Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For this assignment, you need to prepare a written response to the following question. Be sure to fully analyze the questions and provide citations to

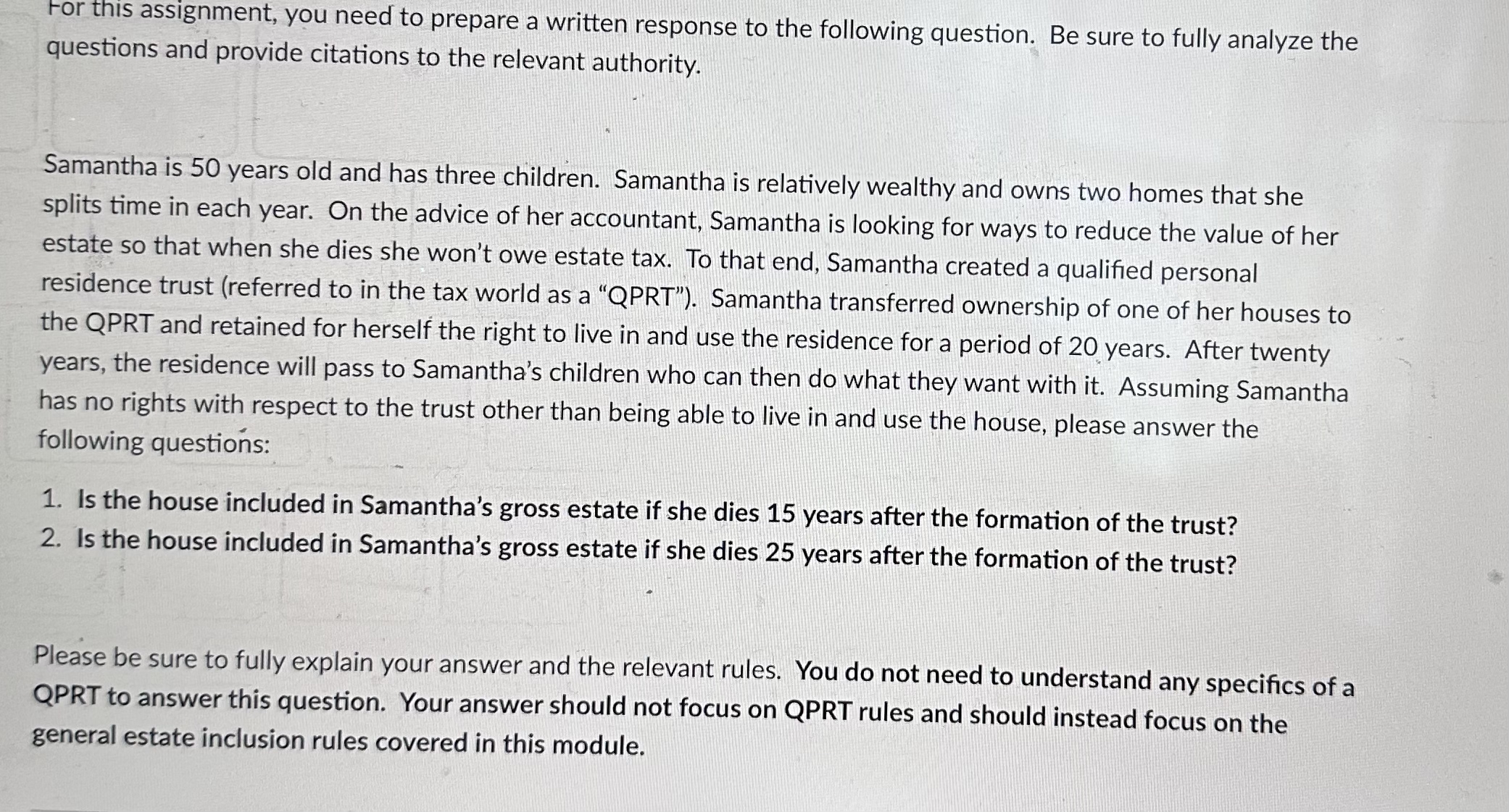

For this assignment, you need to prepare a written response to the following question. Be sure to fully analyze the questions and provide citations to the relevant authority.

Samantha is years old and has three children. Samantha is relatively wealthy and owns two homes that she splits time in each year. On the advice of her accountant, Samantha is looking for ways to reduce the value of her estate so that when she dies she won't owe estate tax. To that end, Samantha created a qualified personal residence trust referred to in the tax world as a QPRT Samantha transferred ownership of one of her houses to the QPRT and retained for herself the right to live in and use the residence for a period of years. After twenty years, the residence will pass to Samantha's children who can then do what they want with it Assuming Samantha has no rights with respect to the trust other than being able to live in and use the house, please answer the following questions:

Is the house included in Samantha's gross estate if she dies years after the formation of the trust?

Is the house included in Samantha's gross estate if she dies years after the formation of the trust?

Please be sure to fully explain your answer and the relevant rules. You do not need to understand any specifics of a QPRT to answer this question. Your answer should not focus on QPRT rules and should instead focus on the general estate inclusion rules covered in this module.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started