Answered step by step

Verified Expert Solution

Question

1 Approved Answer

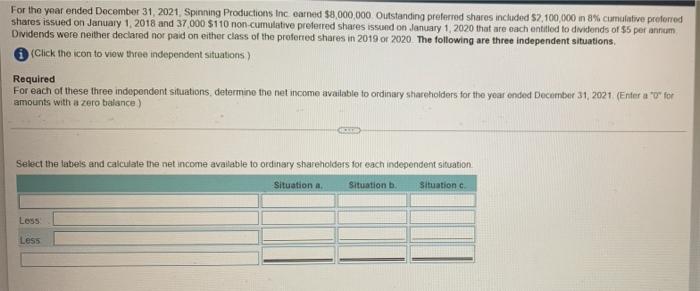

For the year ended December 31, 2021, Spinning Productions Inc earned $8,000,000 Outstanding preferred shares included $2,100,000 n 8% cumulative prefored shares issued on

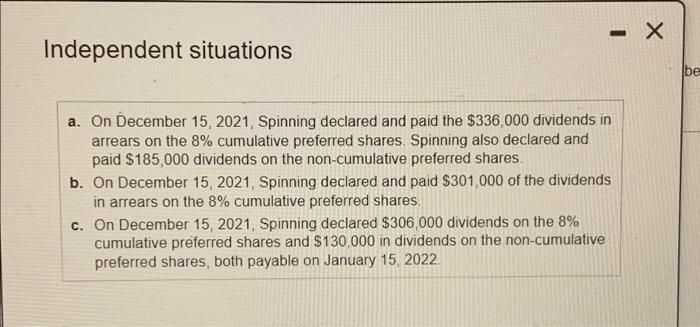

For the year ended December 31, 2021, Spinning Productions Inc earned $8,000,000 Outstanding preferred shares included $2,100,000 n 8% cumulative prefored shares issued on January 1, 2018 and 37,000 $110 non cumulative preferred shares issund on January 1, 2020 that are each entitled to dividends of $5 per annum Dividends were neither declared nor paid on either class of the proferned shares in 2019 or 2020 The following are three independent situations. O (Click tho icon to viow three independent situations) Required For each of these three independent situations, determine the net income available to ordinary shareholders for the yoar onded December 31, 2021 (Enter a o" for amounts with a zero balance) Select the labels and calculate the net income available to ordinary shareholders for each independent situation Situation a. Situation b. Situation c. Less Less - X Independent situations be a. On December 15, 2021, Spinning declared and paid the $336,000 dividends in arrears on the 8% cumulative preferred shares. Spinning also declared and paid $185,000 dividends on the non-cumulative preferred shares. b. On December 15, 2021, Spinning declared and paid $301,000 of the dividends in arrears on the 8% cumulative preferred shares. c. On December 15, 2021, Spinning declared $306,000 dividends on the 8% cumulative preferred shares and $130,000 in dividends on the non-cumulative preferred shares, both payable on January 15, 2022.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Particulars Situatlon a Situtatlonb Situtatlon C Net profit after tax 8...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started