Answered step by step

Verified Expert Solution

Question

1 Approved Answer

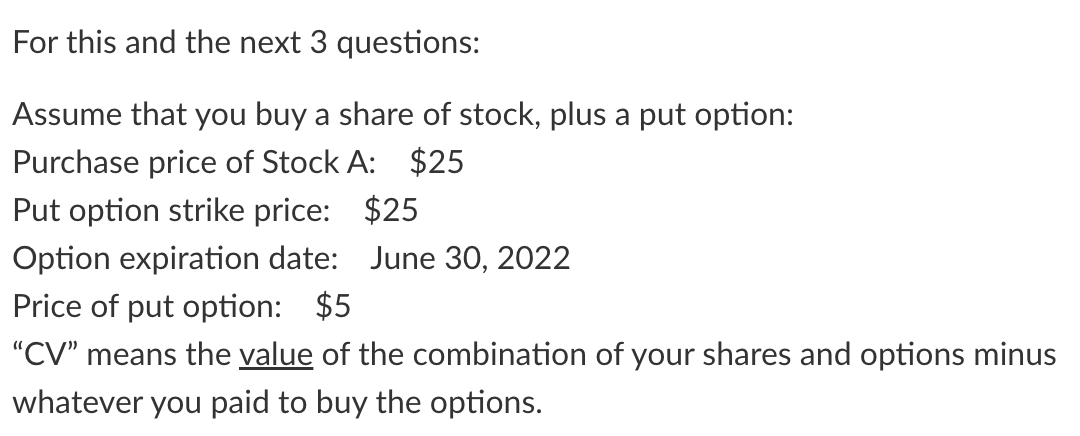

For this and the next 3 questions: Assume that you buy a share of stock, plus a put option: Purchase price of Stock A: $25

For this and the next 3 questions:

Assume that you buy a share of stock, plus a put option: Purchase price of Stock A: $25 Put option strike price: $25 Option expiration date: June 30, 2022 Price of put option: $5 CV means the value of the combination of your shares and options minus whatever you paid to buy the options.

How much profit would you make if the stock goes up to 50? Remember to deduct the cost if the option. Express in dollars, but do not use $ sign.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started