Question

For this assignment, you will need the latest financial statements filed by Under Armour (UA) and Nike. Both sets are available on Moodle. Use the

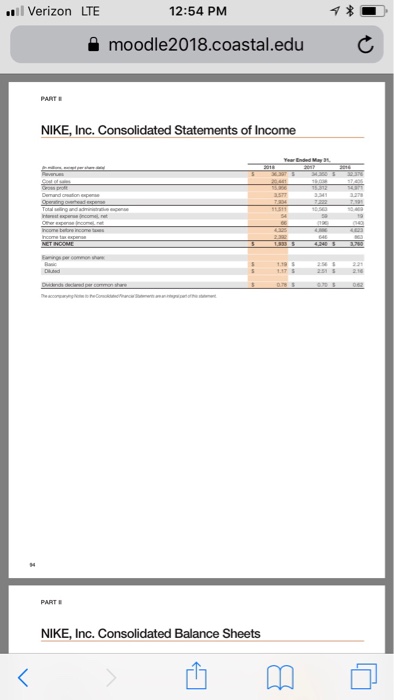

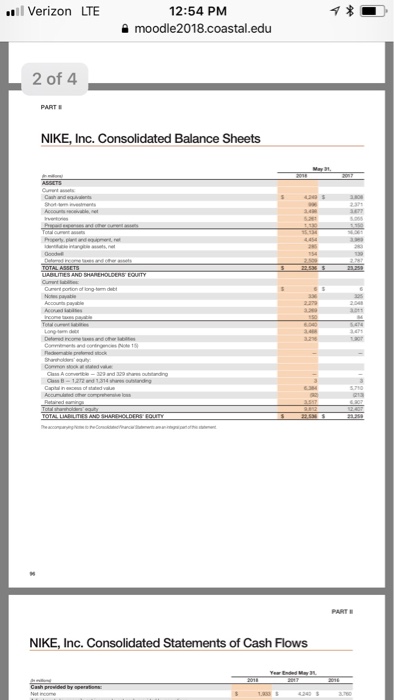

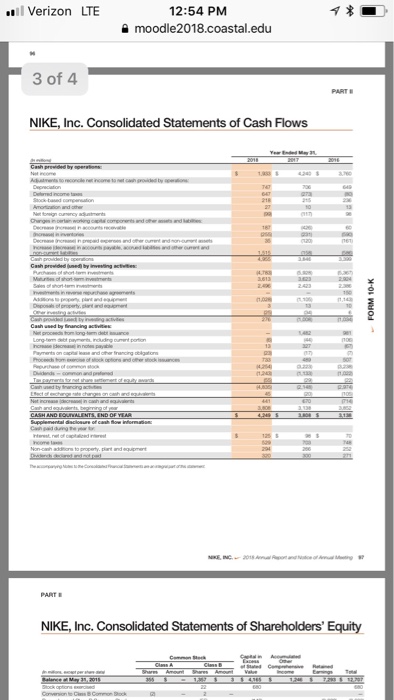

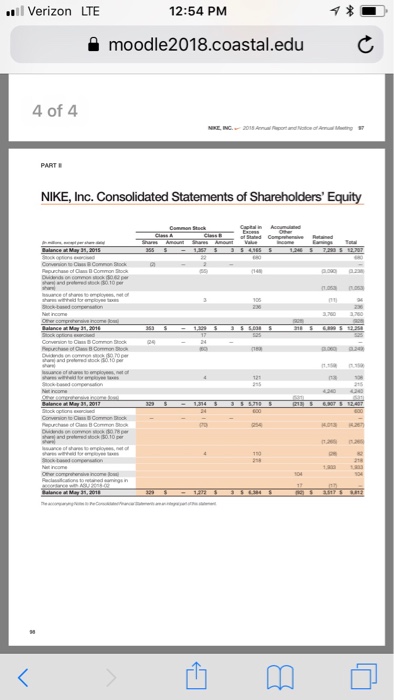

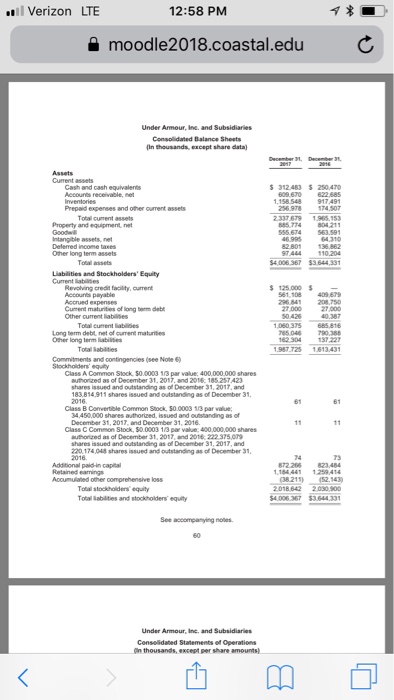

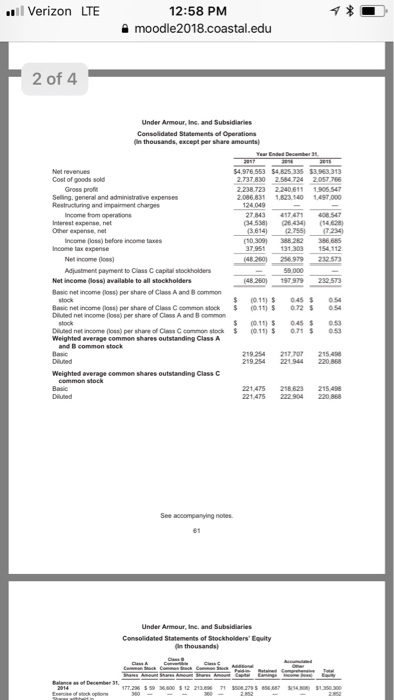

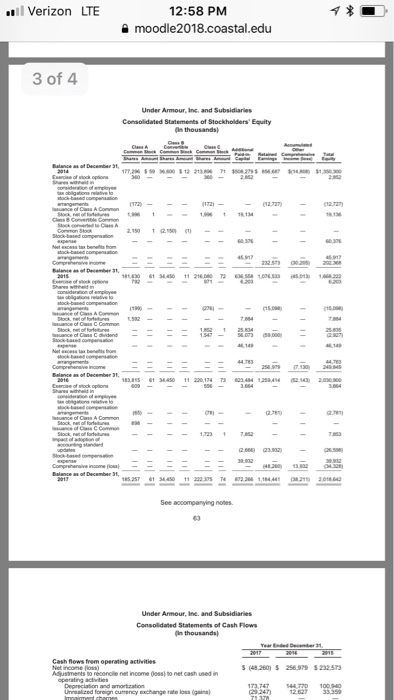

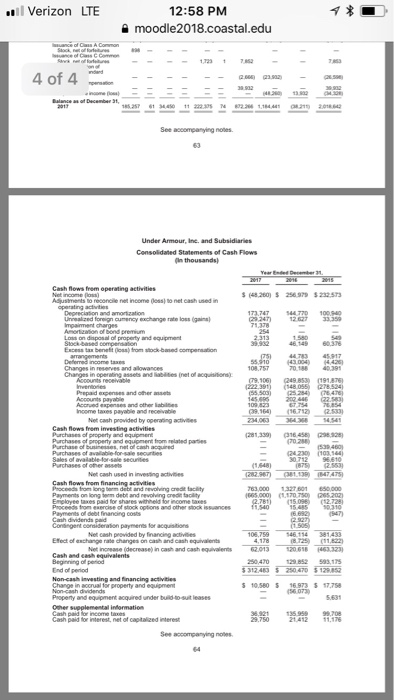

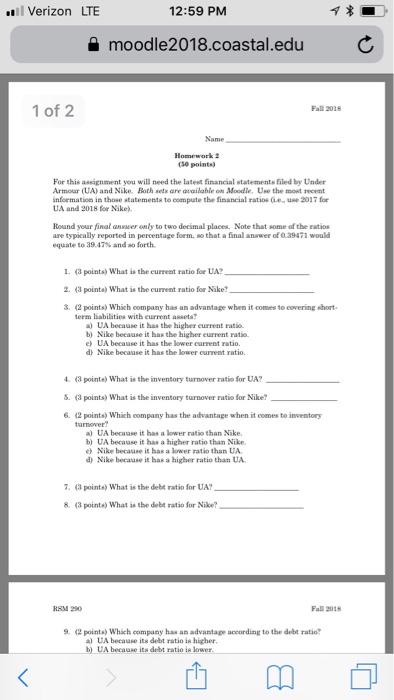

For this assignment, you will need the latest financial statements filed by Under Armour (UA) and Nike. Both sets are available on Moodle. Use the most recent information in those statements to compute the financial ratios (i.e., use 2017 for UA and 2018 for Nike). Round your final answer only to two decimal places. Note that some of the ratios are typically reported in percentage form so that a final answer of 0.39471 would equate to 39.47% and so forth. 1. (3 points) What is the current ratio for UA? _______________________ 2. (3 points) What is the current ratio for Nike? _______________________ 3. (2 points) Which company has an advantage when it comes to covering short-term liabilities with current assets?

a) UA because it has the higher current ratio.

b) Nike because it has the higher current ratio.

c) UA because it has the lower current ratio.

d) Nike because it has the lower current ratio. 4. (3 points) What is the inventory turnover ratio for UA? ____________________ 5. (3 points) What is the inventory turnover ratio for Nike? __________________ 6. (2 points) Which company has the advantage when it comes to inventory turnover?

a) UA because it has a lower ratio than Nike.

b) UA because it has a higher ratio than Nike.

c) Nike because it has a lower ratio than UA.

d) Nike because it has a higher ratio than UA. 7. (3 points) What is the debt ratio for UA? _______________________ 8. (3 points) What is the debt ratio for Nike? _______________________

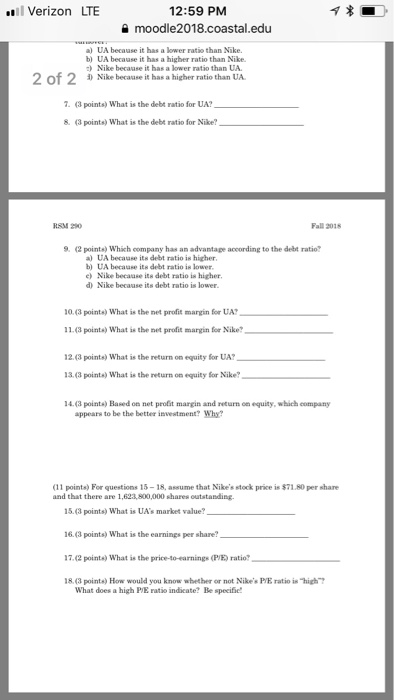

9. (2 points) Which company has an advantage according to the debt ratio?

a) UA because its debt ratio is higher.

b) UA because its debt ratio is lower.

c) Nike because its debt ratio is higher.

d) Nike because its debt ratio is lower. 10. (3 points) What is the net profit margin for UA? ________________________ 11. (3 points) What is the net profit margin for Nike? ________________________ 12. (3 points) What is the return on equity for UA? ________________________ 13. (3 points) What is the return on equity for Nike? ________________________ 14. (3 points) Based on net profit margin and return on equity, which company appears to be the better investment? Why? (11 points) For questions 15 18, assume that Nikes stock price is $71.80 per share and that there are 1,623,800,000 shares outstanding. 15. (3 points)

15. What is UAs market value? ________________________ 16. (3 points) What is the earnings per share? ________________________ 17. (2 points) What is the price-to-earnings (P/E) ratio? ________________________ 18. (3 points) How would you know whether or not Nikes P/E ratio is high? What does a high P/E ratio indicate? Be specific!

Verizon LTE 12:54 PM moodle2018.coastal.eduC NIKE, Inc. Consolidated Statements of Income PART NIKE, Inc. Consolidated Balance Sheets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started