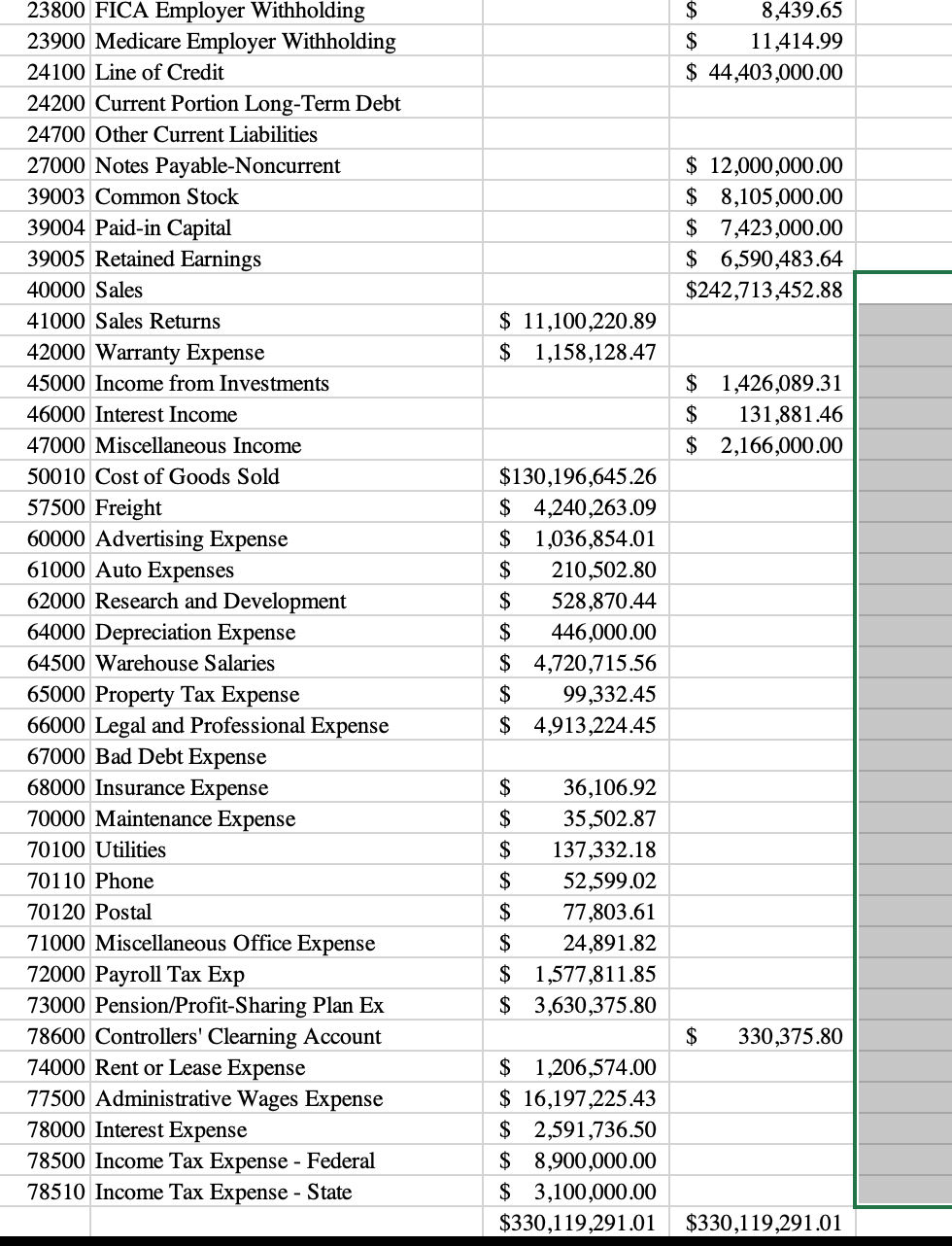

For this assignment you'll chose three different relationships (A, B, and C ) from the trial balance (a relationship = 2 or more accounts) and hypothesize at least two reasons we see the change we do, as well as if you think RMM should increase, decrease or remain neutral. Use your GAAP knowledge and your business acumen to appropriately address what may or may not be expected. You are free to use any information available to you either via the memos or the competitor financial statements. Don't know where to begin? Hint: It is useful to first figure out what the company does...

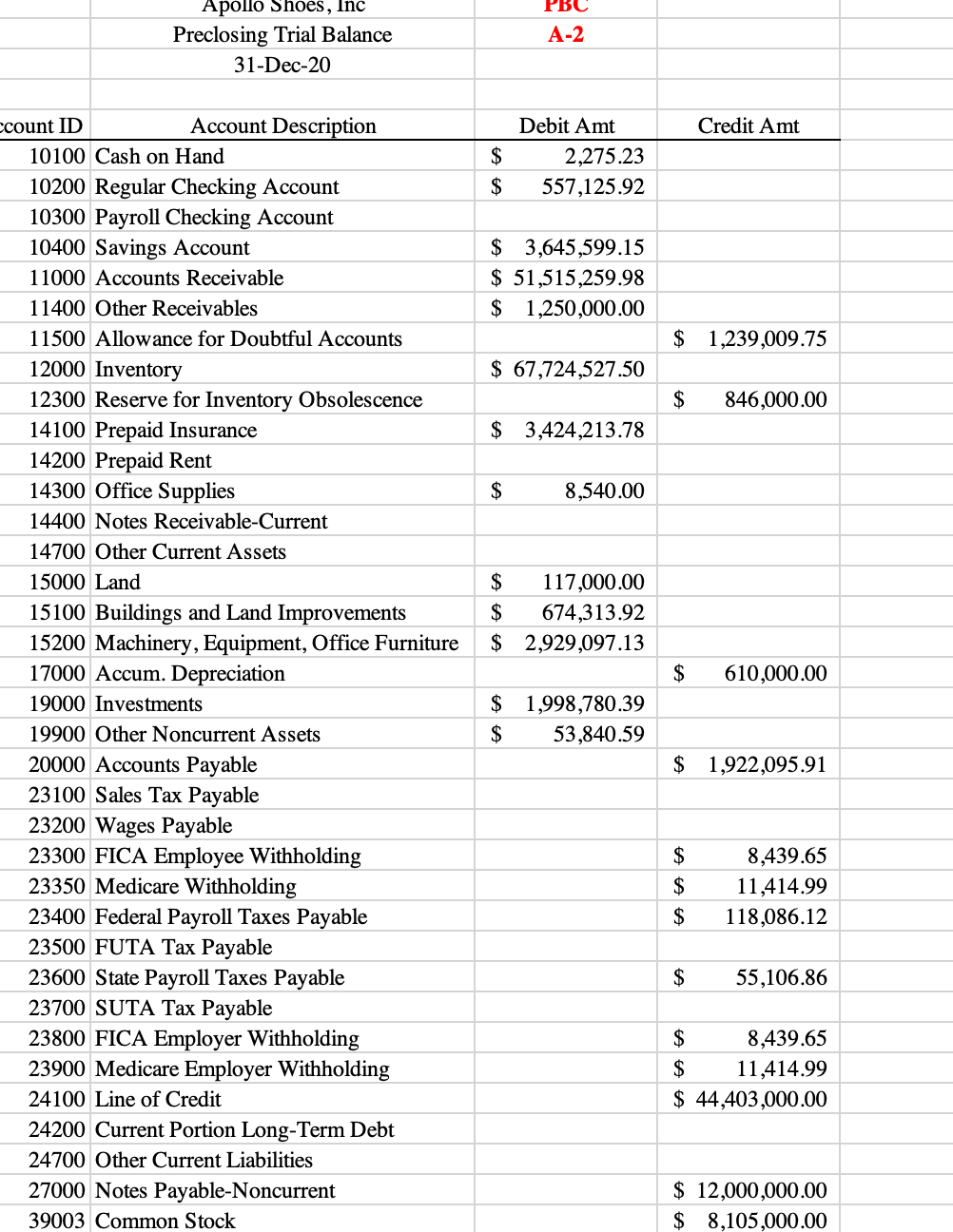

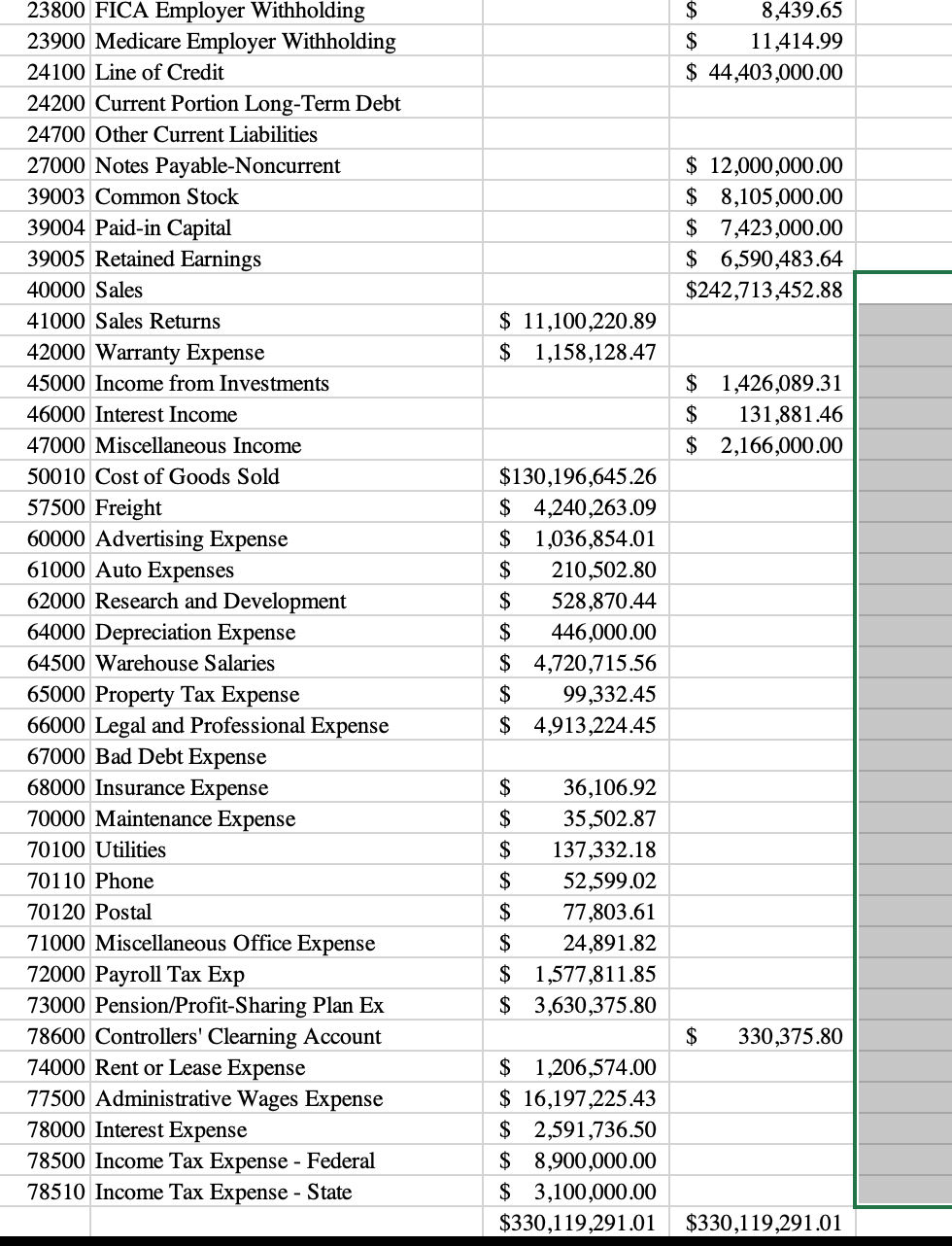

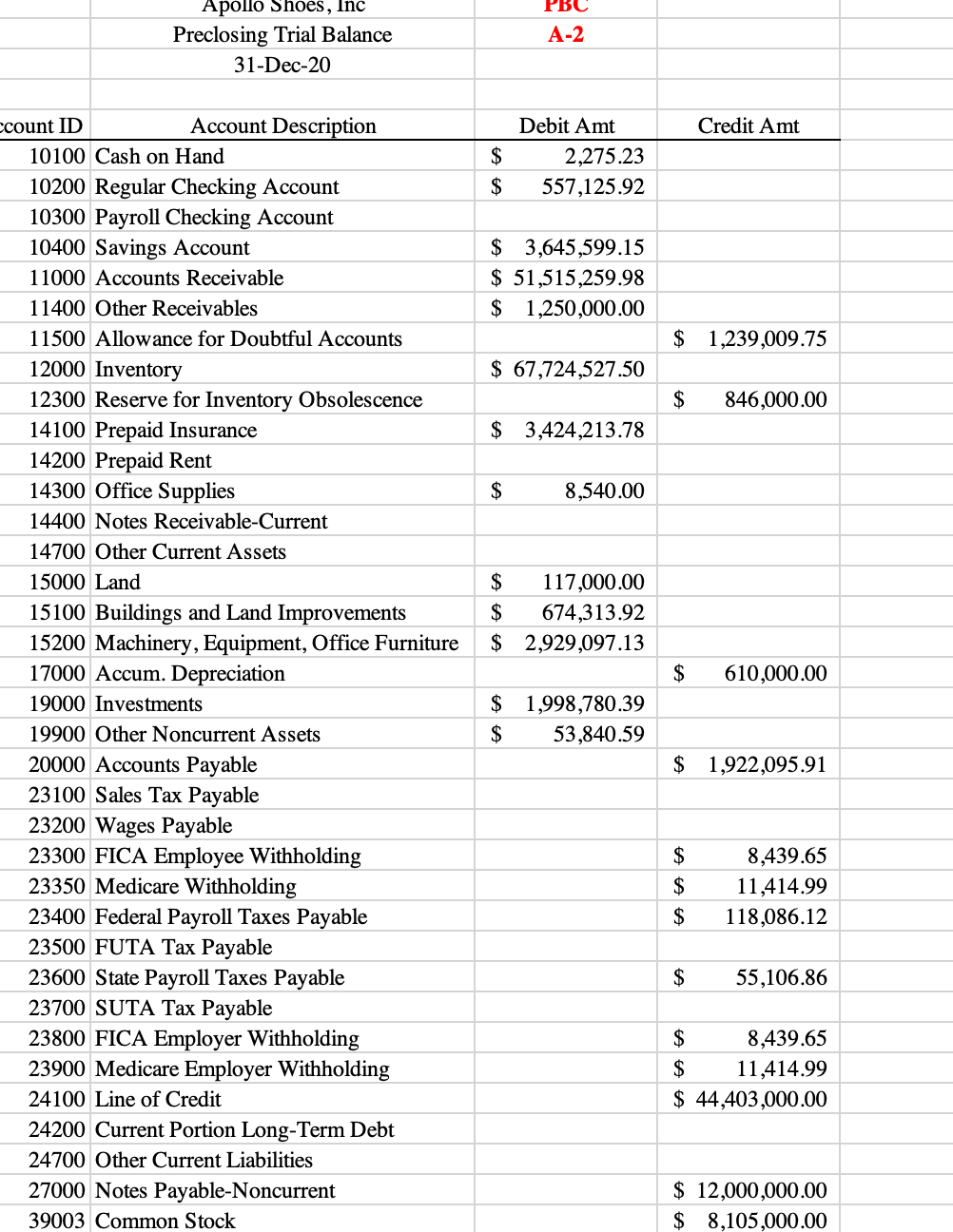

Apollo Shoes, Inc Preclosing Trial Balance 31-Dec-20 PBC A-2 Credit Amt $ Debit Amt 2,275.23 557,125.92 $ $ 3,645,599.15 $ 51,515,259.98 $ 1,250,000.00 $ 1,239,009.75 $ 67,724,527.50 $ 846,000.00 $ 3,424,213.78 $ 8,540.00 $ 117,000.00 $ 674,313.92 $ 2,929,097.13 ccount ID Account Description 10100 Cash on Hand 10200 Regular Checking Account 10300 Payroll Checking Account 10400 Savings Account 11000 Accounts Receivable 11400 Other Receivables 11500 Allowance for Doubtful Accounts 12000 Inventory 12300 Reserve for Inventory Obsolescence 14100 Prepaid Insurance 14200 Prepaid Rent 14300 Office Supplies 14400 Notes Receivable-Current 14700 Other Current Assets 15000 Land 15100 Buildings and Land Improvements 15200 Machinery, Equipment, Office Furniture 17000 Accum. Depreciation 19000 Investments 19900 Other Noncurrent Assets 20000 Accounts Payable 23100 Sales Tax Payable 23200 Wages Payable 23300 FICA Employee Withholding 23350 Medicare Withholding 23400 Federal Payroll Taxes Payable 23500 FUTA Tax Payable 23600 State Payroll Taxes Payable 23700 SUTA Tax Payable 23800 FICA Employer Withholding 23900 Medicare Employer Withholding 24100 Line of Credit 24200 Current Portion Long-Term Debt 24700 Other Current Liabilities 27000 Notes Payable-Noncurrent 39003 Common Stock $ 610,000.00 $ 1,998,780.39 $ 53,840.59 $ 1,922,095.91 $ $ 8,439.65 11,414.99 118,086.12 $ $ 55,106.86 $ 8,439.65 $ 11,414.99 $ 44,403,000.00 $ 12,000,000.00 $ 8,105,000.00 $ 8,439.65 $ 11,414.99 $ 44,403,000.00 $ 12,000,000.00 $ 8,105,000.00 $ 7,423,000.00 $ 6,590,483.64 $242,713,452.88 $ 11,100,220.89 $ 1,158,128.47 $ 1,426,089.31 $ 131,881.46 $ 2,166,000.00 23800 FICA Employer Withholding 23900 Medicare Employer Withholding 24100 Line of Credit 24200 Current Portion Long-Term Debt 24700 Other Current Liabilities 27000 Notes Payable-Noncurrent 39003 Common Stock 39004 Paid-in Capital 39005 Retained Earnings 40000 Sales 41000 Sales Returns 42000 Warranty Expense 45000 Income from Investments 46000 Interest Income 47000 Miscellaneous Income 50010 Cost of Goods Sold 57500 Freight 60000 Advertising Expense 61000 Auto Expenses 62000 Research and Development 64000 Depreciation Expense 64500 Warehouse Salaries 65000 Property Tax Expense 66000 Legal and Professional Expense 67000 Bad Debt Expense 68000 Insurance Expense 70000 Maintenance Expense 70100 Utilities 70110 Phone 70120 Postal 71000 Miscellaneous Office Expense 72000 Payroll Tax Exp 73000 Pension/Profit-Sharing Plan Ex 78600 Controllers' Clearning Account 74000 Rent or Lease Expense 77500 Administrative Wages Expense 78000 Interest Expense 78500 Income Tax Expense - Federal 78510 Income Tax Expense - State $130,196,645.26 $ 4,240,263.09 $ 1,036,854.01 $ 210,502.80 $ 528,870.44 $ 446,000.00 $ 4,720,715.56 $ 99,332.45 $ 4,913,224.45 $ 36,106.92 $ 35,502.87 $ 137,332.18 $ 52,599.02 $ 77,803.61 $ 24,891.82 $ 1,577,811.85 $ 3,630,375.80 $ 330,375.80 $ 1,206,574.00 $ 16,197,225.43 $ 2,591,736.50 $ 8,900,000.00 $ 3,100,000.00 $330,119,291.01 $330,119,291.01 Apollo Shoes, Inc Preclosing Trial Balance 31-Dec-20 PBC A-2 Credit Amt $ Debit Amt 2,275.23 557,125.92 $ $ 3,645,599.15 $ 51,515,259.98 $ 1,250,000.00 $ 1,239,009.75 $ 67,724,527.50 $ 846,000.00 $ 3,424,213.78 $ 8,540.00 $ 117,000.00 $ 674,313.92 $ 2,929,097.13 ccount ID Account Description 10100 Cash on Hand 10200 Regular Checking Account 10300 Payroll Checking Account 10400 Savings Account 11000 Accounts Receivable 11400 Other Receivables 11500 Allowance for Doubtful Accounts 12000 Inventory 12300 Reserve for Inventory Obsolescence 14100 Prepaid Insurance 14200 Prepaid Rent 14300 Office Supplies 14400 Notes Receivable-Current 14700 Other Current Assets 15000 Land 15100 Buildings and Land Improvements 15200 Machinery, Equipment, Office Furniture 17000 Accum. Depreciation 19000 Investments 19900 Other Noncurrent Assets 20000 Accounts Payable 23100 Sales Tax Payable 23200 Wages Payable 23300 FICA Employee Withholding 23350 Medicare Withholding 23400 Federal Payroll Taxes Payable 23500 FUTA Tax Payable 23600 State Payroll Taxes Payable 23700 SUTA Tax Payable 23800 FICA Employer Withholding 23900 Medicare Employer Withholding 24100 Line of Credit 24200 Current Portion Long-Term Debt 24700 Other Current Liabilities 27000 Notes Payable-Noncurrent 39003 Common Stock $ 610,000.00 $ 1,998,780.39 $ 53,840.59 $ 1,922,095.91 $ $ 8,439.65 11,414.99 118,086.12 $ $ 55,106.86 $ 8,439.65 $ 11,414.99 $ 44,403,000.00 $ 12,000,000.00 $ 8,105,000.00 $ 8,439.65 $ 11,414.99 $ 44,403,000.00 $ 12,000,000.00 $ 8,105,000.00 $ 7,423,000.00 $ 6,590,483.64 $242,713,452.88 $ 11,100,220.89 $ 1,158,128.47 $ 1,426,089.31 $ 131,881.46 $ 2,166,000.00 23800 FICA Employer Withholding 23900 Medicare Employer Withholding 24100 Line of Credit 24200 Current Portion Long-Term Debt 24700 Other Current Liabilities 27000 Notes Payable-Noncurrent 39003 Common Stock 39004 Paid-in Capital 39005 Retained Earnings 40000 Sales 41000 Sales Returns 42000 Warranty Expense 45000 Income from Investments 46000 Interest Income 47000 Miscellaneous Income 50010 Cost of Goods Sold 57500 Freight 60000 Advertising Expense 61000 Auto Expenses 62000 Research and Development 64000 Depreciation Expense 64500 Warehouse Salaries 65000 Property Tax Expense 66000 Legal and Professional Expense 67000 Bad Debt Expense 68000 Insurance Expense 70000 Maintenance Expense 70100 Utilities 70110 Phone 70120 Postal 71000 Miscellaneous Office Expense 72000 Payroll Tax Exp 73000 Pension/Profit-Sharing Plan Ex 78600 Controllers' Clearning Account 74000 Rent or Lease Expense 77500 Administrative Wages Expense 78000 Interest Expense 78500 Income Tax Expense - Federal 78510 Income Tax Expense - State $130,196,645.26 $ 4,240,263.09 $ 1,036,854.01 $ 210,502.80 $ 528,870.44 $ 446,000.00 $ 4,720,715.56 $ 99,332.45 $ 4,913,224.45 $ 36,106.92 $ 35,502.87 $ 137,332.18 $ 52,599.02 $ 77,803.61 $ 24,891.82 $ 1,577,811.85 $ 3,630,375.80 $ 330,375.80 $ 1,206,574.00 $ 16,197,225.43 $ 2,591,736.50 $ 8,900,000.00 $ 3,100,000.00 $330,119,291.01 $330,119,291.01