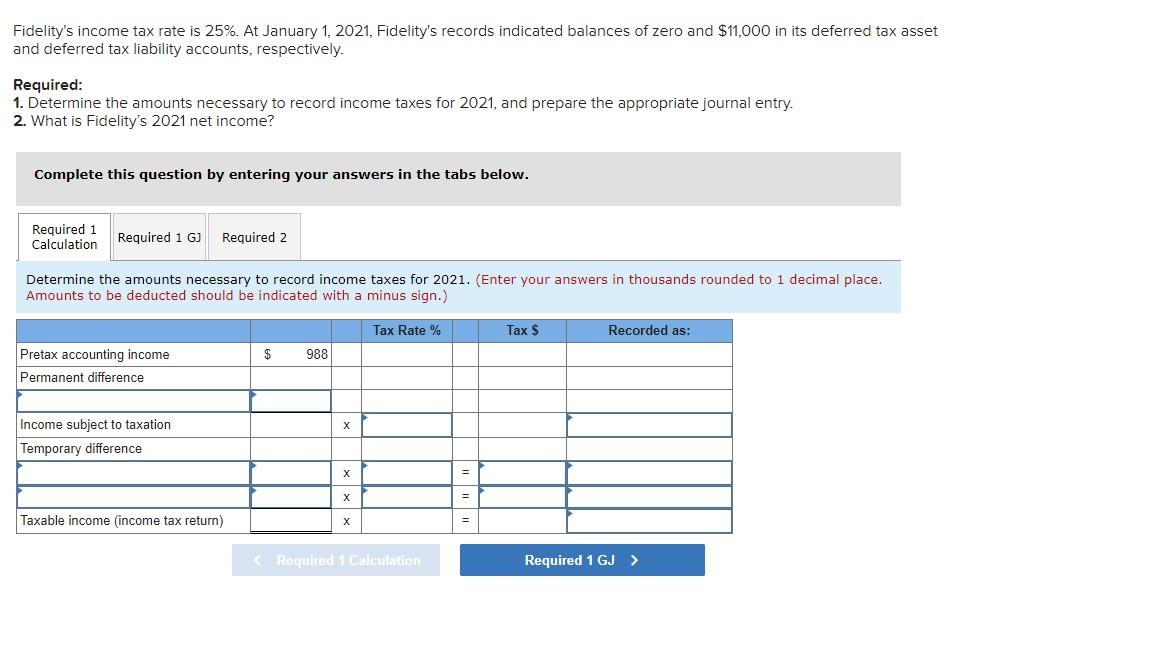

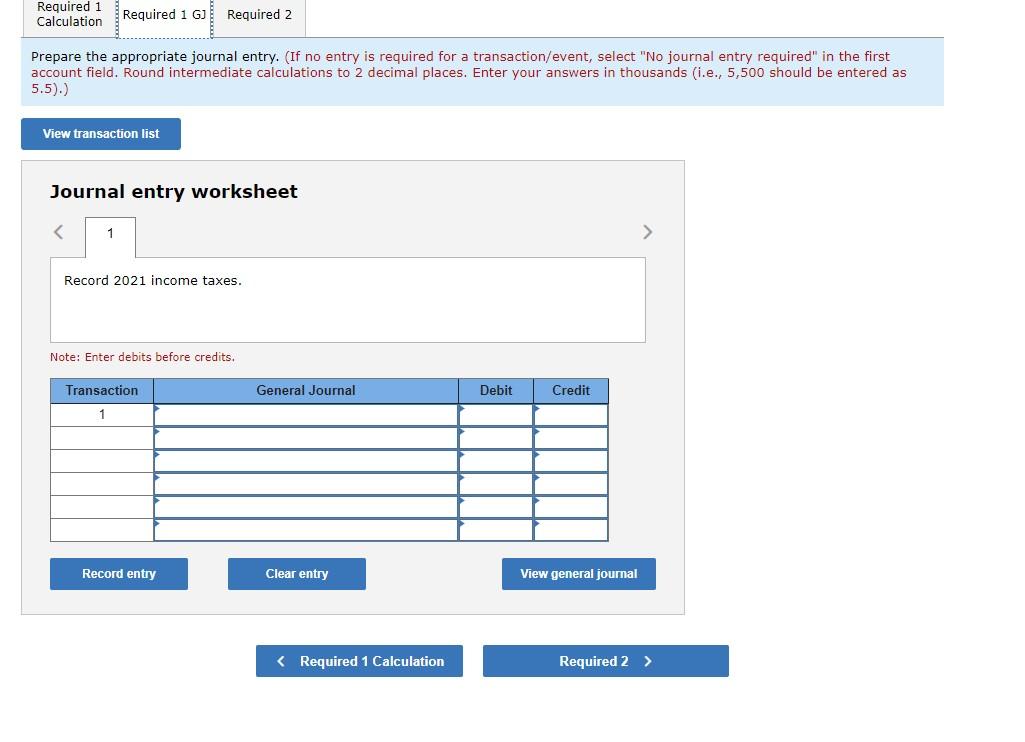

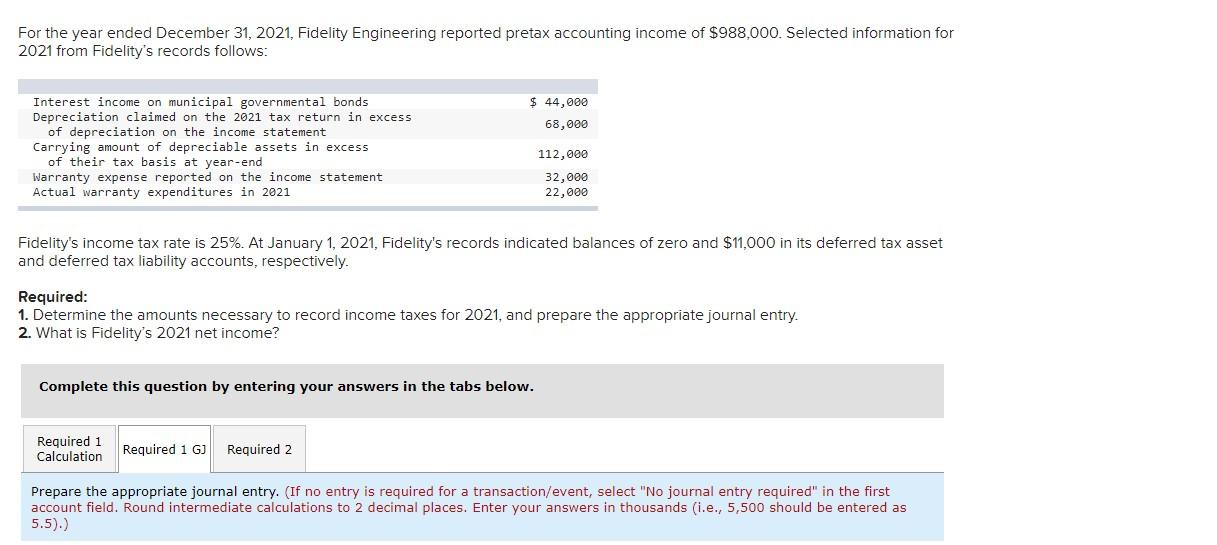

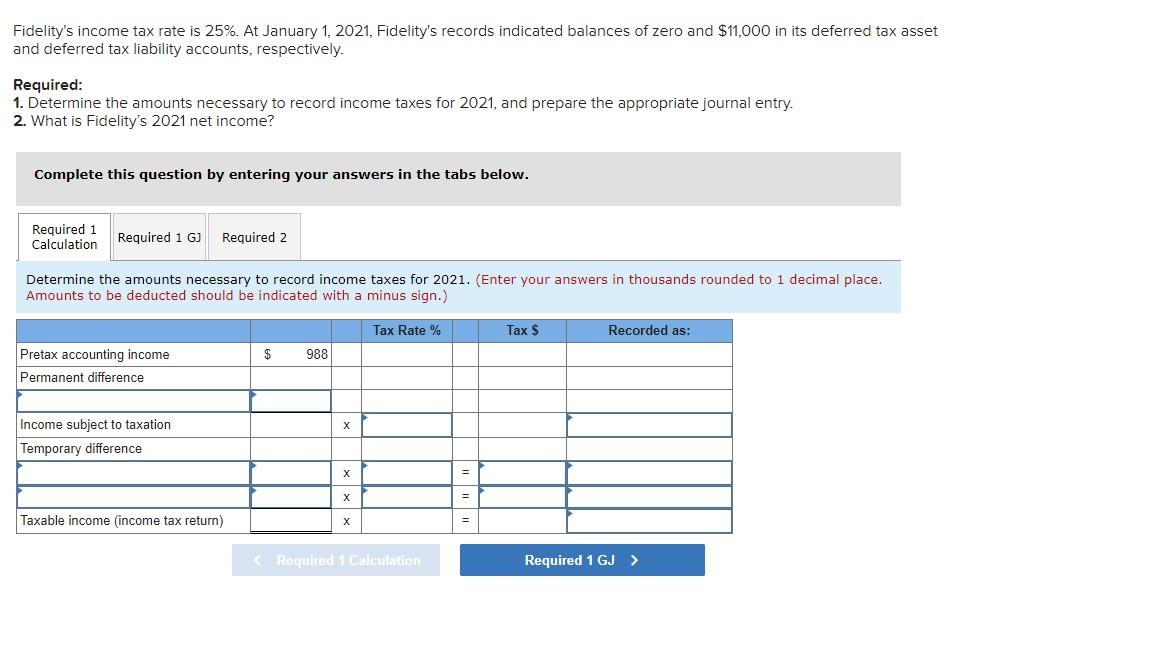

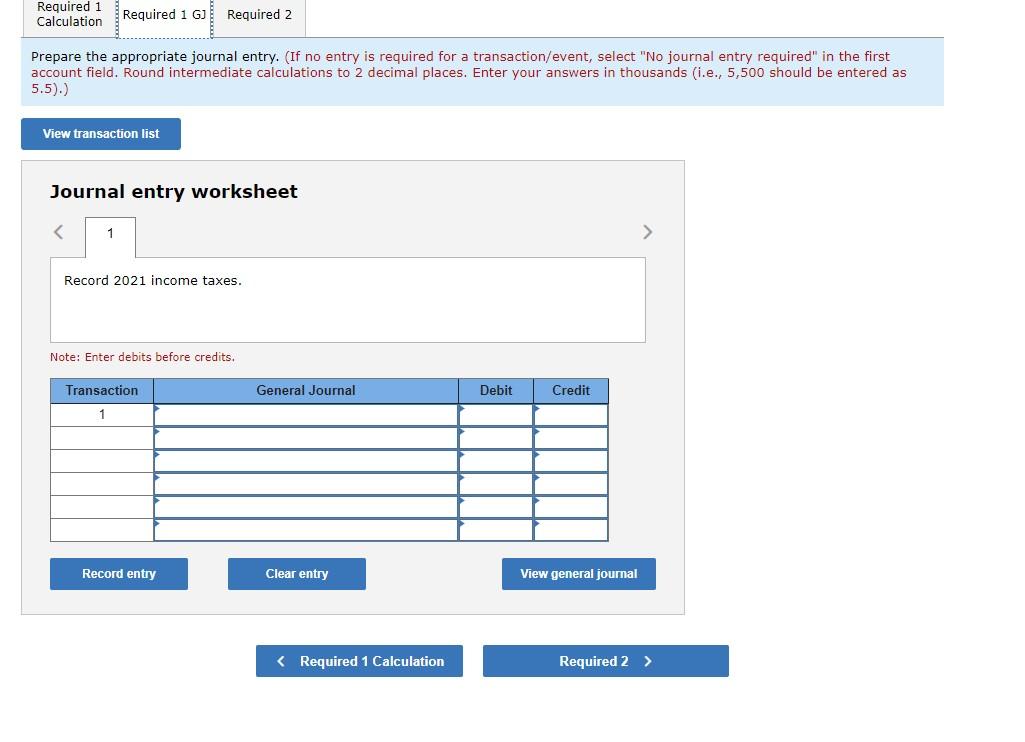

For the year ended December 31, 2021, Fidelity Engineering reported pretax accounting income of $988,000. Selected information for 2021 from Fidelity's records follows: $ 44,000 68,000 Interest income on municipal governmental bonds Depreciation claimed on the 2021 tax return in excess of depreciation on the income statement Carrying amount of depreciable assets in excess of their tax basis at year-end Warranty expense reported on the income statement Actual warranty expenditures in 2021 112,000 32,000 22,000 Fidelity's income tax rate is 25%. At January 1, 2021, Fidelity's records indicated balances of zero and $11,000 in its deferred tax asset and deferred tax liability accounts, respectively. Required: 1. Determine the amounts necessary to record income taxes for 2021, and prepare the appropriate journal entry. 2. What is Fidelity's 2021 net income? Complete this question by entering your answers in the tabs below. Required 1 Calculation Required 1 G Required 2 Prepare the appropriate journal entry. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate calculations to 2 decimal places. Enter your answers in thousands (i.e., 5,500 should be entered as 5.5).) Fidelity's income tax rate is 25%. At January 1, 2021, Fidelity's records indicated balances of zero and $11,000 in its deferred tax asset and deferred tax liability accounts, respectively. Required: 1. Determine the amounts necessary to record income taxes for 2021, and prepare the appropriate journal entry. 2. What is Fidelity's 2021 net income? Complete this question by entering your answers in the tabs below. Required 1 Calculation Required 1 GJ Required 2 Determine the amounts necessary to record income taxes for 2021. (Enter your answers in thousands rounded to 1 decimal place. Amounts to be deducted should be indicated with a minus sign.) Tax Rate % Tax S Recorded as: $ 988 Pretax accounting income Permanent difference Income subject to taxation Temporary difference Taxable income (income tax return) Required 1 Calculation Required 1 GJ > Required 1 Calculation Required 1 G Required 2 Prepare the appropriate journal entry. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round intermediate calculations to 2 decimal places. Enter your answers in thousands (i.e., 5,500 should be entered as 5.5).) View transaction list Journal entry worksheet For the year ended December 31, 2021, Fidelity Engineering reported pretax accounting income of $988,000. Selected information for 2021 from Fidelity's records follows: $ 44,000 68,000 Interest income on municipal governmental bonds Depreciation claimed on the 2021 tax return in excess of depreciation on the income statement Carrying amount of depreciable assets in excess of their tax basis at year-end Warranty expense reported on the income statement Actual warranty expenditures in 2021 112,000 32,000 22,000 Fidelity's income tax rate is 25%. At January 1, 2021, Fidelity's records indicated balances of zero and $11,000 in its deferred tax asset and deferred tax liability accounts, respectively. Required: 1. Determine the amounts necessary to record income taxes for 2021, and prepare the appropriate journal entry. 2. What is Fidelity's 2021 net income? Complete this question by entering your answers in the tabs below. Required 1 Calculation Required 1 G) Required 2 What is Fidelity's 2021 net income? (Round intermediate calculations to 2 decimal places. Enter your answers in thousands (i.e., 5,500 should be entered as 5.5).) Net income