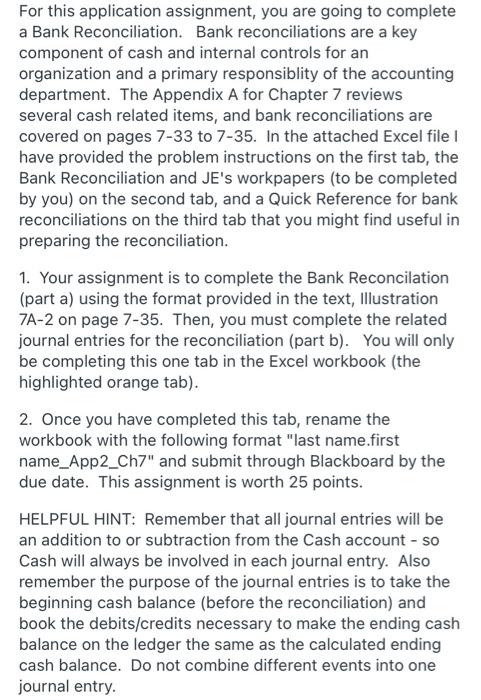

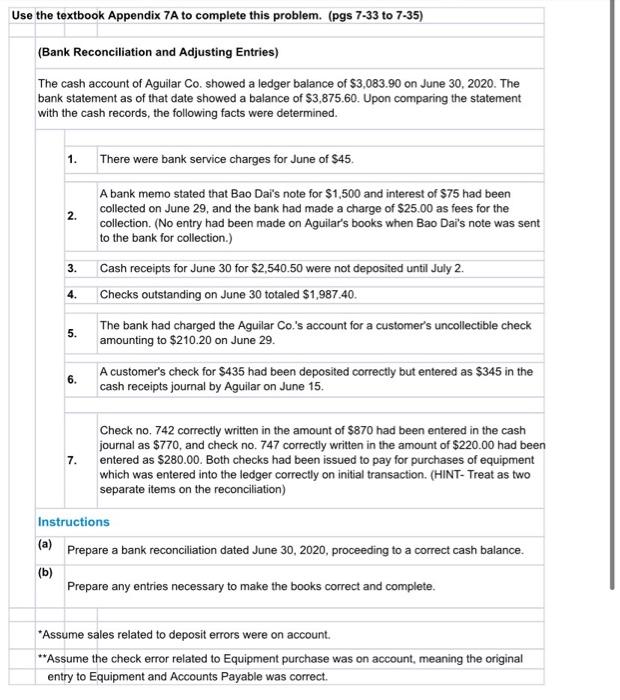

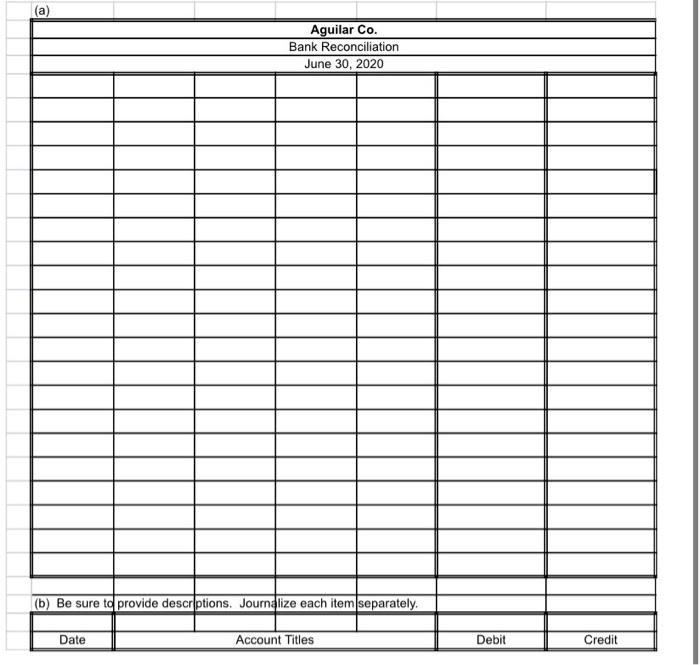

For this application assignment, you are going to complete a Bank Reconciliation. Bank reconciliations are a key component of cash and internal controls for an organization and a primary responsiblity of the accounting department. The Appendix A for Chapter 7 reviews several cash related items, and bank reconciliations are covered on pages 7-33 to 7-35. In the attached Excel file have provided the problem instructions on the first tab, the Bank Reconciliation and JE's workpapers (to be completed by you) on the second tab, and a Quick Reference for bank reconciliations on the third tab that you might find useful in preparing the reconciliation. 1. Your assignment is to complete the Bank Reconcilation (part a) using the format provided in the text, Illustration 7A-2 on page 7-35. Then, you must complete the related journal entries for the reconciliation (part b). You will only be completing this one tab in the Excel workbook (the highlighted orange tab). 2. Once you have completed this tab, rename the workbook with the following format "last name.first name_App2_Ch7" and submit through Blackboard by the due date. This assignment is worth 25 points. HELPFUL HINT: Remember that all journal entries will be an addition to or subtraction from the Cash account - so Cash will always be involved in each journal entry. Also remember the purpose of the journal entries is to take the beginning cash balance (before the reconciliation) and book the debits/credits necessary to make the ending cash balance on the ledger the same as the calculated ending cash balance. Do not combine different events into one journal entry. Use the textbook Appendix 7A to complete this problem. (pgs 7-33 to 7-35) (Bank Reconciliation and Adjusting Entries) The cash account of Aguilar Co. showed a ledger balance of $3,083.90 on June 30, 2020. The bank statement as of that date showed a balance of $3,875.60. Upon comparing the statement with the cash records, the following facts were determined. 1. There were bank service charges for June of $45. 2. A bank memo stated that Bao Dai's note for $1.500 and interest of $75 had been collected on June 29, and the bank had made a charge of $25.00 as fees for the collection. (No entry had been made on Aguilar's books when Bao Dai's note was sent to the bank for collection.) Cash receipts for June 30 for $2,540.50 were not deposited until July 2. Checks outstanding on June 30 totaled $1,987.40. 3. 4. 5. The bank had charged the Aguilar Co.'s account for a customer's uncollectible check amounting to $210.20 on June 29. 6. A customer's check for $435 had been deposited correctly but entered as $345 in the cash receipts journal by Aguilar on June 15. 7. Check no. 742 correctly written in the amount of $870 had been entered in the cash journal as $770, and check no. 747 correctly written in the amount of $220.00 had been entered as $280.00. Both checks had been issued to pay for purchases of equipment which was entered into the ledger correctly on initial transaction. (HINT- Treat as two separate items on the reconciliation) Instructions (a) Prepare a bank reconciliation dated June 30, 2020, proceeding to a correct cash balance. (b) Prepare any entries necessary to make the books correct and complete. *Assume sales related to deposit errors were on account. **Assume the check error related to Equipment purchase was on account, meaning the original entry to Equipment and Accounts Payable was correct. (a) Aguilar Co. Bank Reconciliation June 30, 2020 (b) Be sure to provide descrptions. Journalize each item separately. Date Account Titles Debit Credit For this application assignment, you are going to complete a Bank Reconciliation. Bank reconciliations are a key component of cash and internal controls for an organization and a primary responsiblity of the accounting department. The Appendix A for Chapter 7 reviews several cash related items, and bank reconciliations are covered on pages 7-33 to 7-35. In the attached Excel file have provided the problem instructions on the first tab, the Bank Reconciliation and JE's workpapers (to be completed by you) on the second tab, and a Quick Reference for bank reconciliations on the third tab that you might find useful in preparing the reconciliation. 1. Your assignment is to complete the Bank Reconcilation (part a) using the format provided in the text, Illustration 7A-2 on page 7-35. Then, you must complete the related journal entries for the reconciliation (part b). You will only be completing this one tab in the Excel workbook (the highlighted orange tab). 2. Once you have completed this tab, rename the workbook with the following format "last name.first name_App2_Ch7" and submit through Blackboard by the due date. This assignment is worth 25 points. HELPFUL HINT: Remember that all journal entries will be an addition to or subtraction from the Cash account - so Cash will always be involved in each journal entry. Also remember the purpose of the journal entries is to take the beginning cash balance (before the reconciliation) and book the debits/credits necessary to make the ending cash balance on the ledger the same as the calculated ending cash balance. Do not combine different events into one journal entry. Use the textbook Appendix 7A to complete this problem. (pgs 7-33 to 7-35) (Bank Reconciliation and Adjusting Entries) The cash account of Aguilar Co. showed a ledger balance of $3,083.90 on June 30, 2020. The bank statement as of that date showed a balance of $3,875.60. Upon comparing the statement with the cash records, the following facts were determined. 1. There were bank service charges for June of $45. 2. A bank memo stated that Bao Dai's note for $1.500 and interest of $75 had been collected on June 29, and the bank had made a charge of $25.00 as fees for the collection. (No entry had been made on Aguilar's books when Bao Dai's note was sent to the bank for collection.) Cash receipts for June 30 for $2,540.50 were not deposited until July 2. Checks outstanding on June 30 totaled $1,987.40. 3. 4. 5. The bank had charged the Aguilar Co.'s account for a customer's uncollectible check amounting to $210.20 on June 29. 6. A customer's check for $435 had been deposited correctly but entered as $345 in the cash receipts journal by Aguilar on June 15. 7. Check no. 742 correctly written in the amount of $870 had been entered in the cash journal as $770, and check no. 747 correctly written in the amount of $220.00 had been entered as $280.00. Both checks had been issued to pay for purchases of equipment which was entered into the ledger correctly on initial transaction. (HINT- Treat as two separate items on the reconciliation) Instructions (a) Prepare a bank reconciliation dated June 30, 2020, proceeding to a correct cash balance. (b) Prepare any entries necessary to make the books correct and complete. *Assume sales related to deposit errors were on account. **Assume the check error related to Equipment purchase was on account, meaning the original entry to Equipment and Accounts Payable was correct. (a) Aguilar Co. Bank Reconciliation June 30, 2020 (b) Be sure to provide descrptions. Journalize each item separately. Date Account Titles Debit Credit